In summary

- The Bitcoin mining profit and loss sustainability index hit a 14-month low, according to CryptoQuant.

- The metric measures the price of Bitcoin against the profitability of running a Bitcoin mining operation.

- Shares of publicly traded BTC miners have fallen by double digits this week.

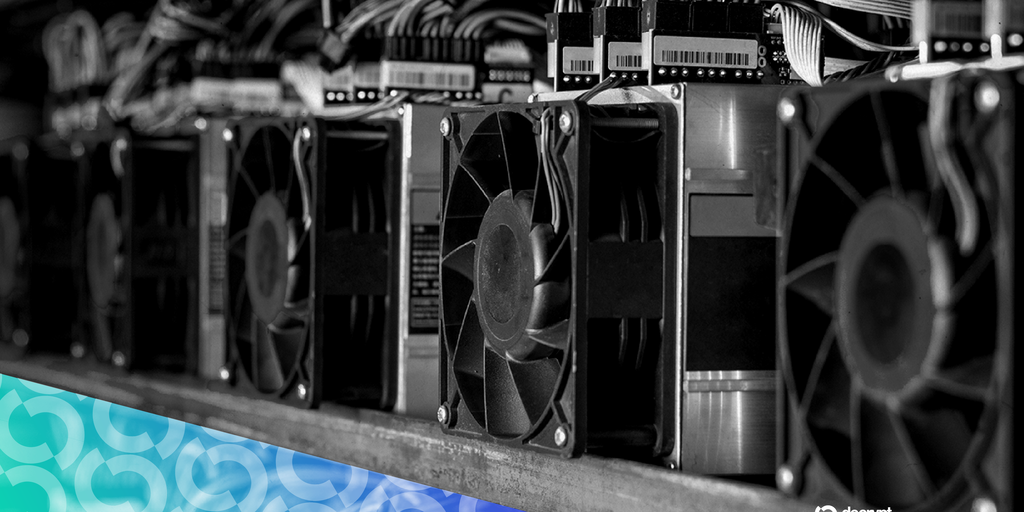

Bitcoin miners are struggling to turn a profit lately amid the asset’s falling price and external complications, including a winter storm that shook much of the United States last weekend and affected production at major mining companies.

A ratio that tracks the relationship between the price of Bitcoin and the profitability of the operation bitcoin Mining operations have reached their lowest level in 14 months. according to CryptoQuant data.

“Miners’ profit and loss sustainability index is at 21, the lowest since November 2024,” the company wrote in its latest mining report, published on Thursday.

In other words, with Bitcoin’s price falling sharply this week and its current mining difficulty level, miners are “extremely underpaid,” according to CryptoQuant. And that’s despite the fact that the network’s hash rate, or the measure of all computing power on the network, has fallen in five consecutive periods and is at its lowest level since September 2025.

In addition to Bitcoin miners being “extremely underpaid” according to the aforementioned index, some were severely affected by a recent major winter storm that covered the eastern United States, bombarding several states with ice and snow.

The winter storm, which caused a further decline in the hash rate, also reduced daily mining revenue to an annual low of $28 million, according to the data firm.

The decline in production coincided with a bleaker market for traditional stocks and crypto assets, where shares of publicly traded miners such as MARA Holdings, CleanSpark and Riot Holdings have fallen by double-digit percentages over the past five trading days.

Bitcoin has fared only slightly better, falling 6% over the past seven days to change hands at $83,956, about 33% below its October all-time high of $126,080.

Earlier this week, data from Cambridge Bitcoin Electricity Consumption Index highlighted that now it costs more to mine BTC than buy it on the open market.

The financial difficulties and opportunities brought by the demand for AI computing have led some publicly traded miners such as Bitfarms and digital bits completely close their operations in search of more beneficial business models for shareholders.

A CryptoQuant representative did not immediately respond to Decipher request for comment.

Daily report Fact sheet

Start each day with the biggest news stories, plus original features, a podcast, videos and more.