The encryption market seems to close August with a positive note, although it remains below the key brand of $ 4 billion. Total market capitalization is currently at $ 3.87 billion, even less than that psychological threshold.

The merchants are observing next September with a renewed interest, helped by the expectations of potential rates cuts that could improve the appetite of the risk. Within this backdrop, US coins have focused again. While the main chips such as XRP, Solana, Cardano and Chainlink continue to dominate attention, there are three less viewed coins in the US that could see action in September.

Stellar (XLM)

Stellar (XLM) is about to close August in El Red, 8.7% less than the month and 12.7% during the past week. However, despite this weakness, it could be one of the US coins. Made in September.

The greatest driver is its real world asset growth (RWA), which rose 12.9% in the last 30 days to $ 511.42 million in value. That makes Stellar one of the few projects of great capitalization that end August with a positive fundamental note.

Higher transaction volumes may also be necessary to maintain this growth, an objective to which the star development foundation is clearly directed.

In an exclusive bit to be Incrypto, Matt Kaiser, Mesari star analyst, said:

“At the end of 2025, the Stellar Development Foundation has as its objective that Stellar has $ 3 billion in the Ochain of RWA and is a superior chain in Defi TVL. This could create a steering wheel where more institutional capital increases user participation, which leads to volumes of higher transactions and an ecosystem activity.”

