This morning in the cryptocurrency market, all attention is focused on “Bitcoin Jesus” Roger Ver, as reports emerge that he has been granted a US pardon in exchange for a $48 million settlement with the Department of Justice.

At the same time,

And just to add fuel to an already chaotic morning, an anonymous Bitcoin whale OG opened a $600 million short against BTC, using massive leverage. Will the market overwhelm him or prove him right?

Bitcoin price under the shadow of a $600 million whale

Bitcoin is trading just above $121,000, moving sideways after rejecting between $124,000 and $126,000, but traders are nervous about a whale, which has turned the entire market into its shadow.

This direction, already famous for converting $5 billion of BTC into ETH earlier this year, has doubled down on its bearish trend. He loaded a $332 million short on ETH with 12x leverage, staked it with $30 million USDC as margin, and then extended his Bitcoin short to $607 million, increasing the leverage from 6x to 8x. This position is equivalent to 5,000 BTC with an average entry of $120,761, with a liquidation of $133,760.

For now, however, the whale’s presence keeps the market divided: Retail longs nervously eye funding rates, while institutional desks whisper about whether this is a calculated hedge or simply suicidal risk.

Figure of the day: “Bitcoin Jesus” Roger See Returns to the headlines

The figure of the day is, without a doubt, Roger Ver. Known worldwide as “Bitcoin Jesus” for his relentless evangelism during the early years of adoption, Ver later became the face of Bitcoin Cash after the 2017 fork and positioned himself as a challenger to Bitcoin’s dominance.

For years he was in regulatory obscurity, which kept him away from the US, but that’s about to change as Ver reportedly reached a deal with authorities to resolve tax evasion allegations, agreeing to pay $48 million.

Some people see this as vindication and think it’s better to just write the check and move on. Others, however, see it as a collapse of his radical stance, which Ver had previously defended.

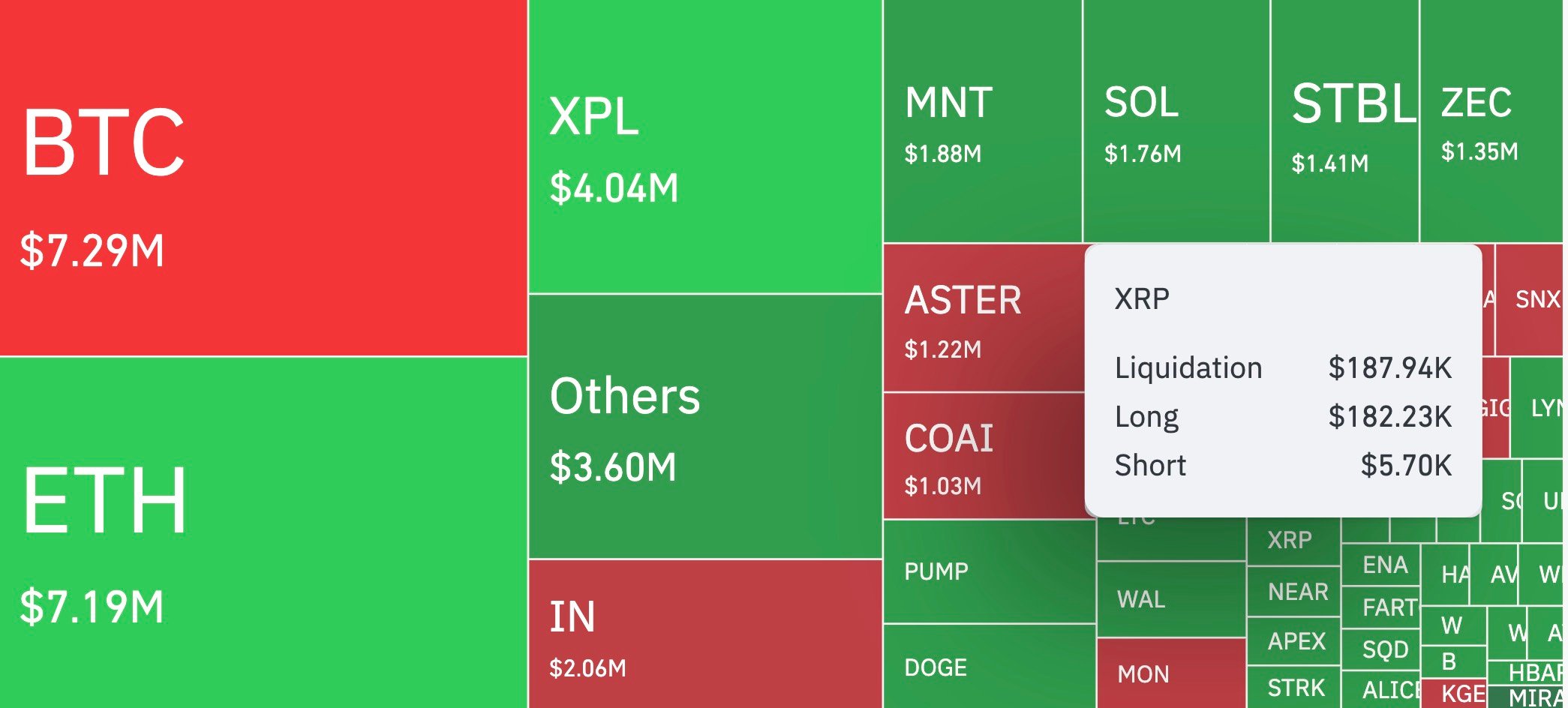

XRP Traders Face 3,192% Bloodbath

The chart of the day is not Bitcoin; It is XRP, and not the price chart. In just four hours, the liquidation imbalance skyrocketed by 3.192%, leaving almost all long traders on the wrong side of the book. The data shows that $187,940 in total was liquidated, of which $182,230 was in long positions, compared to just $5,700 in short positions.

This means that the bulls were the ones who suffered all the pain, as they discovered again that the XRP derivatives market is a minefield, where liquidity disappears instantly and even small movements lead to liquidations.

When positioning becomes too one-sided, the first reversal wipes out everyone, leaving only the smartest investors to take advantage of the cheap deals. For opposing players, this type of situation may present an opportunity, but for most retail traders, it was nothing short of a massacre.

Until XRP reclaims the $3.00 to $3.10 range, the scars of this imbalance will continue to affect sentiment.

night perspective

- Bitcoin (BTC): Support is near $120,000, resistance at $123,000. A squeeze above $126,000 could liquidate overly large shorts and trigger a rapid rally.

- Ethereum (ETH): With ETF outflows of -$8.5 million and a new shortage of whales, ETH faces further downward pressure. The support at $2,940 is essential.

- XRP: After 3.192% sell-off spike, recovering $3.10 would offer relief. Traders should keep an eye on liquidation groups for new positioning traps.

- Solana (SOL) and Mantle (MNT): Despite liquidations of over $1.7 million each, both tokens remained in the green, suggesting strong underlying demand.

- Macro: Focus is on the US session, where new ETF flow figures and whale positioning could decide whether BTC remains range-bound or breaks out violently.