Bitcoin is quoted at $ 111,654 with a daily turnover of $ 44.1 billion, and the backdrop of the market is changing. Institutional flows have returned in force. Coinshares informs $ 2.48 billion in net tickets only last week, limiting August with $ 4.37 billion and taking the account of the year to $ 35.5 billion, 58% more than the same period last year. This indicates that despite macro turbulence, money is constantly finding its way back to cryptography.

Global ETF tickets drive impulse

The United States continues to lead the position, representing $ 2.29 billion, 92% of the total tickets last week. Europe remained at a distance, with Switzerland by adding $ 109.4 million, Germany $ 69.9 million and Canada $ 41.1 million.

These figures highlight that demand is not limited to a region. The small departures of Friday are more like profits than to the weakness in the trend.

Ethereum surprisingly stole the attention center, attracting $ 1.4 billion, while Bitcoin attracted $ 748 million. Solana and XRP also benefited, raising $ 177 million and $ 134 million, respectively, as optimism grows around ETF approval.

The important thing here is the rotation of investors: institutions pursue the growth of Ethereum but constantly return to Bitcoin when uncertainty increases.

Macro turbulence still matters

The optimism of last week was abolished by the release of basic PCE inflation data, which reduced the hopes of a rate of the September Fed. Cryptographic assets under administration decreased by 10% to $ 219 billion after the news.

But the setback looks temporary. As Konstantin Anissimov of Currency.com pointed out, Ethereum funds only generated almost $ 4 billion in August, indicating that the appetite has not disappeared.

In my experience, this is the pattern we have seen for years: investors take risks with Ethereum when the markets are calm, but return to Bitcoin every time macro risks are built. Bitcoin’s safe attractive continues superficial, reinforced for $ 250 million ETF tickets last week.

Bitcoin technical perspectives: Breakout or Breakdown?

In the graphics, Bitcoin’s pricing is becoming a short -term bassist, since BTC presses against the resistance to $ 113,400 while building a higher minimum base, an ascending triangle of textbooks.

The 50-SMA is at $ 111,325 and 200-SMA at $ 112,755, providing bulls with layer support. The RSI has cooled to 47 after test 60, leaving room for the impulse to restart before another moves higher.

If buyers handle a clean rest above $ 113,400, the following levels to see are $ 115,400 and $ 117,150. A stronger impulse could extend the race to $ 125,000 in the medium term. On the other hand, lose the floor of $ 110,000 risks a slide to $ 108,450 and $ 107,407.

For merchants, the configuration is simple: a closure above $ 113,400 opens space for lengths that are heading to $ 117,000 and possibly $ 130,000, while the stops must remain below $ 110,000.

With the institutional demand for resurgence and technical indicators that suggest that a coil is ready to relax, Bitcoin can be preparing for its next great concentration. This is the type of configuration where whales are positioned in silence, letting the retail trade catch up once the outbreak is already underway.

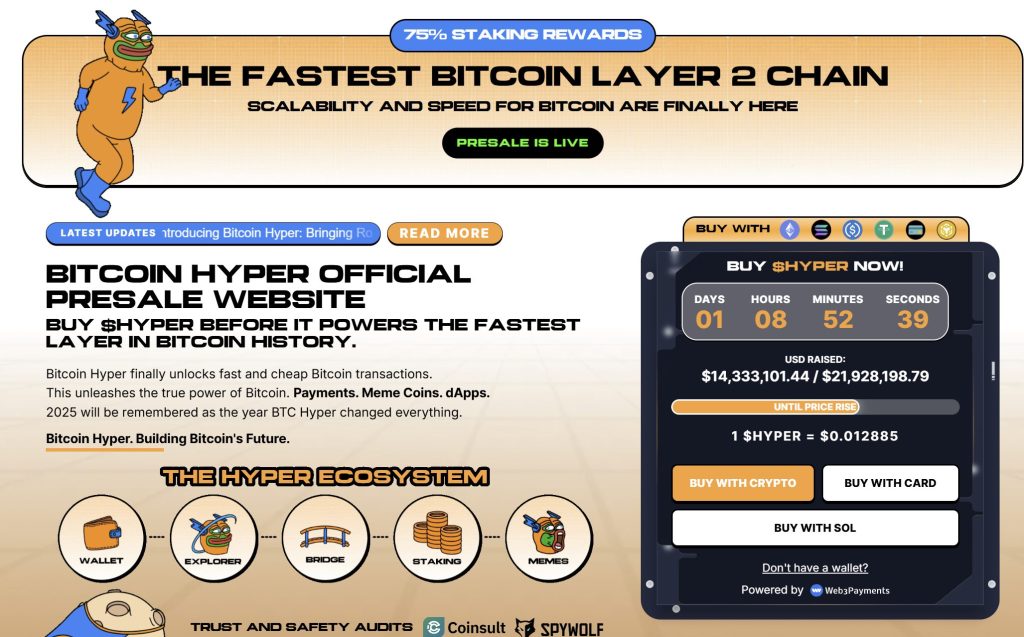

Bitcoin Hyper presale ($ Hyper) combines BTC safety with solar speed

Bitcoin Hyper ($ Hyper) is being positioned as the first native Bitcoin layer fed by the Solana virtual machine (SVM). Its objective is to expand the BTC ecosystem by allowing low -cost intelligent contracts, decentralized applications and even the creation of meme coins.

By combining the unparalleled security of BTC with the Solana High Performance frame, the project opens the door to completely new cases, including the BTC bridge without seams and the development of scalable DAPP.

The team has put a strong emphasis on trust and scalability, with the project audited by consultation to provide confidence to investors in their foundations.

The impulse is being built quickly. The presale has already crossed $ 14.7 million, leaving only a limited allocation still available. In today’s stage, hyper tokens have a price of only $ 0.012885, but that figure will increase as the presale progresses.

You can buy Hyper Tokens on the official Bitcoin Hyper website using Crypto or a bank card.

Click here to participate in the presale

Bitcoin’s pricing prediction: ETF tickets of $ 2.48B indicates reversion of scope – are whales on silence again? It appeared first in Cryptonews.

– US $ 440 million

– US $ 440 million  + US $ 85.1m

+ US $ 85.1m  + US $ 8.1m …

+ US $ 8.1m …