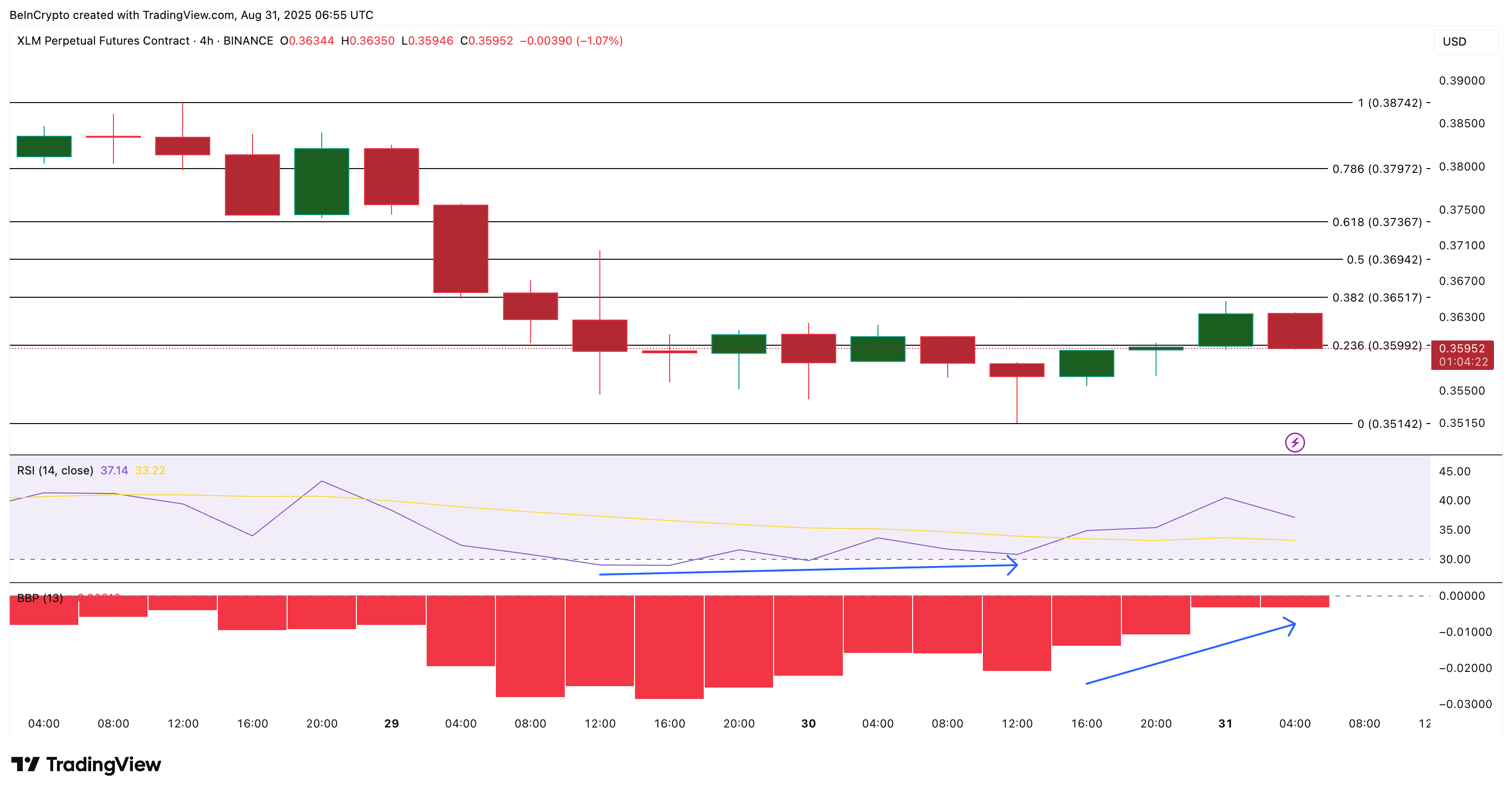

In the Technical Front, Stellar may be showing a short -term bullish signal. The 4 -hour graph shows a hidden upward divergence, where the price made a low lower one, but the RSI (relative resistance index, an impulse indicator) recorded a lower low.

At the same time, Bull-Bear’s power indicator (BBP), which compares the purchase and sale pressure, has become less negative, validating the fact that sellers are losing strength. If this rare bullish configuration continues, XLM could boost the resistance to $ 0.36 and $ 0.37, with an invalidation below $ 0.35.

Do you want more tokens ideas like this? Register in the daily newsletter of Editor Harsh Notariya here.

A movement above $ 0.38 would ensure that the bullish configuration appears even in the daily table.

History (IP)

Story (IP), a layer 1 block chain designed to anchor intellectual property in the chain, has been one of the highlights this year. The Token rose more than 30% in the last 24 hours, extending its profits of three months to 91%. Annually, Story (IP) has increased more than 300%.

Token growth occurs in the middle of the continuous speculation about a possible repurchase program and after the advertisement of the history of the IP Trust gray scale, which fueled more fed the Alcista narrative of the Token and led it to a new maximum of all time only a few hours ago.

From a technical perspective, the story (IP) has come out of an ascending expansion wedge, a pattern typically associated with bearish reversions.

By exceeding the higher trend line, the price of IP has invalidated the bearish perspective and confirmed that the bulls remain in control. This is further reinforced by the bull bear power indicator (BBP), which has become higher even when prices were consolidated, indicating the underlying resistance that is directed to September.

At the time of publication, the story is quoted at $ 7.86, with immediate resistance to $ 8.23 and the maximum of all time about $ 9.09. A rupture above these levels would place the token again in the price discovery mode, opening the door to the top cool in September. This validates the presence of history in the Made in USA currencies list.

On the negative side, the upward configuration would be invalidated if the story falls below $ 6.84, with deeper risks that emerge below $ 5.45.

Pi Coin (Pi)

Pi Coin (PI) has been one of the low yield in 2025. Token has dropped 4.7% during the past month, 8% more in the last week, but no more than 55% year -on -year fell. At $ 0.38, the widest structure remains bassist, however, September could keep merchants interested in short -term peaks.

Two developments have helped to put PI on the radar as a key made in the USA Coin: the recent update of the protocol that added a Linux node and the launch of a Pi ETP value network among eight new products, which have generated some impulse.

