The encryption market has increased today, and about 80 of the 100 main currencies have appreciated in the last 24 hours. In general, capitalization of the cryptocurrency market has increased by 0.5%, now at $ 3.94 billion. At the same time, the total cryptographic negotiation volume is $ 94.3 billion, a lower level than seen in recent days.

Cryptographic winners and losers

At the time of writing, seven of the 10 main currencies for market capitalization have increased in the last 24 hours.

Bitcoin (BTC) Appreciated 0.4% at the time of writing, which means that it does not change, it is currently quoted at $ 111,425. This is the smallest increase in the list.

At the same time, Ethereum (eth) It has dropped 0.3%, which means that it has also not changed to a large extent in one day, it is now quoted at $ 4,290. This is also the only fall in the category, along with Lido Ether States (Steth).

On the other hand, the highest increase is Dogecoin (Doge) 7.4% at the price of $ 0.2335.

It is followed by XRP (XRP)‘s 2.8%, now changing from hands to $ 2.91.

Looking at the 100 main currencies, about two dozen coins are low, and the rest are up.

Worldcoin (WLD) He is the winner of the category. I knew 23.9% in one day, $ 1.26.

Dordinated penguins (PENGUB) It is the only other currency with a two -digit increase. The currency appreciated 11.9%, now quoting at $ 0.03195.

On the other hand, there is a currency with a two -digit drop: World Liberty Financial (WLFI) with 12.6% at $ 0.2093. He has been falling since his recent release.

Meanwhile, El Salvador has bought 21 BTC to celebrate the fourth anniversary of the Bitcoin de la Nación Law.

This last purchase has taken the total country to 6,313.18 Bitcoin, valued at more than $ 701 million.

‘Liquidity conditions could improve the feeling of risk through cryptography’

James Toledano, Director of Operations of WalletHe commented that September can be a weaker month for Bitcoin. However, “this year it feels a bit different”, as we have seen increases.

“Optimism around a potential [US Federal Reserve] The rates cut has helped BTC stay at the level of $ 110K, the conviction is still a bit silenced until the clarity of the policy arrives, ”he explains.

Preparing the cutting of potential rates, “markets currently have a price at a high probability of at least one cutting of 25 basic points,” said Toledano, “and if delivered, liquidity conditions could improve the feeling of risk through cryptography.”

“In the short term, Bitcoin’s price action is likely to remain in scope, but the Fed tone will be the key promoter of whether the impulse becomes the fourth quarter,” concluded the executive.

Bitunix Analysts added that in the short term, risk assets benefit from Dovish’s expectations. However, “if the Fed moves too aggressively in rates cuts, it could trigger fears of recession that cushion the upward feeling.”

Meanwhile, Glass glass He discovered that during the past year, the limit made 5–7y BTC Cohort fell from $ 14.9 billion to $ 8.5 billion. “Almost all this offer simply aged in older bands, highlighting the persistence of long -term holders,” they concluded.

Levels and events to see below

At the time of writing Monday morning, BTC quote $ 111,425. During a large part of the last 24 hours, the number one currency in the world was negotiated aside. Then it decreased to the intradic minimum of $ 110,690 before jumping to the maximum intradic of $ 111,795.

This is not yet far from the maximum of the week of $ 113,225, while the current price has dropped 10.1% from the historical maximum of $ 124,128, registered 25 days ago.

Bitcoin has recently been consolidating about $ 110,800. Falling below this, the price would comply with the supports of $ 108,450 and $ 107,400. However, a rise above $ 113,400 can lead to $ 115,400 and $ 117,150.

Ethereum is currently quoted at $ 4,290. The trade was relatively broken on the last day. The lowest point was $ 4,272, while the highest is the current price.

During the past week, ETH went from the lowest point of $ 4,241 at the highest price of $ 4,482.

If the currency rises above $ 4,490 and maintains that level, it can move towards $ 4,665 and $ 4,865. On the contrary, a fall below $ 4,250 could lead to the lowest levels of $ 4,070, $ 3,940 and $ 3,785.

