Reason to trust

Strict editorial policy that focuses on precision, relevance and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publications

Strict editorial policy that focuses on precision, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultrices Quis Pellentsque Nec, Ulforper Eu hate.

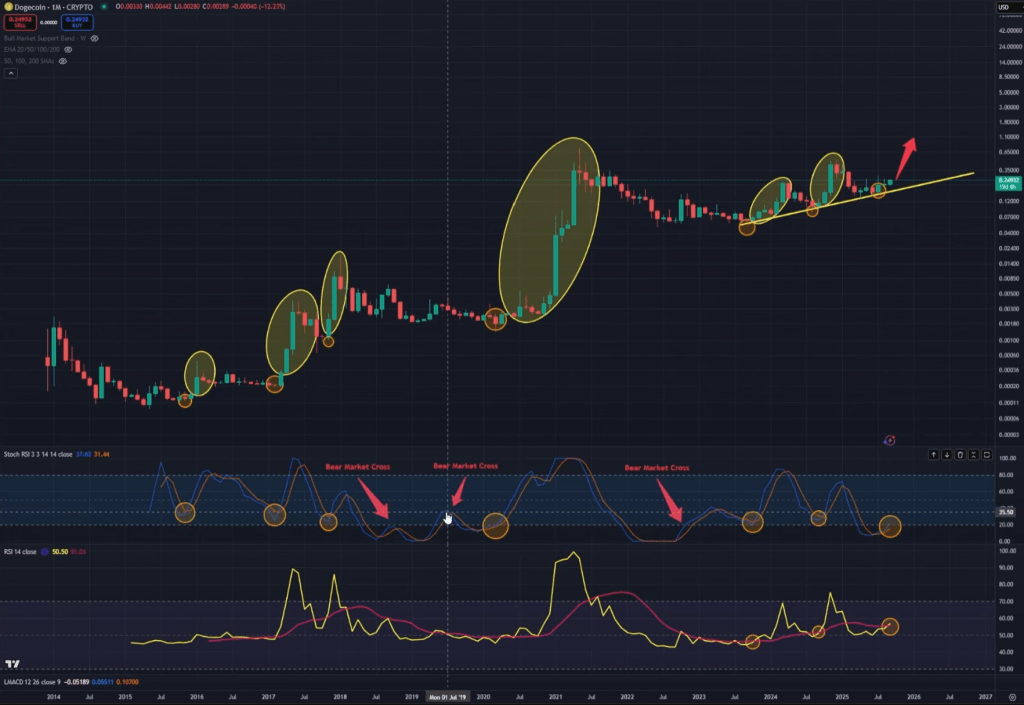

Dogecoin is approaching a family inflection in the monthly table that previously preceded its most explosive advances, according to a new high rate analysis by Kevin (Kev Capital TA) published on September 11. The analyst argues that a new stochastic RSI (Stoch RSI) crossed the aluatic of the monthly cases, since they are not formed above 20 threshold, the state of technology that combines the technical cycle. takeoff.

Dogecoin Imminent Explosion?

“In February 2017, Dogecoin obtained a V -shaped RSI cross above 20 level and performed another rally … 1,852%,” he said, adding that a subsequent monthly cross “produced a very good gain of 1,751%” before the market finally overcome. The configuration, he says, is merging again in the fourth quarter.

The frame is deliberately simple: it combines the RSI Monthly Stoch with the monthly RSI and a structure of anchored trends. In the 2015-2017 cycle, the Stoch RSI crosses sustained above 20 were the dividing line between the final feles of the failed bears market and the true advances of the Toro cycle. On the contrary, a 2019 impulse rally vanished because “the stock RSI never really had an upward lasting cross”, which occurs in the middle of an still dominant bear regime, he said. In the 2020-2021 cycle, a new Stoch RSI Bull Cross above 20 “is carried out in its main rally in the upward market, which was the largest rally that Dogecoin has never been.”

