Published: March 30, 2025 10:30 AM EST By Pahan T

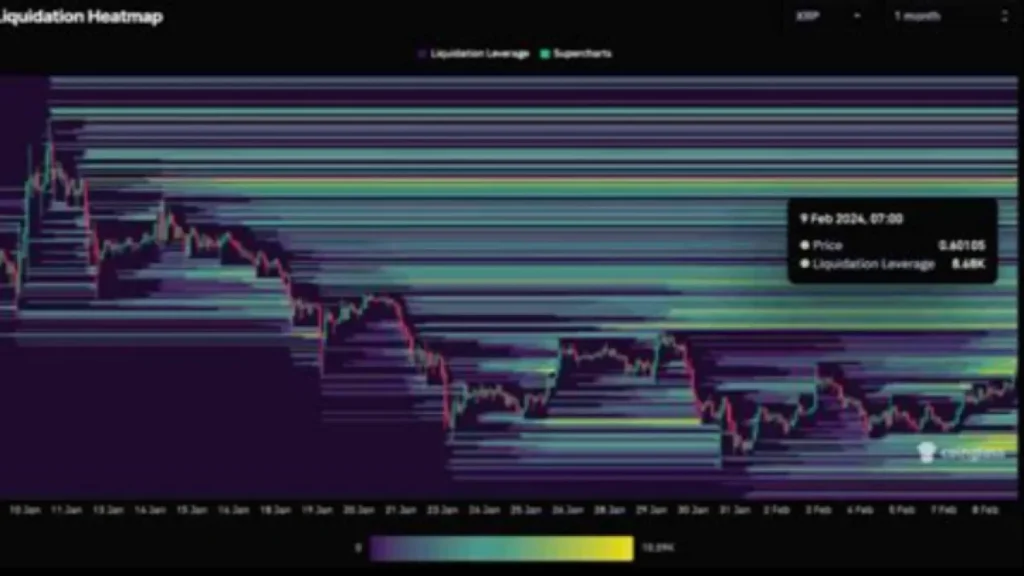

🔍 XRP Price Action Liquidation Snapshot

✔ $4.2M liquidated after 3.67% drop

✔ Critical support test at $2.10

✔ 50/50 long-short wipeout signals extreme volatility

📉 XRP Price Action Liquidation Analysis

The latest XRP price action liquidation event saw:

- 3.67% drop in 24 hours

- $4.2M positions liquidated

- Balanced 50% long/50% short carnage

This XRP price action liquidation mirrors broader crypto weakness as Bitcoin struggles below $70K. The recent drop in XRP’s price has been largely fueled by leveraged liquidations, as traders holding overextended positions were forced to exit.

📌 Understanding XRP Liquidations

Liquidation in crypto trading occurs when an exchange forcefully closes a trader’s position due to a lack of margin balance. This typically happens when the market moves against highly leveraged positions. The impact of these liquidations can create sharp price fluctuations, amplifying XRP’s volatility.

The combination of weak market sentiment, liquidation cascades, and lack of bullish momentum has driven the price lower, testing key support levels.

⚖️ Key XRP Price Action Liquidation Levels

Support (Make-or-Break)

- $2.12 (Immediate support)

- $2.10 (Psychological floor) → Breach could trigger cascade

- $1.95 (Last major defense before a larger drop)

Resistance (Recovery Path)

- $2.21 (First hurdle)

- $2.30-2.40 (200D MA resistance)

- $2.50 (Strong historical resistance)

📊 XRP Price Action Liquidation: Technical Outlook

Technical Indicators Overview

Here’s an enhanced and structured table summarizing the technical indicators for XRP:

| Indicator | Value | Signal | Implication |

|---|---|---|---|

| RSI | 30 (Near oversold) | Bullish Reversal Potential | Suggests XRP is oversold; a relief bounce may occur if buying pressure increases. |

| MACD | Below Signal Line (Bearish) | Downward Momentum | Indicates sustained selling pressure; trend remains bearish unless MACD crosses above signal line. |

Key Takeaways:

- Short-term traders: Watch for RSI reversal signals (e.g., divergence or break above 30) for potential entry.

- Trend traders: MACD remains bearish—caution advised until a bullish crossover confirms trend reversal.

Would you like additional indicators (e.g., Bollinger Bands, Moving Averages) included for a fuller analysis?

🔮 XRP Price Action Liquidation: 3 Scenarios

- Bullish: Holds $2.10 → $2.40 rebound

- Bearish: Loses $2.10 → $1.80 plunge

- Sideways: Chops between $2.10-$2.21

Market Sentiment & External Influences

Several external factors are contributing to XRP’s price movement:

- Regulatory Uncertainty: Ongoing legal battles and crypto regulations are creating market hesitancy.

- Bitcoin’s Performance: As the dominant crypto, Bitcoin’s movement directly affects XRP and altcoins.

- Institutional Interest: Large investors and whales can influence XRP’s liquidity and price swings.

- Macroeconomic Conditions: Interest rate policies and global economic trends are impacting risk assets like crypto.

Potential Catalysts for XRP’s Recovery

If XRP is to regain bullish momentum, a few key catalysts could help trigger a turnaround:

- Clear regulatory framework for XRP and Ripple Labs.

- Increased adoption of XRP in cross-border payments.

- Institutional buying pressure pushing the price above key resistance levels.

- Positive macro trends, such as declining inflation and a stronger risk-on sentiment.

📢 Expert Opinions on XRP’s Future

Crypto analysts remain divided on XRP’s future trajectory. Some believe XRP’s adoption in financial institutions will lead to long-term growth, while others caution that regulatory hurdles could suppress its price for an extended period.

Bullish Analysts Say: “XRP has strong fundamentals and a growing use case. If it maintains its support levels, a rebound above $2.40 is likely.”

Bearish Analysts Warn: “If XRP falls below $2.10, the selling pressure could intensify, pushing it toward the $1.80-$1.90 range.”

Also Read | https://cryptonewsrank.com/shotpump-crypto-surges-63-percent-march-2025/?amp=1

❓ XRP Price Action Liquidation FAQs

Q: What caused this XRP price action liquidation?

A: Leverage flush + BTC weakness + regulatory fears

Q: How does liquidation affect XRP price action?

A: Forced selling worsens declines (vicious cycle)

Q: Best indicator for XRP price action turnaround?

A: RSI >50 + $2.21 breakout

Q: Can XRP recover from this drop?

A: Recovery is possible if it holds key support at $2.10 and breaks above resistance at $2.21

3 thoughts on “XRP Price Action Liquidation: 3.67% Crash Wipes Out $4.2M (Key Levels to Watch)”