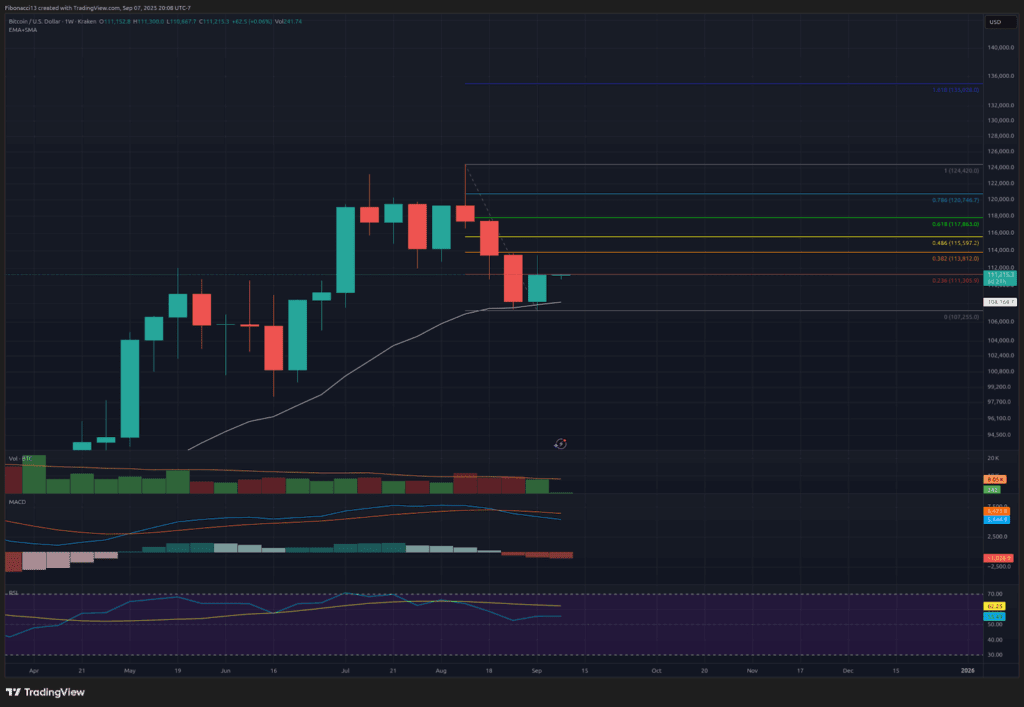

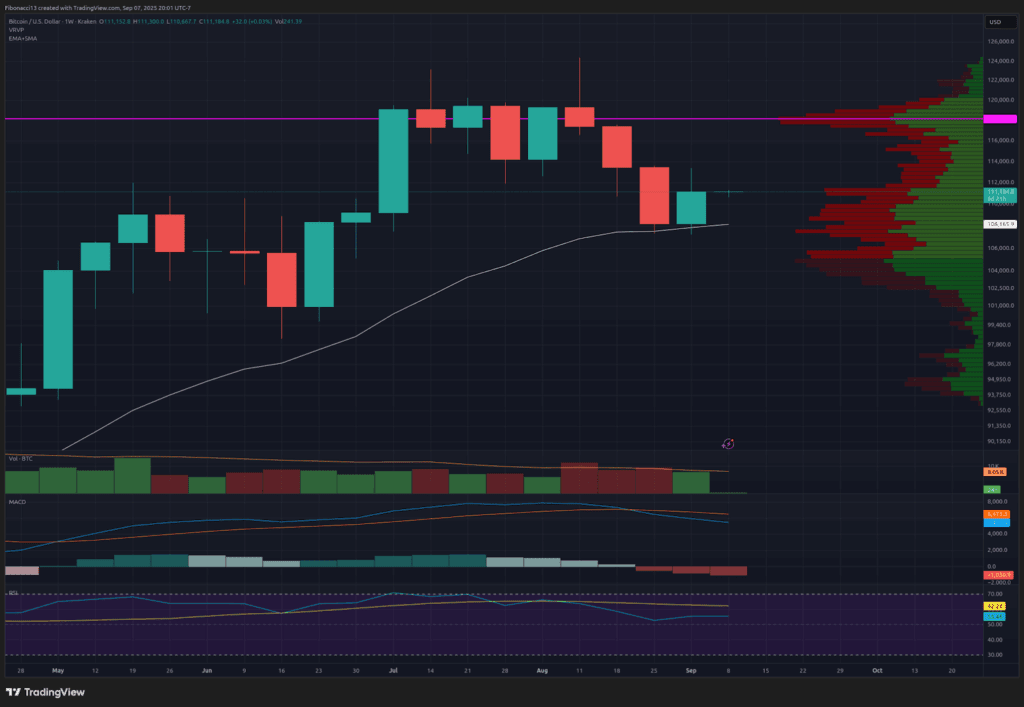

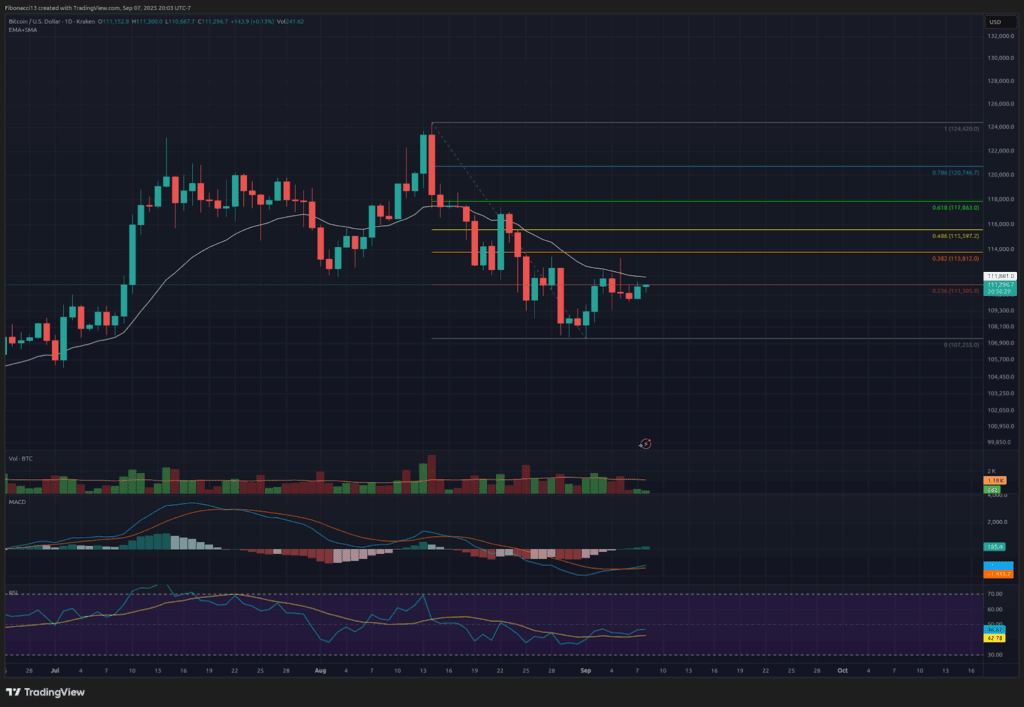

Bitcoin Price found support in the EMA of 21 days last week, avoiding a deeper fall after closing at the minimum of the previous week. Bulls managed to defend the level of $ 107,000, but the impulse stopped just below the resistance. From Wednesday to Friday, Bitcoin failed to close above $ 112,500 and finished the week at $ 111,162.

The inability to claim $ 112,5,000 highlighted a pause in the recent recovery. Even so, keeping over $ 107,000 has kept the bias slightly upwards for now. Merchants are observing closely if this consolidation becomes a base or a continuation of the bearish trend.

Key support levels and resistance now

At present, $ 107,000 is the most important line of defense for the price of Bitcoin. A breakdown below would change the focus to lower support areas to $ 105,000, $ 102,500 and potentially $ 96,000.

On the positive side, $ 112,500 is the first resistance that supports. If the bulls manage to close the newspaper above that level, the following objective is $ 115,500. Beyond there are $ 118,000, a formidable barrier that would need a weekly nearby to confirm a renewed upward trend.

Perspective for this week

Next week could bring more volatility. On Thursday, September 11, US inflation data at 8:30 am a hottest impression can generate a lower risk feeling and drag lower bitcoin, while a softer number could provide relief to bulls.

