In summary

- Bitcoin has fallen 3.77% on average every September since 2013, with eight monthly accidents in 11 years.

- Seasonal pressures, from the rebalancing of the funds to the nerves of the policy fed, are filled with risk that spills the actions to cryptography.

- This year’s configuration adds war, sticky inflation and fed uncertainty, which makes $ 105k the line in the sand for merchants.

Bitcoin is negotiated sideways as August ends, and cryptographic merchants are doing what they do every year at this time: prepare for pain.

The phenomenon known as “Red September” or “The Effect of September” has pursued markets for almost a century. The S&P 500 has averaged negative returns in September since 1928, which makes it the consistently consistent negative month of the index. Bitcoin’s history is worse: cryptocurrency has fallen an average of 3.77% every September since 2013, colliding eight times according to Coinglass data.

“The pattern is predictable: the negative peaks of talks in social networks around August 25, followed by an increase in Bitcoin deposits to exchanges within 48-72 hours,” said Yuri Berg, consultant to the cryptographic liquidity provider with headquarters in Swiss Finchtrade, Decipher.

“Red September has gone from the market anomaly to the monthly psychology experiment. We are seeing an entire market to speak in a sale of a sale based on history instead of the current foundations.”

The mechanics behind Red September dates back to the behaviors of the structural market that converge each fall. Mutual funds close their fiscal years in September, which causes tax loss collection and portfolio rebalancing that floods markets with sales orders. The summer holiday season ends, bringing merchants back to the desks where they reassess positions after months of thin liquidity. Bond emissions arise after Labor Day, extracting capital from shares and risk assets as institutions turn in fixed income.

The Federal Open Market Committee celebrates its September meeting, creating uncertainty that freezes the purchase until the policy address is clarified. In Crypto, these pressures are composed: Bitcoin 24/7 means alternative.

The waterfall begins in traditional markets and spills in cryptography in a matter of days. When the S&P 500 falls, institutional investors throw Bitcoin first to comply with margin calls or reduce portfolio risk. Future markets amplify the damage through the liquidation waterfalls: A 5% punctual movement can trigger 20% in derivative eliminatories. The social feeling metrics become negative at the end of August and merchants sell prevently to avoid expected losses. The options of options cover their exposure selling a Bitcoin point as volatility increases, adding mechanical pressure regardless of the foundations.

And like any other market, some believe that this becomes a pattern of pure rational expectation, which is just another way of saying self -fulfilling prophecy.

