Ethereum maintains a strong support above $ 4,300, since analysts are still optimistic for a possible rupture at $ 6K, since ETFs absorb $ 3.95 billion despite mixed flows. While centralized exchange balances continue to reduce the amount of ETH in circulation, the trend line graphics still suggest continuous support for high purchase zones. This shortage, together with the underlying technical force, continues to make ETH an attractive option for long -term investors. At the same time, market analysts report that capital is moving high -performance Altcoins, with names like Magacoin Finance by adding to the lists of observation for their explosive predictions of Roi.

Ethereum pricing prediction: $ 6K still ahead

Ethereum quotes about $ 4,355, during an ascending line of trends that has fed the profits since June. Multiple support areas have been identified between $ 4,200 and $ 4,400. The graph is now shaped to a break of $ 4,800- $ 5,000, which in the coming months could lead to greater impulse to $ 5,600- $ 6,000.

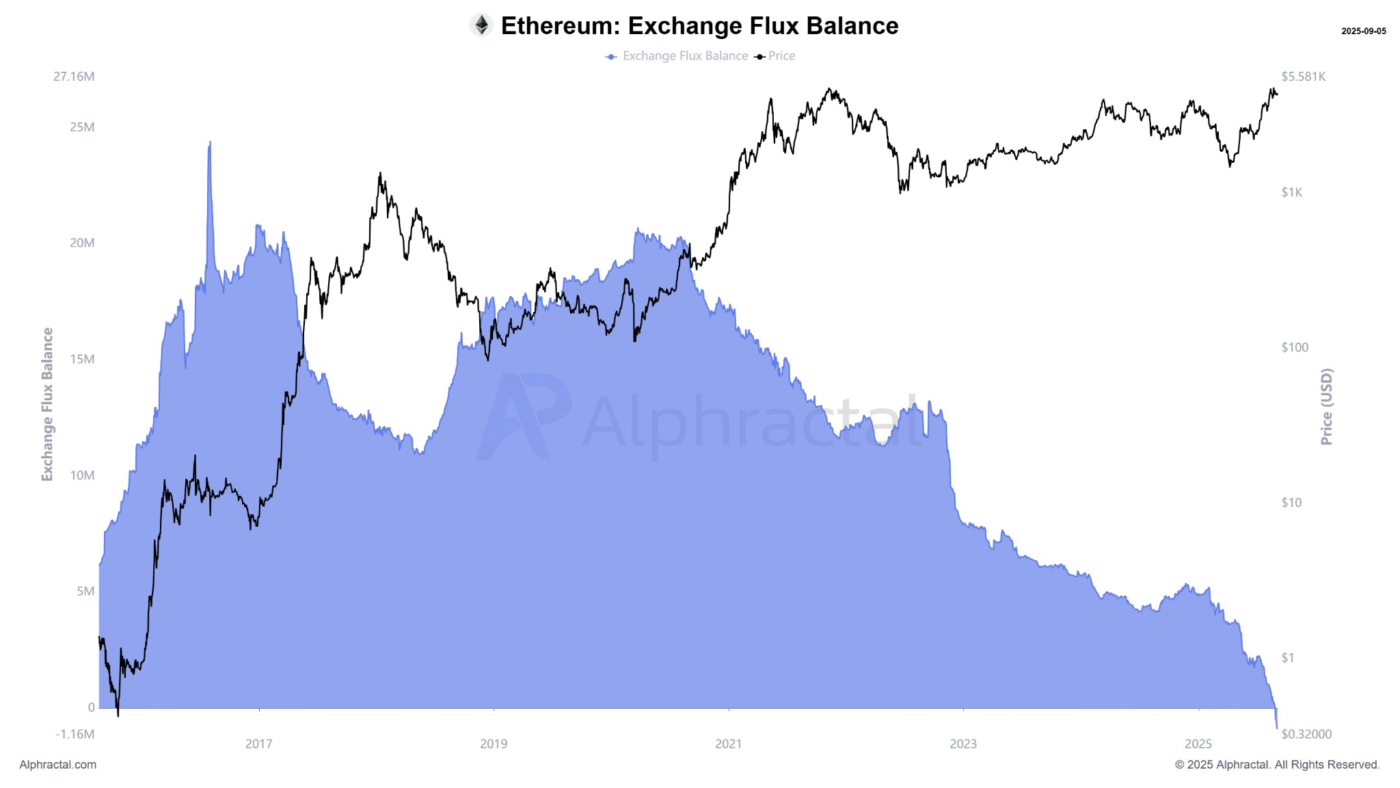

The exchange flow balance supports this view. The data indicates that ETH’s supply in exchanges has decreased since 2020 and continues to reach new minimums this year. This fall means that investors are changing coins in cold storage or in rethinking wallets instead of selling them, and reducing the outstanding supply. With less tokens that are negotiated in exchanges, the configuration is optimistic for the continuation whenever Ethereum maintains its position above the support zone of $ 4,200.

The exchange flow balance supports this view. The data indicates that ETH’s supply in exchanges has decreased since 2020 and continues to reach new minimums this year. This fall means that investors are changing coins in cold storage or in rethinking wallets instead of selling them, and reducing the outstanding supply. With less tokens that are negotiated in exchanges, the configuration is optimistic for the continuation whenever Ethereum maintains its position above the support zone of $ 4,200.

ETF Buzz – $ 3.95b In entries highlight institutional demand

ETF of Ethereum highlight the tension between short -term caution and long -term condemnation. Ishares Ethereum Trust (ETHA) of Blackrock had a total of tickets of almost $ 149 million alone in one day, while other emitters experienced strong reimbursements that result in a total of $ 167 million of net exits.

Despite the unequal distribution, the image of the year is due to the date is clear: $ 3.95b has fluid in ETF ETF, reinforcing the institutional attraction of Ethereum. This structural demand, together with the weakening of the exchange balances, increases the validity of the upward case so that ETH reaches $ 6K, even if the short -term spot trade continues to be broken.

Capital flows to greater alternative potential

Not all investor money remains in specialties such as ETH. Analysts highlight that some whales and retail merchants are turning in high performance alternatives that promise greater rise. One of those cryptocurrencies that has made waves in the community of Cryptocurrencies is Magacoin’s finances, which has been mentioned that it has a 30x-40X ROI potential.

The project has already approved security audits, giving additional peace of minds to investors who are cautious with speculative works. Analysts say it is the combination of growth opportunities, exaggeration between investors and the shortage of early engines that is promoting capital. For investors seeking the long -term strength of ETH and short -term short -term increase, alternatives such as this are reaching discussions.

Conclusion

Ethereum has a strong long -term thesis. With the ETFs that bring $ 3.95b, the exchange balances to minimums of several years and the price action that points towards a break above $ 4,800, the analysts believe that a $ 6K ETH is still on the table. However, history is not just about specialties, capital rotation indicates that investors are also chasing high performance plays. As investors prepare for another year of ups and downs in the fourth quarter of 2025, Altcoins such as Magacoin Finance join the wide range of investment options for those who wish to participate in the 40X potential of the cryptography panorama.

For more information about Magacoin Finance, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/x: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Discharge of responsibility: This is a press release provided by a third party responsible for the content. Conduct your own research before taking any content based on the content.