The attention of investors is becoming World Liberty Financial after its promoter file, WLFI, debuted for trade, and its Stablcoin USD1 badge increased to a supply of $ 2.64 billion in just six months.

Amid the growing adoption, speculation is wild in which Altcoins will benefit more. According to analysts, BNB Coin, Chainlink (Link) and Bonk (Bonk) can be the probable contenders.

Why BNB, Link and Bonk could benefit from WLFI’s adoption

Sponsored

Sponsored

The BNB chain has quickly become the backbone of the expansion of USD1. According to Coinmarketcap, 81% of the USD1 supply is currently maintained in the BNB chain, which makes it the dominant network for WLFI’s stable.

While the supply of USD1 Stablecoin in other chains grew at $ 437.59 million in August, the BNB chain remains very ahead.

This concentration suggests the central role of BNB in the WLFI ecosystem. As the USD1 issuance continues to rise, the demand for BNB chain block and liquidity supply is likely to follow.

For BNB holders, the network effect could be translated into sustained utility and greater transaction volumes. This could be a good omen for the BNB price.

Chainlink (Link) is the second potential beneficiary, whose cross -chain interoperability protocol (CCIP) has become a critical infrastructure layer for WLFI operations.

Zach Rynes, the Chainlink community link, revealed that CCIP processed more than $ 130 million in cross -chain transfer volume in a single day. According to reports, $ 106 million, or 81.5%, is directly linked to WLFI transfers.

Sponsored

Sponsored

WLFI has also adopted the Cruzada chain token standard (CCT) of Chainlink, which makes Oracle services and interoperability of links are indispensable for its expansion strategy.

With more than 80% of the CCIP volume linked to WLFI, the association places the link in the heart of a growing multiple ecosystem.

Therefore, the increase in WLFI activity could translate into stronger foundations for the price of the link.

Sponsored

Sponsored

A third but no less promising Altcoin is Bonk (Bonk), the main card of Solana Memes. Wlfi recently took advantage of Bonk. Fun as the official release of USD1 in Solana, an acclaimed movement as a transformer for both ecosystems.

“We are proud to announce that we have partnered with World Liberty Financial to become the launch of the official USD1 in Solana … bringing the next wave of users to Solana,” Bonk. Fun announced.

Analysts such as Unipc argue that the agreement could unlock an increase in liquidity for the Bonk ecosystem. They point out that USD1 led $ 30 billion in a volume of negotiation to the BNB chain only in its first month.

As WLFI replicates his success in Solana, Bonk and his associated ecosystem they could see significant liquidity and attention entries.

Sponsored

Sponsored

Short -term turns, long -term opportunities for the WLFI ecosystem

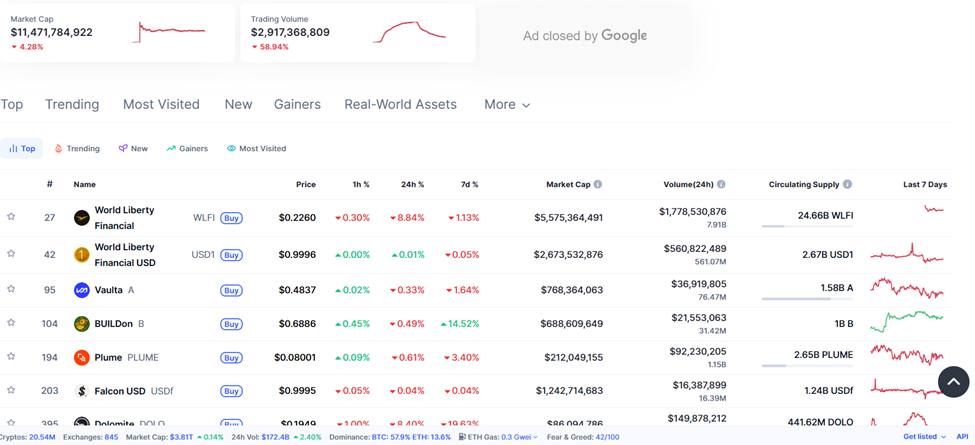

Despite these bullish signals, the wider WLFI sector faces winds against short term. CoinmarketCAP data shows that ecosystem market capitalization fell 4.28% to $ 11.47 billion, while the negotiation volume has fallen almost 60%.

Sponsored

Sponsored

Analysts suggest that early exits can weigh the action of WLFI price, although the feeling could change as new associations such as Bonk.fun’s Go Live.

Ultimately, BNB, Link and Bonk stand out as the main Altcoins ready to benefit from WLFI’s expanding footprint.

These projects could be the avant -garde of the next wave of liquidity, interoperability and growth driven by the stable in cryptographic markets. However, this depends on the adoption of the adoption of WLFI.