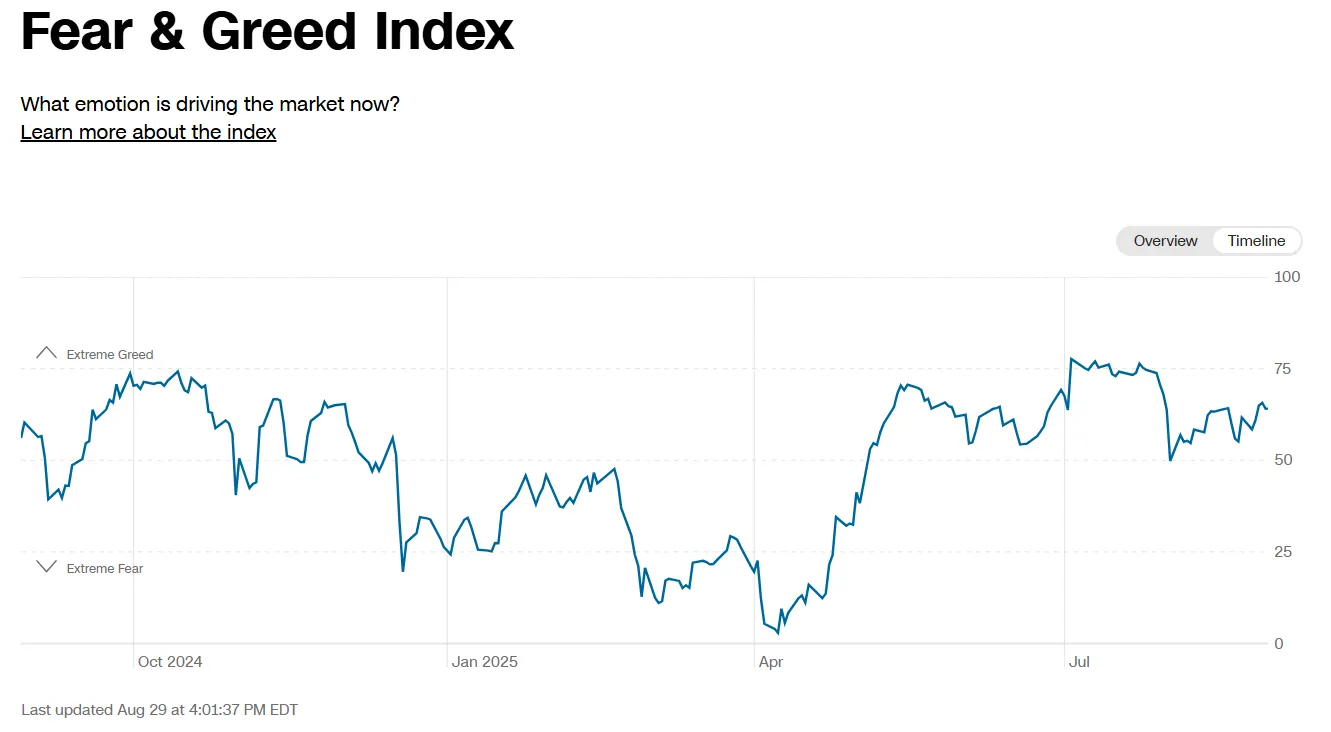

The numbers support Berg’s observation. The Crypto Fear and Greed index has fallen from 74 out of every 100 to 52, despite the global values market that shows a more optimistic vision with 64 points. Neutral limit but even in the “greed” area.

But this September comes with unusual cross tracks. The Federal Reserve has shared positive statements, with the market price in another cut for the September 18 meeting. The inflation of the nucleus remains stuck at 3.1%, while two active wars interrupt the global supply chains. These conditions create what Daniel Keller, CEO of influence technologies, sees as a perfect storm.

“We have two combat theaters that define history, one in Europe and one in the Middle East, which are interrupting critical supply chains,” Keller told Decipher. “In addition, the United States has initiated a global trade war against almost all its main allies. The contemporary state of global geopolitics perfectly positions BTC for a strong decrease in September 2025.”

In other words, at this time, markets do not see Bitcoin as a coverage, which was BTC’s dominant pre-covid narrative as an asset. Markets see it much more as a risk asset.

Technical indicators are beginning to paint an image of fear for merchants. Bitcoin broke below the critical support level of $ 110,000 that has anchored the rally since May. The 50 -day mobile average is at $ 114,000 and now acts as a resistance with the 200 -day EMA that provides support near the $ 103K price line.

Technical merchants can be seeing $ 105,000 as the line in the sand. In Myriad, a prediction market developed by the Decrypt parent company, Dastan, the merchants currently place the chances of Bitcoin returning to $ 105,000 to almost 75%.

A break below $ 105k would go to the levels of less than 100K below the 200 -day mobile average. Hold over $ 110,000 during the first two weeks of September, and the seasonal curse could finally break.

The Reading Force Index 38, in over -sales territory, which implies that at least some Bitcoin investors are trying to get rid of their coins as soon as possible. The volume remains 30% below the averages of July, typical for trade in summer ends but potentially problematic if volatility increases.

But even if things seem that merchants are preparing for the story to repeat, some believe that Bitcoin’s foundations are now stronger than ever, and that should be enough for the king of cryptography to exceed this difficult month, or at least not a clash as it has done in the past.

“The idea of ’Red September’ is more myth than mathematics,” said Ben Kurland, CEO of Crypto Research Platform Dyor. Decipher. “Historically, September has been weak due to the re -quilibrium of the portfolio, the retail impulse that fades and the macro blows, but those patterns imported when Bitcoin was a smaller and more thin market.”

Kurland points to liquidity as the true driver now. “Inflation is not lower, it is demonstrating to be sticky with even higher central readings. But even with that wind against, the Fed is under pressure to relieve as growth cools, and institutional entries are deeper than ever.”

Traditional warning signals are already flashing. The FOMC meets from September 17 to 18, with the markets divided on whether the officials will keep the fees or reduce them.

Keller advises to see the indexes of fear and greed closely. “Merchants in the coming weeks should monitor fear and greed rates to determine the general feeling of the market and if it is better to keep in case prices jump or sell as the ‘Red September’ is approaching,” he said.

The seasonal pattern can weaken as cryptography matures. The September losses of Bitcoin have moderated from a negative average of 6% in the 2010 to 2.55% negative in the last five years. Institutional adoption through ETF and corporate treasures has added stability. In fact, in the last two years, Bitcoin has registered positive profits in September.

Berg sees the whole phenomenon as self-reforted psychology. “After years of the sale of September departures, the cryptographic community has trained to wait for weakness. This creates a cycle in which the fear of salsa becomes the immersion itself,” he said.

The perspective seems bleak, do not worry: after the September Red arrives in October, or “uptober”, which historically is the best month of the year of Bitcoin.

Discharge of responsibility

The opinions and opinions expressed by the author are only for informative purposes and do not constitute financial advice, investment or other advice.

Daily report Information sheet

Start every day with the main news at this time, in addition to original characteristics, a podcast, videos and more.