Hbar Price has shown signs of life, increasing 2.6% in the last 24 hours to operate about $ 0.219. Despite this short -term rebound, the Token has still dropped approximately 7% in the monthly table. However, during the past year, Hbar has gained more than 330%, which shows that the broader trend remains optimistic.

The daily structure is still fragile, but multiple indicators, from signs of purchase of sauce to impulse changes, suggest that bears could be losing their grip.

Early purchase signals arise in the 4 -hour table

In the 4 -hour table, the money flow rate (MFI), which tracks capital entries and outputs, has been a higher trend, even printing higher maximums while the Hbar price continued to fall. This has not yet appeared in the daily table because the purchase of short -term immersion is generally registered first in lower deadlines.

The meaning: it suggests that Hbar capital rotation has already begun. A movement above 35.90 (anterior height) in the MFI could confirm this extent of accumulation led by accumulation

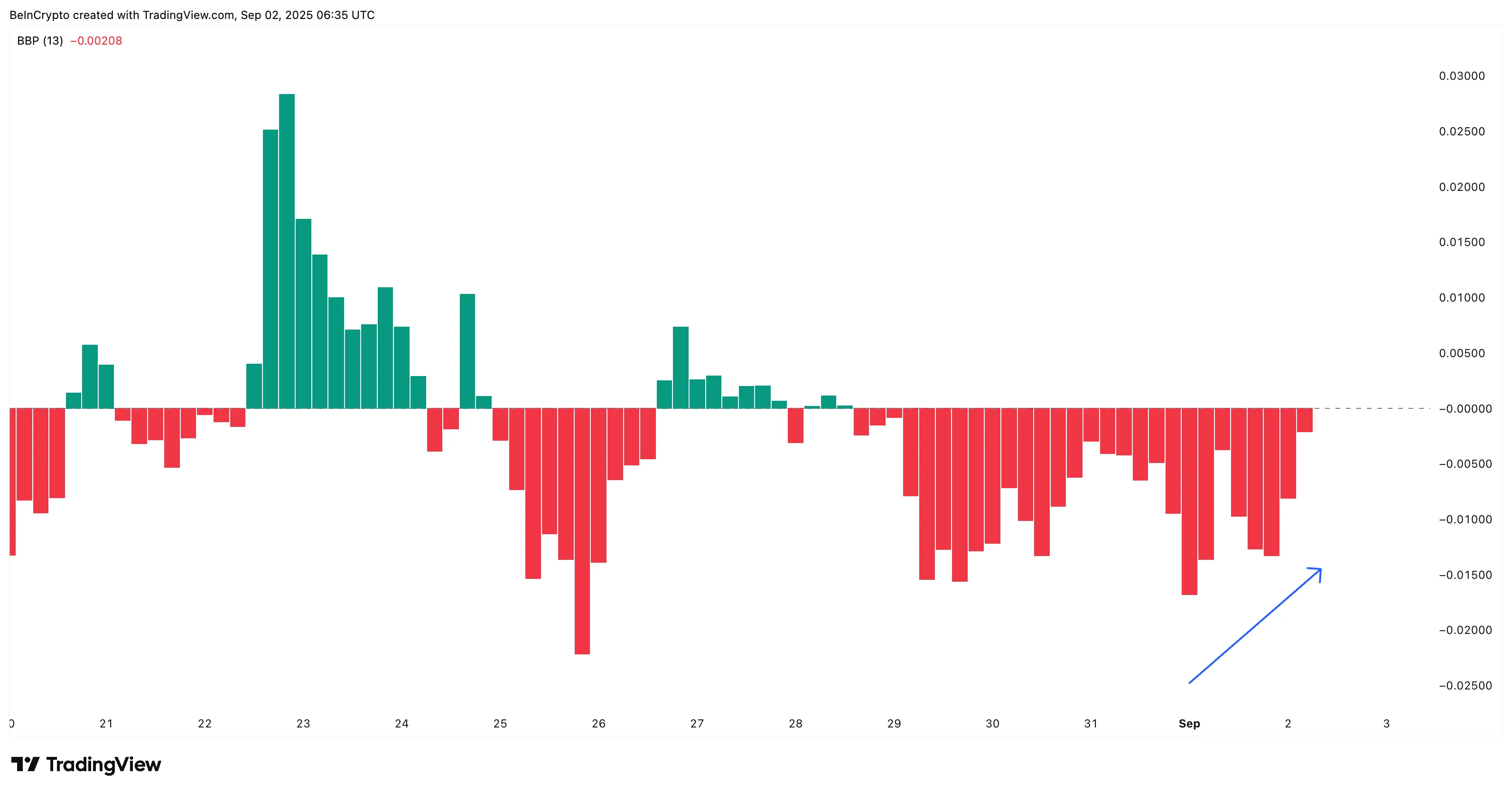

At the same time, the bull power (BBP), which measures the buyer’s force in front of the seller, has decreased since September 1. That means that the bearish domain is fading, while the purchase of sauce continues.

Together, these 4 -hour signs suggest that, although the hbar price is not yet out of the forest, the tide can be rotating.

For token ta and market updates: Do you want more tokens ideas like this? Register in the daily newsletter of Editor Harsh Notariya here.

The daily hbar pricing divergence could cause a rebound

In the daily table, the price of Hbar remains within a descending triangle, with the fibonacci setback levels that serve as markers. The critical support is at $ 0.210: losing it could open the door at $ 0.187. On the positive side, claiming $ 0.235– $ 0.249 would be the first clear sign that the bearish control is being invalidated.

And there is some validation for this optimism.

Between July 13 and September 2, the Hbar price formed a higher minimum, while the relative resistance index (RSI), which tracks the impulse, carved a lower minimum.

This is a hidden bull divergence, often pointing out the continuation of the broader trend. Taking into account the annual profits of 330% HBAR, it is aligned with the idea that the biggest image remains intact, even if short -term pressures persist.

If buyers defend $ 0.210 and claim $ 0.235– $ 0.249, this divergence could be the spark for a sustained rebound and even a rally if the broader market is aligned.

Discharge of responsibility

In line with the guidelines of the trust project, this price analysis article is only for informative purposes and should not be considered financial or investment advice. Beinyptto is committed to precise and impartial reports, but market conditions are subject to changes without prior notice. Always carry out your own research and consult a professional before making financial decisions. Note that our terms and conditions, privacy policy and resignations have been updated.