Abu Dhabi just made a quiet but massive bet on Bitcoin.

Sovereign debt-linked investors disclosed more than $1.04 billion in U.S. spot Bitcoin ETFs by the end of 2025. Mubadala Investment Company alone reported more than 12.7 million BlackRock spot Bitcoin ETF shares, worth about $630.7 million.

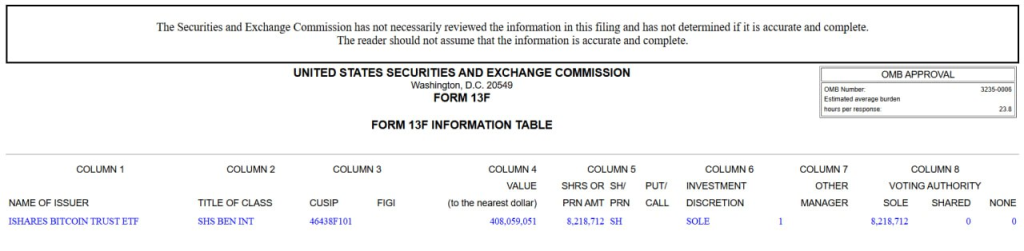

Al Warda Investments added another 8.2 million shares, valued at about $408.1 million. Altogether, that’s approximately 20.9 million shares linked to one of the largest Bitcoin ETF issuers in the world.

This is not retail speculation. This is state-backed capital that is allocated at scale.

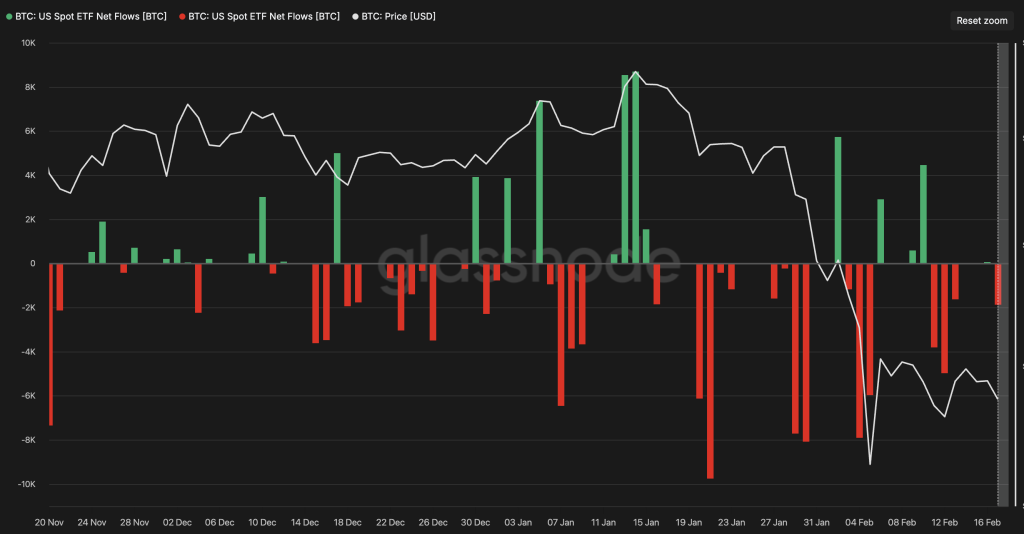

The filings come as Bitcoin ETFs recorded $104.87 million in daily net outflows and short-term selling pressure returned. Spot Bitcoin has been hovering around the mid-$60,000 range, while overall sentiment remains fragile.

However, these positions reflect holdings as of December 31. That suggests a longer-term allocation strategy rather than tactical trading.

Bitcoin Price Prediction: Are Governments Keeping the Price at This Level to Accumulate It?

Bitcoin is still compressing between clear levels.

On the chart, the price bounced strongly from the demand zone of $60,000 to $64,000 and is now settling just below the resistance band of $70,000 to $71,000.

That area remains limited to the upside. A clear break and hold above $71,000 would change the short-term structure and open the way towards $80,000 and then $90,000.

The downside is simple. $64,000 is the key floor. If you lose it, $60,000 will quickly come back into play.

Now, zoom out and connect it slightly to the ETF story. While prices are falling and sentiment appears fragile, sovereign-sized allocations are quietly accumulating in the fund.

If the structure continues to improve and $71,000 eventually becomes support, the price could start to reach that longer-term positioning. For now, it is a battle between range resistance and a base trying to form above $64,000.

As Governments Accumulate, Bitcoin Hyper Could Activate Capital

State-backed money can give us patience. They assign. They wait. They are maintained thanks to volatility.

Retail doesn’t always move that way.

Bitcoin Hyper ($HYPER) is designed for participants who want more than just slow range compression. This Bitcoin-centric Layer 2, powered by Solana technology, adds speed, lower fees, and real on-chain utility while preserving Bitcoin’s core security.

It maintains the strength of the Bitcoin brand but unlocks real activity on top of it. Payments. Rethinking. Scalable execution.

The momentum is already visible. The Bitcoin Hyper pre-sale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next surge. Staking rewards currently reach up to 37%.

If Bitcoin eventually surpasses $71,000, great. If it continues to cut while institutions accumulate, Bitcoin Hyper could be positioned to move anyway.

Visit the official Bitcoin Hyper website here