An outstanding Bitcoin billionaire continues its aggressive pivot in Ethereum, according to data from the Lookonchain whale monitoring platform.

In the last 12 hours, the investor sold 2,000 BTC for a value of $ 221 million and used income to buy 49,850 ETH valued at $ 219 million in the spot markets.

In total, the whale has accumulated 691,358 ETH worth approximately $ 3 billion in the last two weeks, marking one of the most significant continuous capital changes from Bitcoin to Ethereum seen in recent months.

After briefly stopping its ETH purchases for two days, the whale returned to the market strongly, depositing another 1,000 BTC ($ 108.27 million) to Hiperliquid, where it sold the coins and turned the funds directly into Ethereum Spot.

Together with these purchases, the merchant also closed a long leverage position of 96,452 ETH ($ 433 million), obtaining a gain of $ 2.6 million before reinvesting immediately on Spot Eth.

In the last 14 hours, its activity has intensified even more, with sales of 3,968 BTC for a value of $ 437 million coincident with new acquisitions of 96,531 ETH valued at $ 443 million.

This series of movements underlines a strong conviction in Ethereum by Bitcoin, and billions in capital are actively reallocated in real time.

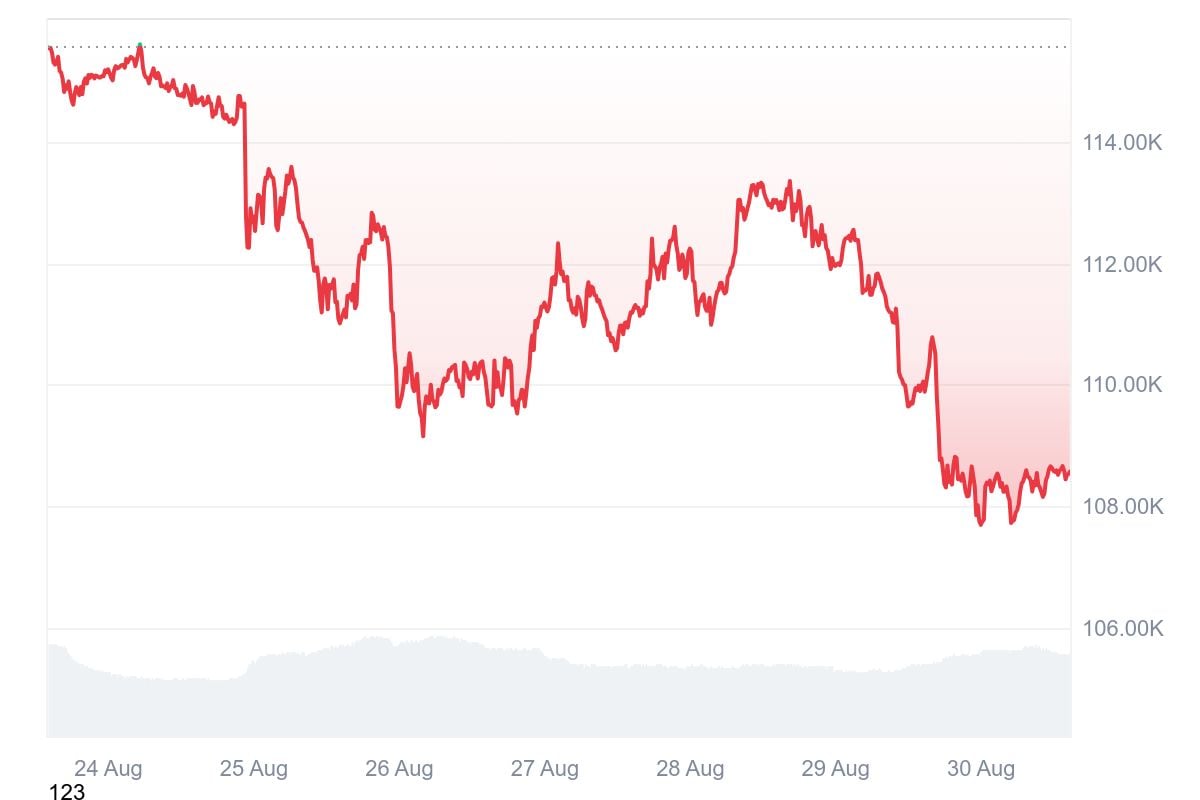

Bitcoin’s price dropped 6%

Bitcoin has been constantly decreasing during last week. According to Coinmarketcap data, the price of BTC has dropped 5.96% of $ 115,560 to $ 108,572.

Bitcoin (BTC) is priced at $ 108,541,96, increasing 1.35% on the last day. Its market capitalization is $ 2.16 billion, which shows a 1.35% decrease, while the 24 -hour negotiation volume is $ 72.74 billion, 11.58% more.

The fully diluted assessment (FDV) is $ 2.27 billion, with a volume to market-capital volume of 3.41%. The total supply is 19.91 million BTC.