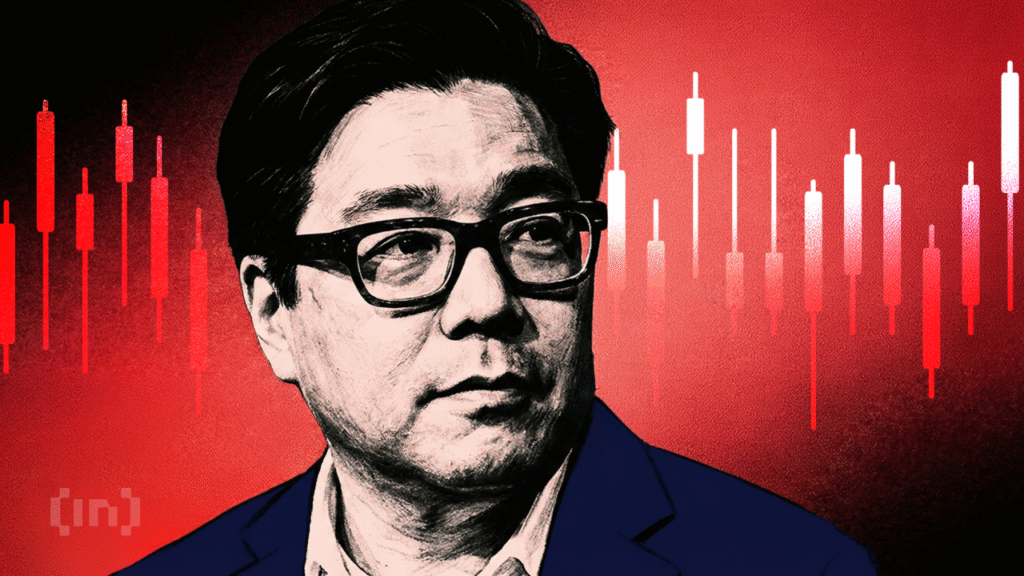

As the price of Ethereum (ETH) reels from a sharp sell-off, few names have drawn more attention than BitMine Immersion Technologies (BMNR), the public company chaired by Fundstrat’s Tom Lee.

BitMine, once a modest crypto mining hardware company, has reinvented itself as the largest corporate holder of Ethereum, amassing approximately 4.24 million ETH, or about 3.5% of the total supply.

BitMine’s $6B Injury Puts Tom Lee’s ETH Treasury on the Brink

With the price of ETH trading near multi-month lows and social media talking of between $5 and $7 billion in unrealized losses, a single question dominates crypto Twitter: What would really happen if BitMine sold its Ethereum now?

Sponsored

Sponsored

The short answer: it would probably be one of the most destabilizing liquidation events in Ethereum history.

A sale that the market is not made to absorb

At current prices of $2,408, BitMine’s ETH stock is worth approximately $10.2 billion, well below the estimated $15.6 billion invested at average entry prices near $3,600-3,900.

Selling that entire position would mean dumping more than 4 million ETH into a market that typically trades tens of billions of dollars a day, but with thousands of participants, not a single seller.

Even if executed gradually, such a volume would overwhelm the order books. Analysts point out that historical whale liquidations show that much smaller dumps have caused price drops of between 10% and 30% in a matter of hours.

In the case of BitMine, the forced sale could send ETH down by 20% to 40%, turning today’s paper losses into damage done.

Instead of being left with $10 billion, BitMine could net between $5 and $7 billion after the slide, according to market depth estimates, effectively locking in a multibillion-dollar loss.

Sponsored

Sponsored

Betting makes it slower and more complicated

Approximately 2 million ETH of BitMine’s holdings are staked, earning around 2.8% annually through Ethereum’s staking mechanism. That return, valued at hundreds of millions per year at scale, would disappear immediately upon exit.

More importantly, staked ETH cannot be sold instantly. Ethereum’s exit queue could delay withdrawals for days or even weeks, meaning BitMine couldn’t get rid of everything at once even if it wanted to.

Ironically, such a delay could prevent the market from suffering an instant collapse, but it would also prolong uncertainty as traders would get the upper hand in the expected oversupply.

Sponsored

Sponsored

From crypto supercycle to cash pile

Strategically, a sale would mark a complete retreat from BitMine’s core identity. The company has positioned itself as an “Ethereum supercycle” play, and is even planning a Made-in-America Validator Network (MAVAN) for commercial launch in 2026. Liquidating ETH would abandon that roadmap entirely.

After the sale, BitMine would transform into a mostly cash-rich company: several billion dollars in liquidity, a minor exposure to Bitcoin (around 193 BTC), and a handful of non-crypto investments, such as Beast Industries.

Volatility would fall, but so would the rise. Any ETH bounce would be missed, which Lee still considers inevitable in the long term.

Sponsored

Sponsored

The consequences of actions, taxes and reputation

For shareholders, the optics could be brutal. BMNR shares have already fallen sharply along with ETH, and capitulation would likely be interpreted as a surrender.

There could be further liquidation, or even fears of delisting, regardless of the company’s debt-free balance sheet.

There is also the tax angle. While current prices imply realized losses, previous tranches purchased at lower prices could still generate taxable gains, which would impact earnings. Regulators could also examine a sell-off of this magnitude for possible market impact.

Finally, there is Tom Lee himself. Few strategists have been more publicly bullish on Ethereum. A sale now would directly contradict its long-standing thesis, raising questions about conviction versus risk management.

In theory, selling would stop the bleeding. In practice, it would crystallize losses, drive down the price of ETH, and dismantle BitMine’s entire strategy. That’s why, despite the noise on X (Twitter), BitMine can continue buying and staking, not selling.

Therefore, as the price of Ethereum, like Bitcoin, continues to fall this weekend, continued liquidation remains the nuclear option.