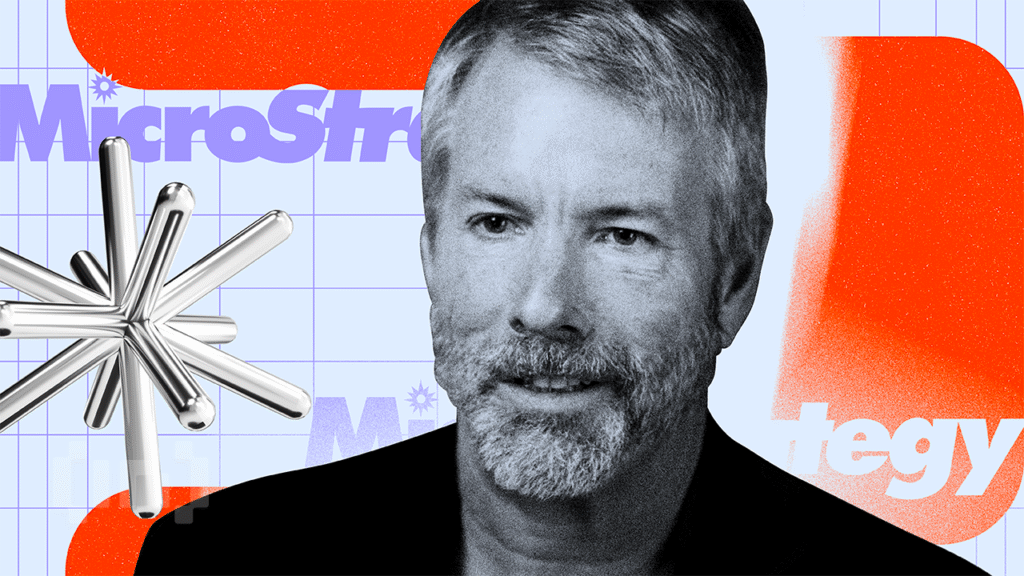

The Microstrategy CEO (now strategy), Michael Saylor, has once again indicated Bitcoin’s additional purchases, reinforcing the aggressive Treasury strategy of the company.

On August 31, Saylor published a table of the independent “Saylor Tracker” platform, which maps Bitcoin’s holdings of the strategy over time.

Saylor suggests a new Bitcoin purchase

The image showed groups of orange points that represent the company’s purchase history, accompanied by his comment: “Bitcoin is still on sale.”

This type of publication has historically preceded purchase ads in the past.

The observers indicate that the company has presented new Bitcoin purchase revelations every Monday during the last three weeks, suggesting that the employer could continue in September.

Last week, the strategy revealed that it had added 3,081 BTC at a cost of $ 356.87 million, paying an average of $ 115,829 per currency. That purchase raised its total stash to 632,457 BTC, for an estimated value of $ 68.6 billion.

The strategy has been largely based on capital markets to finance your purchase. Until now, in 2025, the company has raised $ 5.6 billion in OPI, which represents approximately 12% of all USA listings.

Meanwhile, this aggressive fund collection has not significantly affected the performance of the company’s actions.

According to the strategy, their MSTR actions have constantly surpassed the magnificent so -seven technological actions year after year.

Fallen legal case

Saylor’s comment coincided with the withdrawal of a collective claim that had been pending since May.

Investors had claimed that the strategy cheated shareholders by exaggerating the benefits of adopting fair value accounting, which allows digital assets to be marked at market prices each quarter.

Bloomberg reported that the plaintiffs dismissed the “prejudice” case, which prevents them from increasing the same claims again.

This decision eliminates a significant cantilever for the company and can establish a useful precedent for other companies that have Bitcoin as a balance sheet.

By ensuring legal relief while indicating a greater accumulation of Bitcoin, the strategy reinforced its double approach to take advantage of capital markets and double its Bitcoin model as treasury.

Discharge of responsibility

In compliance with the guidelines of the Trust Project, Beinypto is committed to impartial transparent reports. This news article aims to provide precise and timely information. However, readers are advised to verify independently and consult with a professional before making any decision based on this content. Note that our terms and conditions, privacy policy and resignations have been updated.