Historically, the price of Bitcoin reaches its maximum point approximately 20 months after one half of Bitcoin. The last half of half of Bitcoin occurred in April 2024, which means that we could see a cycle cycle in December this year.

The probabilities of this are increasingly probable as the president of the FED, Powell, reduced the rates in 25 BPS today, giving the money funds of approximately $ 7.4 billion a reason to go out and move on to a hard asset like Bitcoin, especially now that it is easier to obtain an exposure to Bitcoin through Bitcoins Spot ETFs and proxies as Bitcoin Companies.

Powell also pointed out that two more rates cuts could be on their way before the year comes out, which would only reduce yields in money market funds, which could boost investors to hard assets such as Bitcoin and Gold, as well as more risky assets such as technology and AI -related actions.

This could catalyze the final stage of a “melted” comparable to what we saw with technology stocks at the end of 1999 before Bubble Dot Com Bubble.

In addition, like the tastes of Henrik Zeberg and David Hunter, I think the stage is preparing for the final parabolic stage of a Toro race that began at the end of 2022.

Using a traditional financial index as a reference point, Zeberg sees the S&P 500 greater than 7,000 before the year comes out, while Hunter sees it by increasing to 8,000 (or more) within the same period of time.

In addition, we can be witnessing the breakdown of a 14 -year support level for the US dollar, according to the Macro Octavio strategist (Tavi) Costa, which means that we could see a markedly weaker dollar in the coming months, more than support the case of bull for hard and risk assets.

What happens in 2026?

Both Zeberg and Hunter believe that, at the beginning of next year, we will see the greatest bust in all the markets we have seen since October 1929, when the financial markets in the United States collapsed, stimulating the appearance of the great depression.

Zeberg’s justification for this includes the true economy that stops, partly evidenced by the number of houses in the market.

Hunter believes that we are at the end of half a century, a secular cycle of secular debt that will end with a leverage, relaxed, different from everything we have seen in modern history, according to what he shared in the stories of coins.

Other signs such as loan payment criminals also point to the idea that the real economy is stopping, which will inevitably have an effect on the financial economy.

Bitcoin’s recession is not guaranteed, but it is likely

Even if we do not head towards a global macro bust, the price of Bitcoin will receive a success in 2026 if the story is repeated.

That is, the price of Bitcoin fell from almost $ 69,000 at the end of 2021 to approximately $ 15,500 at the end of 2022 and almost $ 20,000 at the end of 2017 just over $ 3,000 at the end of 2018.

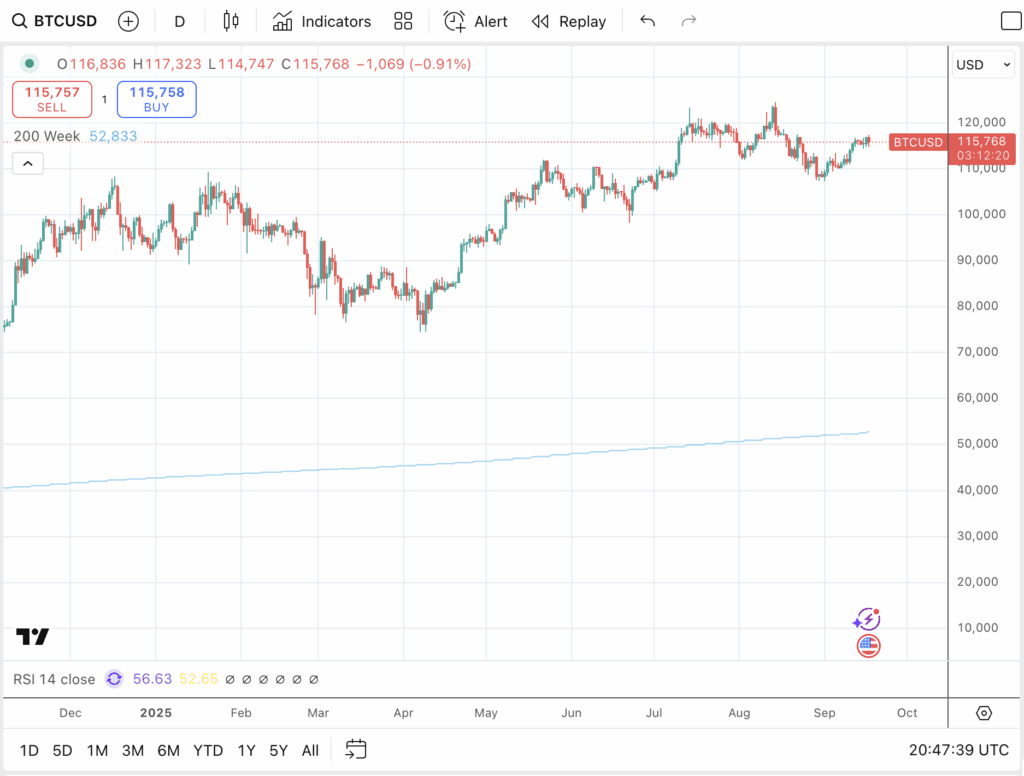

In both cases, the price of Bitcoin took advantage of or submerged below its 200 -week standard mobile (SMA), the light blue line in the tables below.

Currently, Bitcoin’s 200 weeks SMA is at approximately $ 52,000. If we see a parabolic increase in the price of Bitcoin in the coming months, it could increase up to $ 65,000, before the price of Bitcoin falls at such a price or decreases some time in 2026.

If we see the type of bust that Zeberg and Hunter forecast, the price of Bitcoin could also fall well below that threshold.

Said all this, nobody knows what the future holds, and does not interpret anything in this article as financial advice.

At the same time, you may want to keep in mind that, although the story is not necessarily repeated, often rhyme.