Ethereum is attracting serious liquidity. Only during the past week, the network absorbed $ 6.7 billion in Stablecoin tickets, an amount greater than many chains handle in years. That carries the Total Stablecoin Base of Ethereum at $ 145b+, more than half of the entire market, solidifying its position as the Crypto settlement layer for tokens backed by dollars.

This is important because stable tickets often act as dry dust, ready to rotate in ETH or other assets once the feeling changes.

At the same time, institutional demand is recovering. The ETHher ETFs, particularly the Blackrock spot product, have seen constant growth in assets under administration, which shows that regulated structures are becoming an entrance door for professional investors.

Macro and Network Photos

On the macro side, the economy of the United States is slowing down, and the expectations for Fed rates cuts at the end of this year are increasing. The weakest financial conditions tend to benefit cryptography, while the impulse of Stablecoin’s policy in Washington is adding legitimacy to the role of Ethereum as the backbone of tokenized dollars.

Capa 2 networks are also expanding performance and reducing costs, which continues to strengthen the long -term adoption case of ETH.

Outstanding key:

- $ 6.7b in New Stablcoins entered Ethereum in a week.

- Ethereum now houses more than 50%of Stablecoin’s global supply.

- ETF tickets and policy clarity support institutional growth.

Ethereum technical configuration: $ 5k at stake

At the time of writing this article, Ethereum’s pricing prediction is neutral since ETH is about $ 4,305, consolidating within a descending triangle that has limited at the end of August. Sellers rely on resistance to $ 4,490, while buyers defend a triple fund support about $ 4,250.

The 50-SMA ($ 4,363) acts as immediate resistance, with 200-SMA ($ 3,885) anchoring the broader trend. The RSI in 47 is neutral but not overene, leaving room for a break.

If ETH deletes $ 4,490 with condemnation, the road opens to $ 4,665 and the $ 4,865 area, which aligns with its historical maximums.

A bullish wrapping or the formation of three white soldiers would confirm the impulse. On the negative side, losing $ 4,250 risks a drop at $ 4,070 and potentially $ 3,940– $ 3,785.

For merchants, the configuration is clear: a long entry above $ 4,490 with stops below $ 4,250 could point to $ 4,665– $ 4,865 in the short term. With record inputs of stable, demand for ETF and improving macro conditions, the case of Ethereum for a break of $ 5,000 This cycle looks stronger than ever.

Bitcoin Hyper presale ($ Hyper) combines BTC safety with solar speed

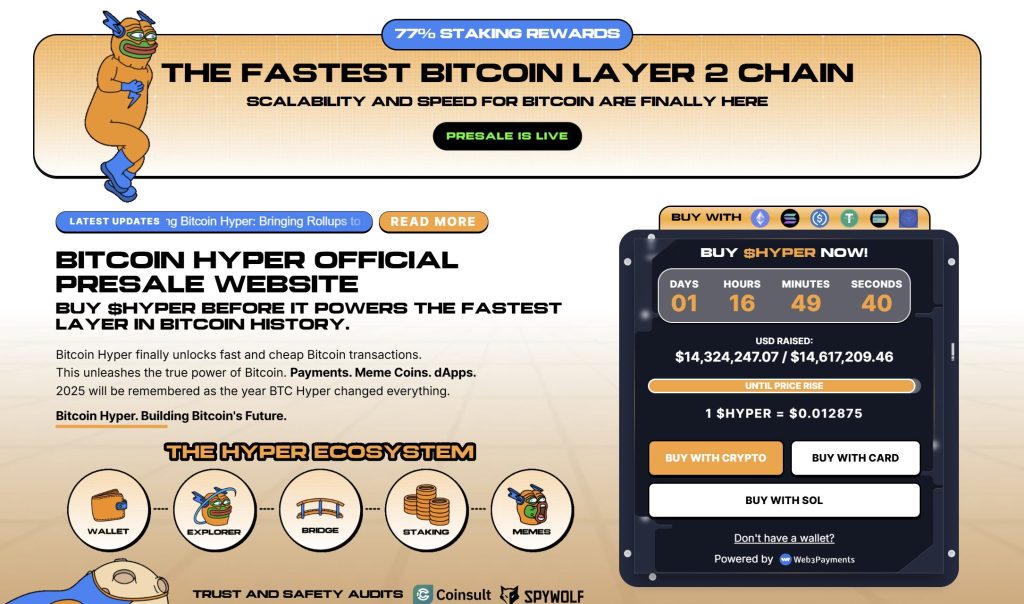

Bitcoin Hyper ($ Hyper) is being positioned as the first native Bitcoin layer fed by the Solana virtual machine (SVM). Its objective is to expand the BTC ecosystem by allowing low -cost intelligent contracts, decentralized applications and even the creation of meme coins.

By combining the unparalleled security of BTC with the Solana High Performance frame, the project opens the door to completely new cases, including the BTC bridge without seams and the development of scalable DAPP.

The team has put a strong emphasis on trust and scalability, with the project audited by consultation to provide confidence to investors in their foundations.

The impulse is being built quickly. The presale has already crossed $ 14.3 million, leaving only a limited allocation still available. In today’s stage, Hyper Tokens have a price of only $ 0.012875, but that figure will increase as the presale progresses.

You can buy Hyper Tokens on the official Bitcoin Hyper website using Crypto or a bank card.

Click here to participate in the presale

Price prediction after Ethereum: Stablecoin’s record entry places an ETH target price of $ 5,000 at play first appeared in Cryptonews.