The real world asset sector (RWA) has cooled, with RWA Tokens dropped 3.7% during the past month, with a lower yield of narratives such as fluid and gamefi rethinking. Even so, the long -term growth history remains intact.

However, despite the correction, a handful of RWA Altcoins to see in September are flashing fundamentals and price configurations.

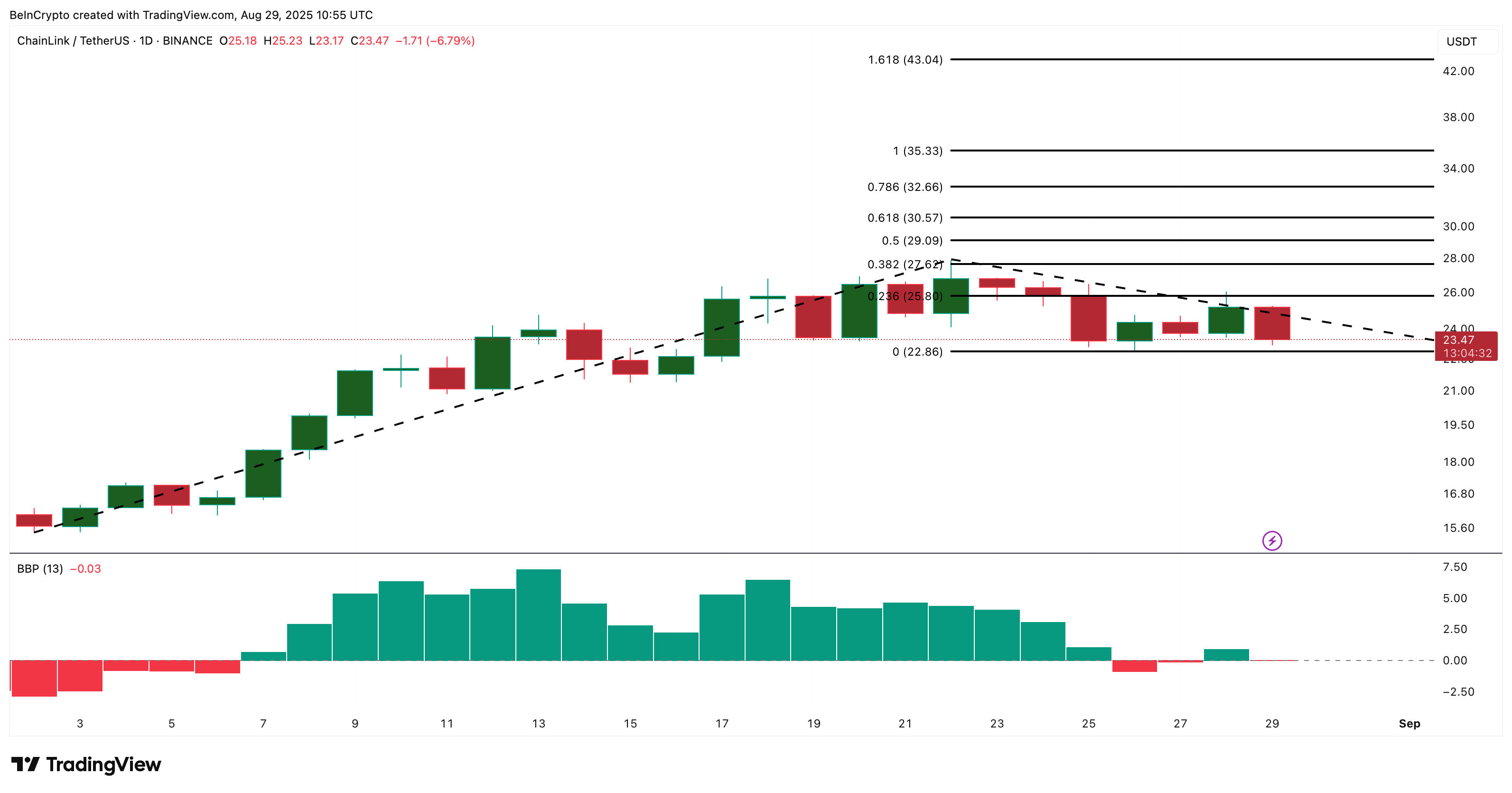

Chainlink (Link)

Chainlink remains the most recognized RWA Altcoin, and the recent announcement of a United States Department of Commerce Department to bring government macroeconomic data in the chain only reinforces its credibility.

