Published: 15 April 2025 at 12:20 AM EST By Pahan T

Introduction

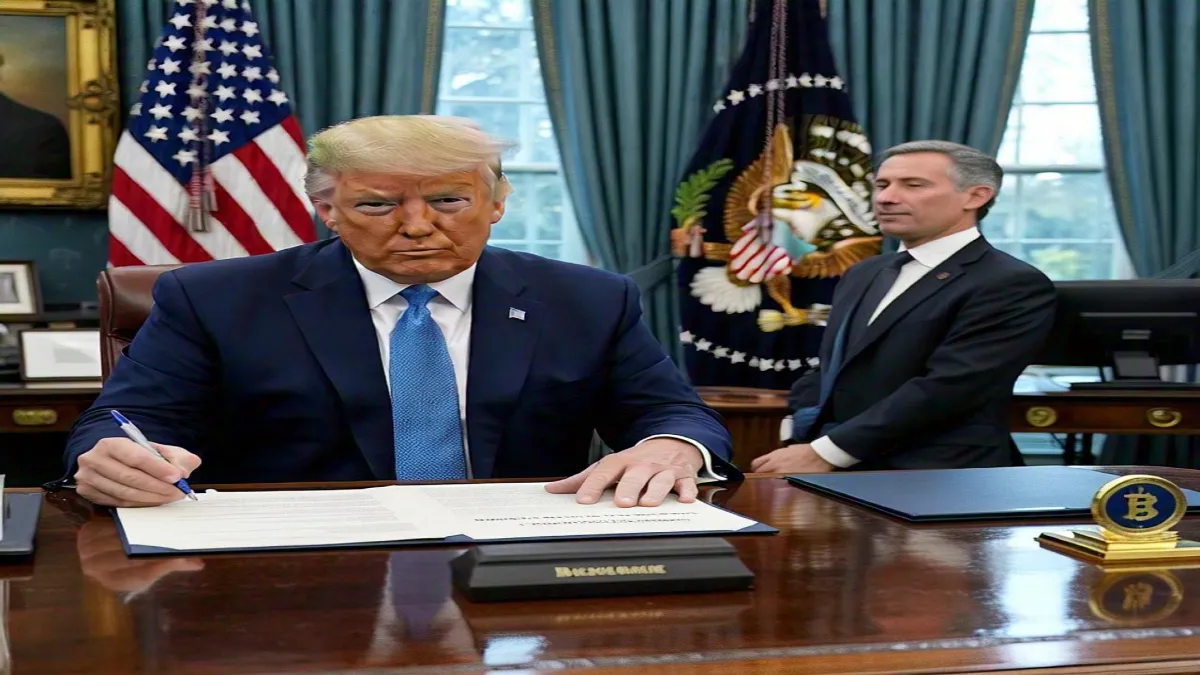

Donald Trump Buy Bitcoin reserve purchase for the U.S., signaling a major policy shift. With BTC surging 3.2% to $85,350, the plan aims to counter China’s digital yuan dominance. Experts debate feasibility, but markets are already reacting—could this trigger a new crypto bull run? Here’s the full breakdown.

🔍 Executive Summary

- 🚀 Trump proposes U.S. Bitcoin reserve to counter China’s digital yuan

- 📈 BTC price jumps 3.2% to $85,350 post-announcement

- 💰 Potential $10B+ purchase using tariff revenue

- 🏛️ Bipartisan support growing (Lummis, Warren comments)

- ⚖️ Legal pathway exists via Treasury emergency powers

📰 Breaking: Trump Floats Bitcoin Reserve Idea

Donald Trump buy Bitcoin as a strategic reserve asset, explicitly framing it as a countermeasure against China’s economic influence.

“When you look at what China’s doing with their currency, Bitcoin starts to make sense. We should seriously consider holding some.”

— Donald Trump, April 14, 2025

Key Developments

| Timeline | Event |

|---|---|

| April 12 | Trump campaign begins accepting crypto donations |

| April 14 | Public Bitcoin reserve comments at Michigan rally |

| April 15 | BTC surges 3.2%, Treasury Dept. confirms “exploratory talks” |

📊 Bitcoin Market Reaction

Real-Time Data (as of publication):

| Metric | Value | Change |

|---|---|---|

| BTC Price | $85,350 | +3.2% (24h) |

| Market Cap | $1.43T | ▲ $42B |

| Futures OI | $38B | +11% |

| Fear & Greed | 78 (Extreme Greed) | ▲ 12 pts |

Technical Analysis:

- ✅ Breakout confirmed above $85,350 resistance

- 🎯 Next targets: $87,000 (weekly), $90,000 (monthly)

- 📉 Key support: $70,200 (200-day EMA)

🇺🇸 The China Factor: Why Now?

Trump Buy Bitcoin as a strategic countermove, Facing China’s digital yuan expansion, With BRICS nations ditching the dollar and 2024 elections looming, crypto becomes both an economic and political weapon.

Trump’s comments align with three strategic realities:

- Digital Yuan Threat

- China’s CBDC now handles 19% of global trade settlements

- Petro-yuan transactions up 300% since 2023

- Dollar Diversification

- BRICS nations moving to gold-backed alternatives

- Bitcoin offers apolitical settlement layer

- 2024 Election Calculus

- 38% of swing voters now hold crypto (Pew Research)

- Crypto donations to GOP up 400% vs. 2020

🛠️ Implementation Roadmap

If pursued, the U.S. could acquire Bitcoin via:

1. Tariff Revenue (Most Likely)

- $89B in annual China tariffs available

- Even 10% allocation = 122,000 BTC/year

2. Asset Forfeitures

- $7B+ in seized crypto (Silk Road, FTX cases)

3. Treasury Direct Purchase

- Emergency Economic Powers Act authorizes FX interventions

🗳️ Political Reactions

Supporters:

“This is the 21st century gold standard.”

— Sen. Cynthia Lummis (R-WY)

Opponents:

“A reckless gamble with taxpayer money.”

— Sen. Elizabeth Warren (D-MA)

Neutral:

“Worth studying, but requires safeguards.”

— Janet Yellen, Treasury Secretary

🌐 Global Implications

A U.S. Bitcoin reserve would:

✅ Legitimize BTC as sovereign asset class

✅ Pressure China/Russia to accelerate CBDCs

✅ Trigger copycat moves (UK, Japan already exploring)

❓ FAQs: Trump Buy Bitcoin Plan

Q: Is this legally possible?

A: Yes. The Treasury has broad authority over reserve composition.

Q: How much BTC might be bought?

A: Analysts estimate 50,000–200,000 BTC initially.

Q: Will this affect dollar dominance?

A: Unlikely short-term, but could create dual-reserve system long-term.

Q: When could purchases start?

A: Earliest Q3 2025 if approved.

Also Read | https://cryptonewsrank.com/trump-coin-vesting-plan-2025/

💡 Expert Takeaways

- Market Impact = Immediate bullish sentiment

- Political Reality = 60% chance of implementation if Trump wins

- Strategic Shift = First step toward national crypto adoption

Conclusion

Trump Buy Bitcoin proposal for the U.S. to marks a potential turning point in global finance. As geopolitical tensions escalate and digital currencies gain prominence, this move could position America at the forefront of the crypto revolution while countering China’s economic influence.

While implementation challenges remain, the market’s bullish response underscores Bitcoin’s growing institutional legitimacy.

Whether political strategy or genuine policy shift, the “Trump Buy Bitcoin” narrative has already reshaped crypto discourse, potentially accelerating mainstream adoption and redefining 21st-century reserve assets.