The legislators of South Korea have criticized Lee Eok-Won, the candidate for the position of president of the Financial Services Commission, for buying actions in the strategy of the American company of Bitcoin (BTC).

According to the media of South Korea, José Ilbo and News1, Lee Eok-Won said he had only invested in American chip actions “to see how the feeling of investors is.”

Lee Eok-Won spoke in response to legislators at a confirmation hearing of the National Assembly on September 2.

The FSC is the main financial regulator in the country and has the last word on the country’s cryptographic regulations. However, President Lee Jae-Myung has previously requested the abolition of FSC.

Recent developments seem to suggest that the president may have reversed or delay their plans to discard the FSC.

Several legislators and media have criticized the election of Lee Eok-Won as president of FSC after discovering that he has a large portfolio of actions abroad, including the actions of Nvidia and Tesla.

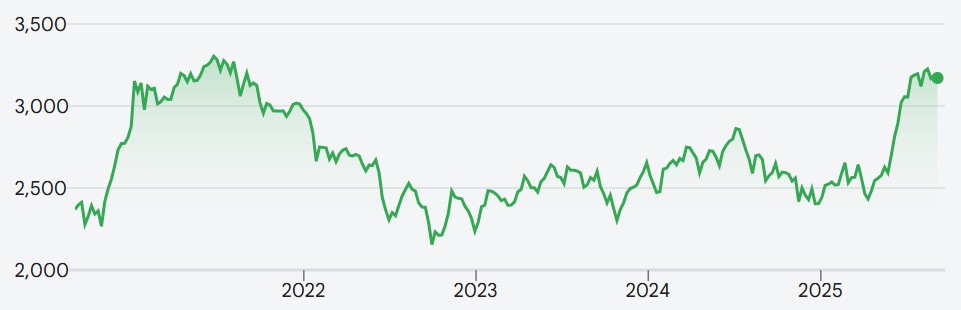

Critics say this goes against the president’s policies. Lee Jae-Myung wants to give new life to the national stock market, which has stagnated for several years.

‘It is not a good look for the government’

The legislator of the Popular Power Party of the main opposition, Kim Sang-Hoon, pointed to the government, saying:

“[Nominating Lee Eok-won] It is not a good look for this administration, which is supposedly trying to mark the beginning of the ‘Kospi 5,000’ “era.

The Government launched a special Kospi 5,000 committee at the end of June, as part of an offer to increase the domestic market value by more than 50%.

PPP legislators called on the nomination of Lee Eok-Won “inappropriate” due to their holdings in companies such as the strategy, the largest Bitcoin Treasury company in the world. The nominee replied:

“It was not good to deal with actions [during my time at the ministry]. [After I left the post,] I left and obtained some experience in the market. I wanted to see how the stock market worked and see how the feeling of investors was. ”

Kim, a member of the Political Affairs Committee of the National Assembly, said:

“Who would choose to invest in the Kospi when [the FSC Nominee] Are you focusing on US actions instead of the domestic market?

‘There is no intrinsic value in crypto

Lee Eok-Won was appointed first vice minister of the Ministry of Economy and Finance in March 2021.

The data sent recently show that the total shares and investments of funds from the nominee are worth 71.26 million wones (more than $ 51,000). Invested almost $ 8,000 of this amount in direct purchases of shares of the United States, including strategy actions.

Lee Eok-Won has also faced criticism this week from Crypto’s defenders after his comments on the value of cryptaseins.

The nominated said that BTC and other currencies “have no intrinsic value” and that they could not be classified as currencies or financial products.

It also poured cold water over the talk that the government and pension funds could be able to launch Bitcoins strategic reserves.

National cryptography defenders claim that statements like these sound as if they belong to a past era. They say that the regulatory bosses in South Korea made similar comments during the 2017-2018 bitcoin boom.

Critics call ‘outdated’ comments

News1 wrote that several experts in the cryptographic industry think that Lee Eok-Won’s attitude is left behind “behind global trends.”

An employee of the unnamed cryptographic industry said that Lee Eok-Won’s comments reflected “an invalid and inappropriate opinion. The same individual said:

“The argument that Crypto does not have an intrinsic value is inappropriate at a time when large US corporations and other global organizations are using cryptoassets such as strategic reserves. Cryptanians such as Bitcoin have digital utility, including safety and transferability.”

Lee Eok-Won was not committed when asked about the possibilities that the FSC approves a Bitcoin ETF. He said:

“I understand that there are several expectations and concerns about the impact of the introduction of an ETF of Bitcoin Spot. We will evaluate the global regulatory trends to establish a possible introduction method […] and discuss the matter with the National Assembly. “

The new main regulator of S Korea faces scrutiny about the actions of the strategy, Crypto’s comments appeared first in Cryptonews.