The data in the chain show whales and higher addresses placed early. Whale balances increased by 29.52% in August, which led to 5.03 million links. That means that whales added approximately 1.15 million links, with a value of almost $ 27 million at the current price of $ 23.47.

The 100 main directions now have 646.8 million links, 0.47%more, with an addition of approximately 3 million links, equivalent to around $ 70 million. Exchange balances decreased by 4.19%, a bullish output trend that reduces sales pressure.

For token ta and market updates: Do you want more tokens ideas like this? Register in the daily newsletter of Editor Harsh Notariya here.

Despite a slow week, Link remains in an upward trend, publishing profits worth more than 30% month by month. While Bears pressed it in 5.9% this week, bulls have largely maintained control. Every time the bears have tried to take control of the action of the link price, the bulls have intervened, as evidenced by the bull power indicator (BBP).

The Bull Bear Power (BBP) indicator measures whether buyers (bulls) or vendors (bears) are promoting the impulse.

A clean rupture above $ 25.80 would open a movement towards $ 27.62, and beyond that, the Fibonacci extension objectives suggest a route as high as $ 43.04.

However, the lack of $ 22.86 could invite deeper setbacks, but current whale flows and exchange advocate continuous resistance. With the stacking of whales, Link Surfacing ETF conversations and an association linked to the government that validated the foundations, Chainlink is a leading RWA currency in September.

ONDO (ONDO)

Ondo is one of the fastest growing names in Token Rwa space. Make real world assets, such as US Treasury bonds. And corporate bonds, tokenized for chain investors.

The whales have been added silently at the end of August. The cohort of 100 million to one billion ONDO grew holdings of 981.38 million on August 24 to 989.53 million ondo at the time of publication. That is an accumulation of 8.15 million ONDO, for a value of approximately $ 7.4 million at current prices of approximately $ 0.91.

Technically, Ondo shows a bull divergence. Since August 19, the price has made lower minimums, but the RSI has printed higher minimums. This divergence suggests a bearish pressure and a potential reversal. Ondo rose 13.2% in the last three months, which shows that the widest trend is still intact despite short -term weakness.

The relative force index (RSI) tracks the price speed moves to show if an asset is overwhest or oversight. The highest values mean a stronger purchase, while the lowest values indicate a heavier sale.

The immediate resistance is about $ 0.93. A breakdown above $ 0.9786 would validate the upward divergence and the objectives open to $ 1.14.

