Bitcoin (BTC) is quoted around $ 108,700, plan in the day, but even more than 6% in the last month and around 5% during the last week. The price action of Bitcoin silenced reflects a broader caution throughout the market, but under the surface, the signals in the chain suggest that a rebound narration is being strengthened.

The capitulation of the short -term holder, the price groups carried out and the technical levels together point to a market that prepares for its next decisive movement.

Short -term sopruptor shows weak hands coming out

The worn production ratio (SOPR) ratio measures whether the coins transferred in the chain were sold with profits or losses. For short -term holders, which are usually the most reactive, the metric provides an almost real -time feeling indicator.

With Bitcoin price sliding in recent weeks, the short -term SOPR has fallen to 0.982 (August 29), its lowest level in months. This means that a large part of the short -term holders are sold with loss, often interpreted as capitulation by weak hands.

Historically, such behavior clears the market for short -term speculators, creating conditions for the strongest hands to intervene.

You can see a parallel on April 17, when SOPR played 0.94, a minimum of one year. At that time, Bitcoin touched a fund at $ 84,800 before bouncing 31.6% at $ 111,600 once SOPR turned back above 1.

The current movement exhibits a similar configuration, which suggests that this last capitulation can indicate a market fund.

For Token ta and market updates: Do you want more tokens ideas like this? Register in the daily newsletter of Editor Harsh Notariya here.

At the time of publication, the short -term SOPR metric has increased to 0.99, but remains around the minimum of several weeks.

URPD highlights heavy support and resistance groups

The UTXO made price distribution maps (URPD) where the existing BTC supply moved for the last time, providing information on support and resistance. Each group represents the price levels where large amounts of Bitcoin were bought, creating natural barriers.

At the lower end, $ 107,000 anchor a strong group of 286,255 BTC (1.44%), while $ 108,200 ($ 108,253.26 in the table) has 447,544 BTC (2.25%). These concentrations explain why the price of Bitcoin has stabilized around the $ 108,000 zone despite the continuous sales pressure.

Interestingly, the last Low coincided with the Bitcoin trade about $ 108,300, almost the same as the URPD cluster of $ 108,200, reinforcing this area as a possible lower market area.

On the side, the resistance accumulates rapidly. $ 113,200 (near the level of $ 113,500) has 210,708 BTC (1.06%), and $ 114,400 has 220,562 BTC (1.11%). The most significant barrier is at $ 116,900, where 2.88% of the offer was made for the last time, the heaviest wall of this region. For bulls, claiming this area is essential for any sustainable rebound.

Bitcoin price levels to see

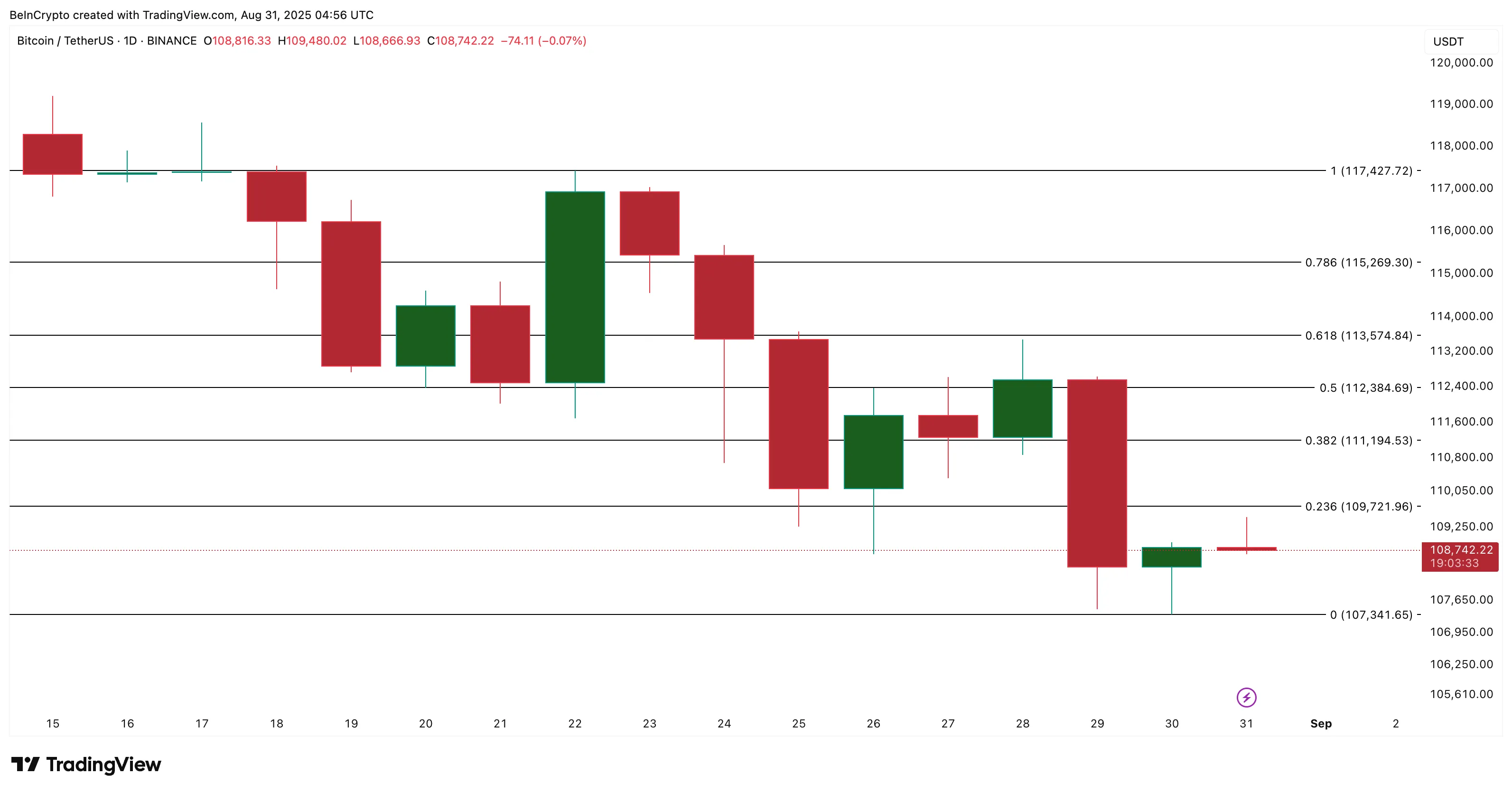

Technically, Bitcoin’s Swing Low at $ 107,300 remains the key level of invalidation (near the lowest key anchor of $ 107,000). A closure below would confirm a bearish continuation and undermine the market background thesis.

On the bouncing side, claiming $ 109,700 is the first sign of force. Above that, $ 112,300 (FIB 0.5) and $ 113,500 (FIB 0.618) are the rupture areas that bulls need to turn.

By visual signs, the $ 113,500 is a repeated rejection zone for the current price of Bitcoin and remains the most critical level to change the narration

For now, the story is clearly connected. Weak hands are coming out (SOPR), strong hands defend key groups (URPD), and the price is falling close to support. If the price of Bitcoin exceeds $ 117,400, it could confirm the renewed force.

But the lack of retention of $ 107,300 would incline the narration to the Bears.

Discharge of responsibility

In line with the guidelines of the trust project, this price analysis article is only for informative purposes and should not be considered financial or investment advice. Beinyptto is committed to precise and impartial reports, but market conditions are subject to changes without prior notice. Always carry out your own research and consult a professional before making financial decisions. Note that our terms and conditions, privacy policy and resignations have been updated.