XRP ended the week at $ 2.78, with merchants who observe a fundamental October while the United States Stock Exchange and Securities Commission (SEC) prepares to govern on six ETF Spot applications. The window between October 18 and October 25 could determine whether XRP joins Bitcoin and Ethereum as the third cryptocurrency with ETF Spot that are quoted in the United States.

Grayscale, 21Shares, Bitwise, Canary Capital, Coinshares and Wisdomtree are under review. Analysts argue that the approval could unlock new institutional flows, particularly because Bitcoin’s liquidity, almost driven by its spot ETF throws, in XRP.

XRPR was launched on September 18, but the broader approvals will accelerate adoption. Market is already looking for, XRP reached an intradic maximum of $ 2.82 today.

Institutional appetite expands through derivatives

Beyond the ETFs, XRP is gaining impulse in the derivative market. Group CME data shows that the open interest in XRP futures has exceeded $ 1 billion, faster growth among cryptographic derivatives this quarter. CME will also launch XRP and Micro XRP options on October 13, offering a regulated exhibition to a broader investor base.

Ripple’s offer for a letter from the US National Bank. UU., Currently under review by the Office of the Comptroller of La Moneda (OCC), adds another layer of credibility. If it is granted, Ripple would get direct access to the US banking system, a measure that could increase confidence among large investors.

Key drivers that support institutional demand include:

- Futures that increase open interest above $ 1b

- Pending the CME XRP options on October 13

- Ripple Us Bank Charter application under the Western Review

- Secan SEC in multiple ETF applications in October

XRP Technical Perspectives: Triangle Tense

Technically, XRP pricing prediction remains neutral, since XRP has been stuck in a descending triangle since July, characterized by lower maximums against a stable floor of $ 2.70. The 50 -day MA at $ 2.96 is limiting the demonstrations, with long upper shadows that show sellers defending the area. The 100 days at $ 2.61 is short -term support.

The candles show doubts.

The past decreases formed sequences that resemble three black crows, confirming the bassist impulse. The most recent sails with a small body with long shadows reveal indecision, without anywhere in total control.

The RSI in 40 suggests an impulse off, hovering above oversized but without bullish divergence. A rupture requires higher minimums above $ 2.70 or an upward wrap candle at the support level.

Commercial scenarios:

- GUBLISH CASE: Short tickets in failed demonstrations about $ 2.90, pointing $ 2.70 and $ 2.59, with stops greater than $ 2.95.

- Alcista Case: Long configurations gain traction only in a daily closure above $ 3.00, with an advantage of $ 3.25 and $ 3.42.

In simple terms, XRP sits at a crossroads. Institutional catalysts in October (ETF approval, CME options and Ripple Bank letter) can provide the spark. However, until the price is released from the hardening triangle, the demonstrations run the risk of fading and the shorts hold the advantage. A rupture above $ 3.00 could mark the beginning of the next higher XRP leg.

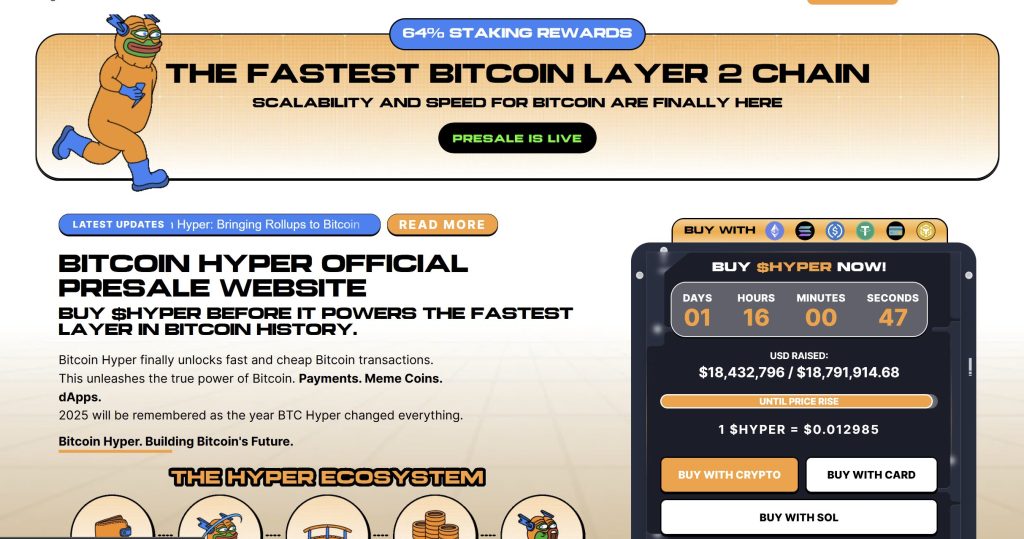

Bitcoin Hyper presale ($ Hyper) combines BTC safety with solar speed

Bitcoin Hyper ($ Hyper) is being positioned as the first native Bitcoin layer fed by the Solana virtual machine (SVM). Its objective is to expand the BTC ecosystem by allowing low -cost intelligent contracts, decentralized applications and even the creation of meme coins.

By combining the unparalleled security of BTC with the Solana High Performance frame, the project opens the door to completely new cases, including the BTC bridge without seams and the development of scalable DAPP.

The team has put a strong emphasis on trust and scalability, with the project audited by consultation to provide confidence to investors in their foundations.

The impulse is being built quickly. The presale has already crossed $ 18.4 million, leaving only a limited allocation still available. In today’s stage, hyper tokens have a price of only $ 0.012985, but that figure will increase as the presale progresses.

You can buy Hyper Tokens on the official Bitcoin Hyper website using Crypto or a bank card.

Click here to participate in the presale

Price prediction after XRP: Bitcoin to XRP Liquidity Rotation expected after the SEC approves first appeared in Cryptonews.

October will be historical:

October will be historical: Gray scale – October 18

Gray scale – October 18