Related reading

Kevin says that the current cycle has followed a cleaner sequence than the previous ones. After a Cross RSI Month RSI confirmed before the cycle, Dogecoin delivered an initial advance “approximately 280%”, then, after a corrective phase, another monthly cross promoted a “November-December rally” of approximately “497%”. The market then restarts again.

Today, he sees that the process is restarted: “We are obtaining a monthly stock RSI cross again. However, we have not yet crossed the level of 20. So these are the initial stages of a possible Rally for Dogecoin.” He emphasizes that historically, “you don’t even get your most bullish price action until the RSIS of shares is above 80 level,” calling at the present time the “first or second entry.”

Beyond Momentum, the analyst highlights a structural confluence of three parts that considers critical in the monthly graph. First, the RSI itself has crossed repeatedly above its mobile average at inflection points; Second, each of those RSI/Ma recaptures “has coincided with a RSI cross of upward stock”; Third, Price has defended a long -term trend line in a series of higher minimums.

Related reading

After a brief deviation below, “now we are breaking the line of trend and the [RSI] Ma at the same time after maintaining the level of 50 “, which describes as a double bottom of the textbook Backdrop

Macro conditions must be aligned

The macro is the warning and, potentially, the accelerator. Kevin frames the monetary policy of the United States as the decisive driver of the cryptography risk cycle: “Monetary policy … That is the Profit Report for the cryptography market.” He argues that inflation has been in a vision of a year while labor data “continue to soften”, a mixture that believes that anchor the expectations of the target cuts “this month … and … in November and December.”

If that path is maintained and the tone of the Federal Reserve is misleading in the next FOMC, it hopes that Bitcoin’s domain will be drifting and so that the dynamics of the “alternative season” will be assigned again, with positioned Dogecoin to “overcome Bitcoin.” On the contrary, an Awkish turn or a drift of higher renewed inflation would be an “important hypo” for configuration.

Seasonality and time also appear in their risk management guide. September remains “seasonally weak”, and with the FOMC approximately one week after its recording date, anticipates a more carpha and indecisive price action in the short term, while markets “feel and wait for Powell’s tone.”

However, the longest time map is still its anchor: monthly bullish trend structure, RSI claims about its ma, Stoch RSI in an early stage shift and the historical tendency of the main expansions of Dogecoin to turn on only after those impulse meters pose well. “These graphics tell us on our faces that Dogecoin is preparing for a larger higher movement … The road is placed,” he said.

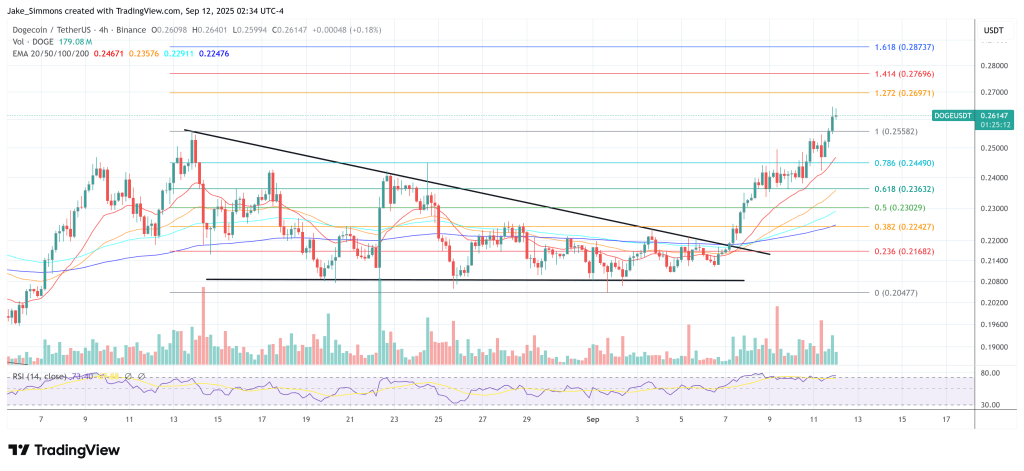

At the time of publication, Dege quoted at $ 0.261.

Outstanding image created with Dall.E, Record of TrainingView.com