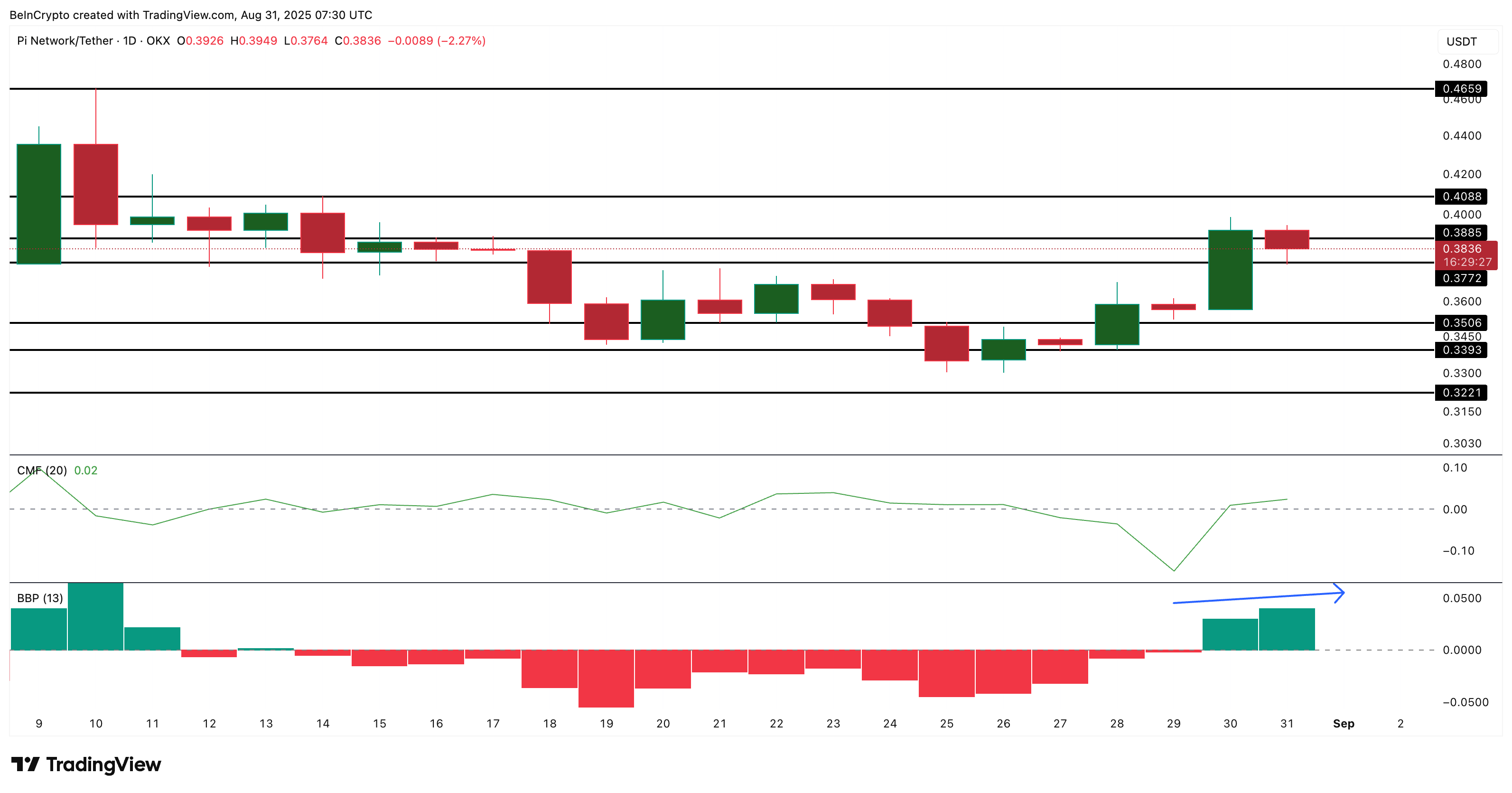

The technical and chain indicators support the case for short -term movements. The Chaikin money flow (CMF) has turned over zero for the first time in a time, pointing out tickets.

A decisive movement above 0.05 in the CMF would confirm a stronger purchase pressure. The BBP indicator has also become positive, aiming at a growing bullish impulse.

If the impulse continues, PI could rise to $ 0.46, a rally of more than 20%of the current levels. However, if the Token breaks below $ 0.33, the risks of new new ones below $ 0.32 of performance.

For now, the configuration suggests that merchants can look at the Pi network for intra -intra -rapid or swing movements in September instead of a sustained recovery. It is worth noting that the general currency pricing structure PI still leans bassist.

Discharge of responsibility

In line with the guidelines of the trust project, this price analysis article is only for informative purposes and should not be considered financial or investment advice. Beinyptto is committed to precise and impartial reports, but market conditions are subject to changes without prior notice. Always carry out your own research and consult a professional before making financial decisions. Note that our terms and conditions, privacy policy and resignations have been updated.