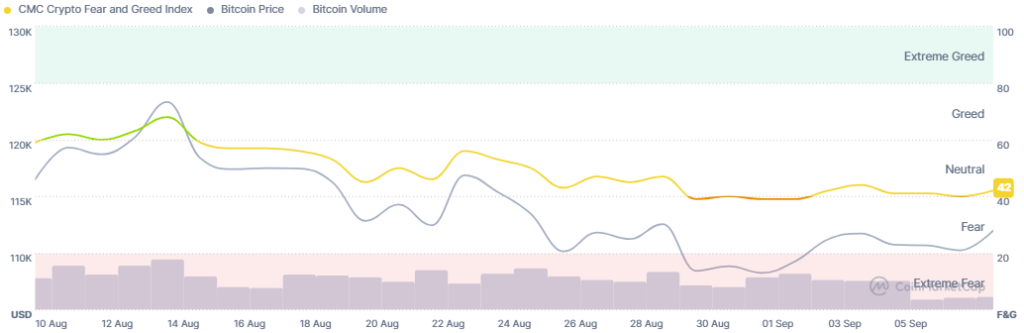

Meanwhile, the feeling of the encryption market has not moved significantly over the weekend, and has remained in the neutral area. The cryptographic and greed cryptographic index increased from 40 yesterday to 42 today.

The precaution reigns among investors, since they expect additional signals that would aim at the management that the market will take in the middle of the period.

In addition, the BTC Spot (ETF) of the United States registered $ 160.18 million in departures on Friday, the previous day of the negotiation. Three ETF saw negative flows, and none recorded inputs.

Black rock, Boxwiseand Gray scale Notable exits of $ 63.21 million, $ 49.65 million and $ 47.33 million, respectively.

The ETEs of eth of the United States also saw another day out on September 5, with $ 446.71 million.

No funds had tickets, and five had departures. The highest of these is Blackrock’s $ 309.88 million, followed by Gray scale $ 51.77 million.

Meanwhile, income in the Ethereum chain fell sharply in August, even when ETH increased to the new maximums of all time. According Token terminalEthereum’s revenues, driven by the files that benefit ETH holders, fell 44% month to month to $ 14.1 million, below $ 25.6 million in July.

In other news, Japanese Metaplenet bought additional 136 bitcoin on Monday, for a total price of $ 15.2 million. The corporate BTC accumulator has seen a BTC yield of 487% YTD 2025.

By CEO Simon Gerovich, the company occupies a total of 20,136 BTC, with an amount of cumulative purchase of $ 2.8 billion, occupying the sixth place among the main corporate Bitcoin holders.

That said, companies in the main industries have bought 1,755 BTC daily, contributing more than $ 1.3 billion to Bitcoin market capitalization during the last 20 months.

Frequent questions

- Why did cryptography move against actions today?

The encryption market has increased on the last day, while the stock market saw a mixed image on its previous negotiation day. For the closing time of Friday, the S&P 500 It was reduced by 0.32%, the Nasdaq-100 increased by 0.082%, and the Dow Jones industrial fell by 0.48%. This followed the August Jobs report on Friday, which increased the expectations that the United States Federal Reserve will reduce interest rates this month.

- Is this sustainable rally?

We have been seeing slight increases and falls for a while, with the market correcting largely and then consolidating. Analysts expect the market to continue increasing, at least by the end of this year, but for now, it is still uncertain if we will see additional short -term corrections.

The encryption market has increased today, and about 80 of the 100 main currencies have appreciated in the last 24 hours. In general, capitalization of the cryptocurrency market has increased by 0.5%, now at $ 3.94 billion. At the same time, the total cryptographic negotiation volume is $ 94.3 billion, a lower level than seen in recent days. Cryptographic winners and losers at the time of writing, seven of the 10 main currencies for market capitalization have increased in the last 24 hours. Bitcoin (BTC) …

The publication why is Crypto today? – September 8, 2025 appeared first in Cryptonews.