The cryptocurrency market experienced the adverse consequences of Trump’s tariffs against all other countries in April, or at least the threat, which resulted in a massive decrease in prices to minimum of several months.

Although Potus has continued to impose such taxes on some nations while reducing rates for others, more controversy arose on Friday when the United States Court of Appeals ruled that tariffs are illegal.

Illegal rates?

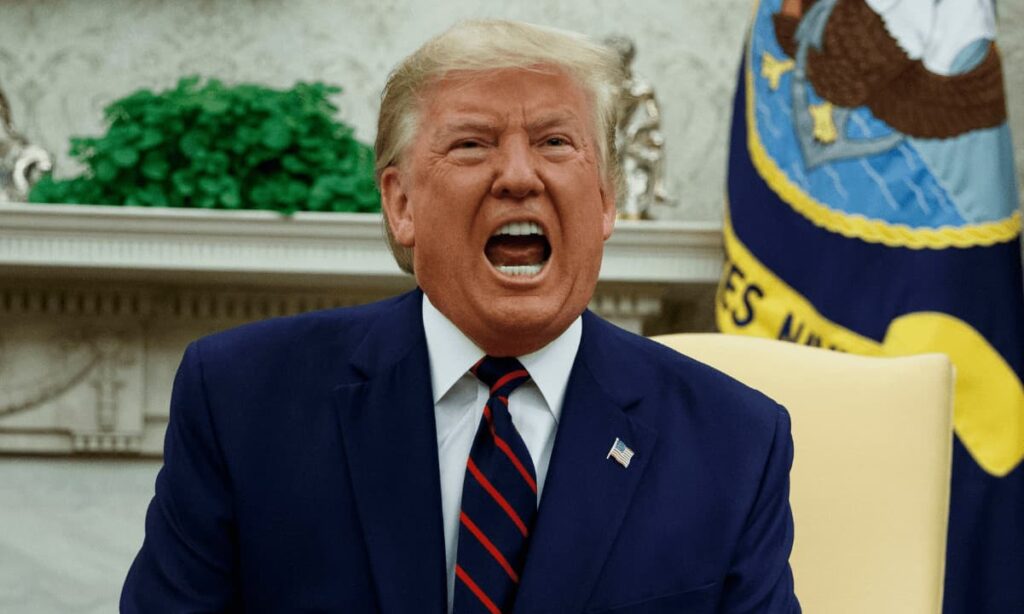

The strike against Trump’s tariffs could be particularly painful for its presidency, given its importance in its foreign policy. After all, the 47th President of the United States has threatened all countries, including many allies, with imposing some type of taxes if they do not yield their commercial demands.

Despite the controversy When surrounding rates, there is a strong argument that Trump has become a winner in negotiations with most of the country’s leaders.

However, the United States Court of Appeals ruled on Friday that most “reciprocal” tariffs are illegal. Some of the nations that were beaten with such were China, Mexico and Canada.

The court, in a 7-4 decision, rejected Trump’s argument that tariffs were allowed under the Emergency Economic Powers Law. Instead, the ruling called them “invalids as contrary to the law.”

The Potus responded quickly, publishing on this social media platform that “all rates are still in force,” and added that the court ruling was “incorrect.”

Impact on Bitcoin and Crypto?

In addition to the decision itself, the moment was also quite controversial. It left only 30 minutes after the futures markets closed on Friday, and Wall Street will not open until Tuesday due to national holidays on Monday.

This is interesting:

The United States Court of Appeals has ruled that President Trump’s global tariffs are illegal 30 minutes after the future was closed.

And, the ruling left before the weekend of Labor Day, when the markets will be closed during the next 3 days.

Is this a coincidence?

– Kobeissi’s letter (@kobeissiletter) August 29, 2025

While this may have saved Wall Street of extreme volatility, the cryptocurrency market is always open. It does not close on weekends or on holidays. In addition, investors tend to react exaggerated and participate in an extreme panic sale when the cryptography market is open and the shocking news is directed.

However, this has not been precisely the case so far. BTC is in red on a weekly scale, but that happened even before the court’s decision. However, there could be a long -term impact on the asset class.

Most experts tend to believe that if the court’s decision is valid and there is less global economic pressure of less rates, then the most risky assets such as Bitcoin and the Altcoins could benefit. Reduced tariffs generally stimulate economic recovery and greater liquidity, which could mean the strength of prices for BTC.

Unlike many companies that could be taxed directly through Trump’s rates, Bitcoin is exempt, so the ruling should not affect its foundations as a class of assets alone.

Free Binance $ 600 (Cryptopotato Exclusive): Use this link to record a new account and receive an exclusive welcome offer of $ 600 in Binance (Complete details).

Limited offer for Cryptopotate readers at Bybit: Use this link to register and open a free $ 500 position in any currency!