This morning, 12 Senate Democrats published a six -page framework for the structure legislation of the digital asset market in which they described their plan to combat illicit finances while protected the financial privacy of users.

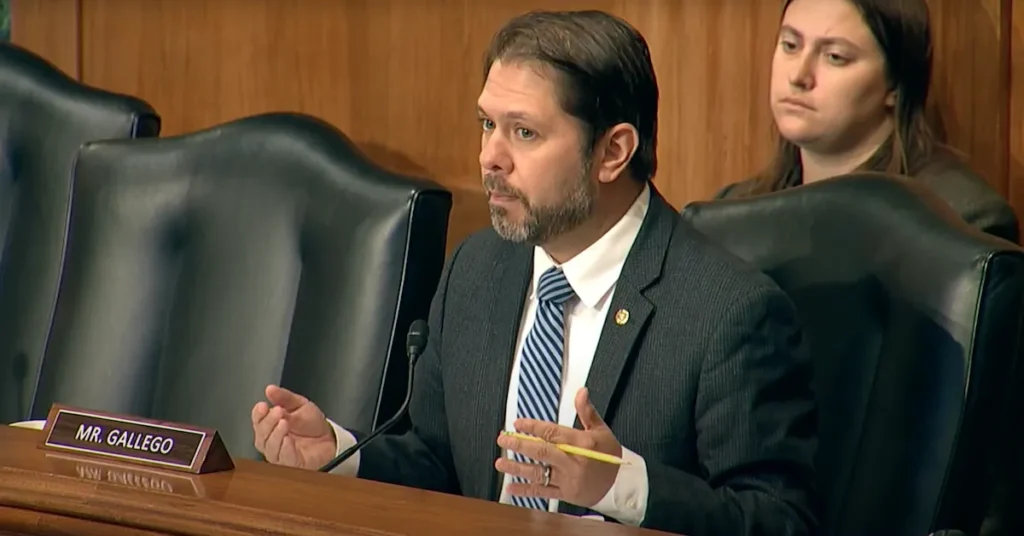

The group of Democrats, which included the member of the Senate Banking Ranking, Ruben Gallego (AZ), Kirsten Gillibrand (NY) and Catherine Cortez Masto (NV), declared on the first page of the document that the legislation of digital assets must be guided by certain values, including “protection of financial privacy while denies the bad actors to the financial system.”

In the fifth section of the frame, they described how this looks.

The scheme included the following points:

- Require that digital asset platforms register with FINCEN as “financial institutions” under the Bank Secrets Law (BSA), while adopting policies against money laundering/combating terrorism financing (AML/CFT)

- Address the use of bad actors of the defi platforms to avoid illicit finance controls

- Make sure the encryption platforms that serve American customers comply with the sanctions and requirements of AML/CFT, even if they are domiciled abroad

- Ecosystems in form to isolate non -conforming platforms that allow illegal activity

Intentionally unclear language?

How do you see the “use of defi platforms of the actors of the bad”? What role will American regulators play in the “configuration of ecosystems to isolate non -compliant platforms”?

These questions remain unanswered according to this framework, which is remarkably less detailed and integral than the draft clarity law that the Senate Banking Committee recently launched.

What comes to mind, I think of the ecosystems of “digital molding” of the United States government is to boost the implementation of a digital identification that only allows the “good actors” to transaccan. The former CFTC president, Tim Massad, said he is in favor of such a scheme in an interview that I did with him earlier this year.

Fortunately, this would be almost impossible to implement technically for Bitcoin. Intelligent blockchain networks, on the other hand, would be more easily susceptible to the censorship of transactions, since the government could order that smart contracts in the network include certain rules and stipulations within the code that prohibit the bad transaction actors.

What Democrats should do

If the Democrats seek to participate in the regulation of Bitcoin and Crypto in good faith, they must be more specific about their intentions and include more details about how they plan to combat illicit finances and at the same time preserve user privacy.

And in their next round of messages, they must clearly define how they plan to “shape ecosystems”, as well as provide clear definitions for what they mean by terms such as “platforms.” For example, when they say “platforms” refer to centralized entities that have private keys of users such as Coinbase or Kraken, or the term also covers services such as Samourai Wallet or Tornado Cash?

These are questions that should be answered if Bitcoin and Crypto Advocates and enthusiasts must trust that Democrats in fact want to consecrate the right of Bitcoin and Crypto users to preserve their privacy.