If the price of Bitcoin can recover $ 112,500 earlier for the week, it is likely to be a boost towards $ 115,500. Otherwise, it maintains the market vulnerable to another evidence of the minimum of $ 107,000.

Market mood: Neutral and inclined support is holding, but resistance remains firm.

The next few weeks

Looking further, Bitcoin eventually eliminated $ 118,000 with a conviction to restore the upward trend and defend against bears. A decisive weekly closure above this level would probably attract impulse buyers and improve feeling in October.

If $ 107,000 is broken, the road opens to $ 105,000 and $ 102,500, with the possibility of a sweep as low as $ 96,000 before a lasting fund is located. Given the pattern of recent closures, some analysts warn that one more fall cannot be ruled out.

Terminology Guide:

Bulls/Bullish: Buyers or investors who expect the price to rise more.

Bears/bassists: Sellers or investors who expect the price to decrease.

Support or support level: A level at which the price must be maintained for the asset, at least initially. The more you touch the support, the weaker it becomes and the more likely it will have not to have the price.

Resistance or resistance level: Opposite to support. The level that probably rejects the price, at least initially. The more you touch the resistance, the weaker it becomes and the more likely it will have not to contain the price.

EMA: Exponential Mobile Average. A mobile average that applies more weight to recent prices than previous prices, reducing the delay of the mobile average.