Russian experts expect the country’s cryptography mining giants to make opi offers in the predictable future, but they say they must first overcome a variety of obstacles.

According to RBC of the Russian media, experts think that sanctions led by the United States and the EU can still demonstrate an obstacle, with national regulations also a potential wrinkle.

Russian cryptography mining giants: Entering opi?

RBC quoted Vasily Turn, the CEO of Gis Mining, as stating that, although many mining companies in the United States have floated in the stock market, Russian miners “currently choose other development tools.”

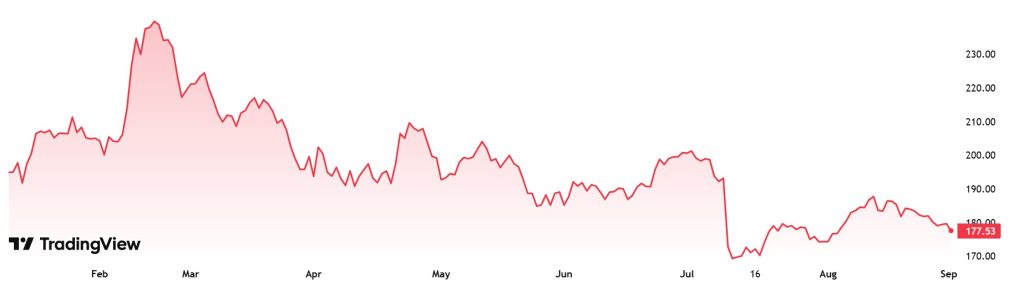

However, many Russian companies are launching an eye in the US market, where the prices of the shares of some of the largest miners of the states have shot in recent months.

Turn said that the main Russian miners are looking to raise funds and grow through the development of strategic associations and private investments, as well as debt financing.

This approach allows miners to maintain flexibility, control commercial risks and adapt to external conditions without responding to stock market pressures, he added.

However, the Chief of Mining of Sig said that it is likely that companies begin to formulate OPI’s plans once Moscow develops “more stable rules.”

But he added that the public listings for Russian miners were now “simply a matter of time and institutional environment.”

American Bitcoin American Movement, says Mine

Turn said that the news that American Bitcoin, the mining company supported by two of the children of the president of the United States, Donald Trump, will float in the stock exchanges this month is a “very important signal for the global cryptography industry.”

The Mining Chief SIG added that cryptographic miners are “becoming increasingly public.” Miners are also searching in stock markets as a means to raise capital and a “scale tool”.

Miners are aware that Russian regulators have not yet created guidelines so that companies related to crypto and blockchain become public.

Turn explained that the market remains in the center of attention, and still “definitely needs time to mature.”

The CEO said that many miners still need to increase the effectiveness of their corporate governance “according to high international standards.”

But other experts suggested that Russian cryptography mining companies could be ready to launch initial public offers (OPI) already in the second half of 2026.

2026 OPI not impossible, says expert

Oleg Ogieko, an independent blockchain, digital finances and energy experts, told RBC that Russian mining companies “may need approximately one year, on average,” to prepare their OPI offers.

But Ogieko explained that given the fact that Russia is still very sanctioned, “the cost of placement is not so attractive.”

He said that companies can expect “to catch the ideal window” with their OPI offers.

However, Ogieko said that while market capitalization of the Russian industrial mining market is “several times smaller” than that of the United States, its prospects are, however, good.

According to data published earlier this year, the Russian cryptography mining sector continues to grow rapidly. The two largest companies in the country, Bitriver and Intelion, obtained combined income of $ 200 million in fiscal year 201024.

Russian mining chiefs say that most industrial miners are still focusing their efforts in Bitcoin (BTC). The smallest numbers also focus on Altcoins such as Litecoin (LTC).

The publication ‘only a matter of time’ before Russian cryptography mining giants launched OPI: experts appeared first in Cryptonews.