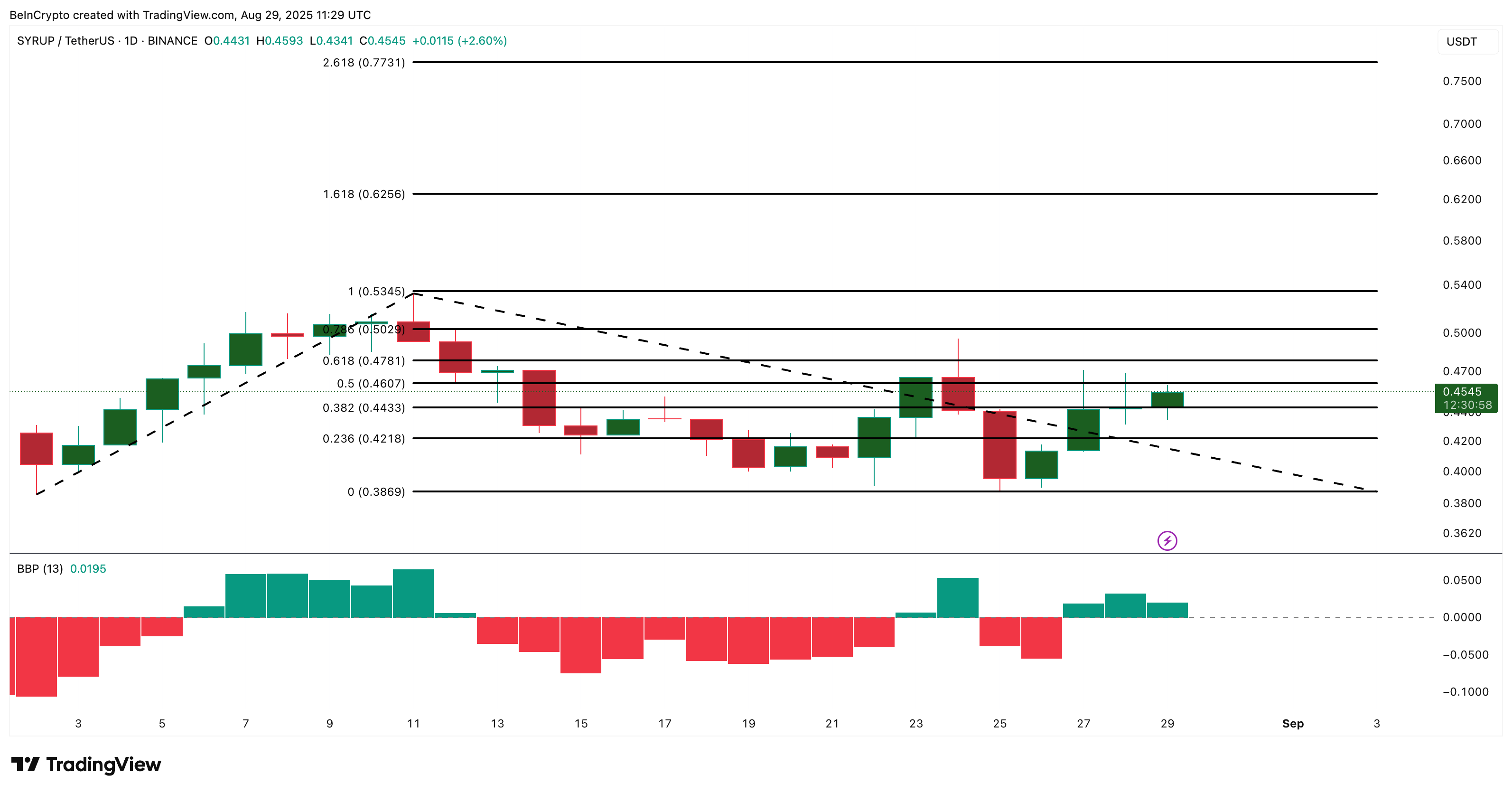

Arce Finance (syrup)

Maple Finance is a credit market focused on institutional loans, and its native syrup token (syrup) has been gaining stable traction as one of the RWA currencies to see.

The performance has been remarkable. In the last three months, syrup has won 39.9%. In the last month, it has increased 4.2%, while seven -day profits are 14%. The consistency of these numbers reflects that the syrup has not disappointed despite market volatility.

The data in the chain admit this force. The 100 main addresses increased holdings by 16.79%, adding approximately 160 million syrup, for an approximate value of $ 72 million at the current price of $ 0.45.

The exchange balances fell by 23.51%, or around 69 million tokens (around $ 31 million), which reflects a slicing of supply. The whales cut positions in almost 59%, but this impact has been exceeded by the accumulation of larger cohorts and constant exchanges.

The action of the syrup also remains constructive. A sustained retention above $ 0.42 keeps bulls in control. A rupture above $ 0.53 could boost the impulse at $ 0.62– $ 0.77 in September. Since bulls have control, courtesy of green bull food indicator candles, an upward movement seems likely.

However, if the syrup falls below $ 0.38, the bullish configuration would be invalidated and sellers would take care. Given its constant accumulation and resistance during the volatile weeks, Maple Finance and his syrup file have earned their place as one of the main RWA Altcoins to see in September.

Discharge of responsibility

In line with the guidelines of the trust project, this price analysis article is only for informative purposes and should not be considered financial or investment advice. Beinyptto is committed to precise and impartial reports, but market conditions are subject to changes without prior notice. Always carry out your own research and consult a professional before making financial decisions. Note that our terms and conditions, privacy policy and resignations have been updated.