Sol Strategies began operating at Nasdaq Global Select Market under the Ticker Stke with $ 94 million in Solana Treasury holdings.

The Canadian firm becomes the first public company focused on Solana on achieving an US listing and maintains dual lrs to CSE under the Hodl symbol.

The debut of Nasdaq follows months of preparation, including a consolidation of actions of one by or eight, reducing the in circulation of 176 million to 22 million to meet the exchange requirements.

Virtual Bridge Ceremony Bridge Traditional Finance with Blockchain

Sol Strategies organized an innovative bell ceremony in the bell at Stke. Community, which allows participants to commemorate their participation through permanent memorandes of Blockchain transactions of Solana.

The celebration included discussions of Live X Spaces with industry and leadership partners of the company.

The company operates as a “foreign private issuer“According to the SEC rules, exempting it from certain regulatory requirements of the United States, including the requests for the application for power and presentations in section 16.

This state allows continuous operation under Canadian governance standards without requiring most independent directors.

The current capital structure includes 22 million common shares in circulation, 12 million arrest orders and 5.3 million options on shares after consolidation.

The firm renamed Cypherpunk Holdings in September 2024, changing the focus and investment of Solana Blockchain.

Now, Sol Strategies administers 3.62 million Sun under Delegation, including 402,623 Sun of his treasure, valued at C $ 111.7 million.

The record participation includes 8,812 unique wallets that apply with the firm, and Ark Invest of Cathie Wood moves 3.6 million sun worth approximate value of C $ 888 million to the infrastructure of Sun strategies in July.

Accelerates the Solana Solana Treasury Armedary race

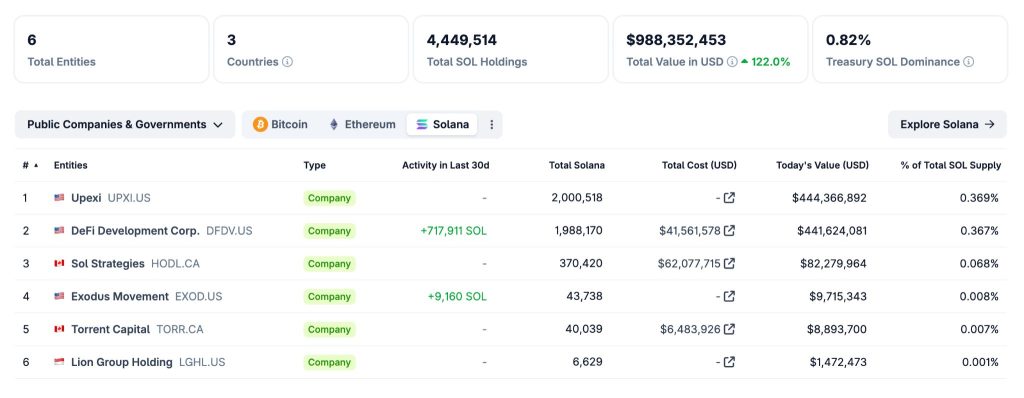

SOL strategies face increasing competition as institutions run to build massive Solana treasures.

Forward Industries announced a private placement of $ 1.65 billion directed by Galaxy Digital, Jump Crypto and Mulicoin Capital to establish a Treasury Treasury Strategy of Digital Assets centered in Solana.

Kyle Samani de Multicoin Capital will become president of Forward Industries after the completion of the transaction.

Galaxy Digital contributes to the institutional infrastructure, including trade services, loans and bets, while Jump Crypt provides technical experience through initiatives such as the Dredering Validation Client.

Defi Development Corporation has 1.27 million sun valued at $ 248 million after raising $ 122.5 million in debt financing led by Cantor Fitzgerald. The firm added almost 292,000 Sol in recent months.

Upexi remains the largest corporate head with more than 2 million sun for an approximate value of $ 444 million, according to Coingcko.

Just today, QMMM Holdings reported an increase in shares of 1,736% after announcing plans to build $ 100 million cryptographic treasury aimed at Bitcoin, Ethereum and Solana.

The “crypto-autonomous ecosystem” based in Hong Kong combines artificial intelligence with blockchain technology.

The five largest institutional holders now control more than 3.7 million sun with a value of $ 726 million, with the institutional property that represents approximately 1.55% of the total circulating supply.

The technical analysis points to an imminent break

SUN It currently quotes $ 216.24 within an upward ascending channel that has guided its advance of $ 152 at the current levels.

Multiple horizontal resistance levels are marked at $ 185.78, $ 204.58, $ 209.79, $ 218.60, with targets projected to $ 245.06.

The 4 -hour graph shows Sol placed just below $ 218.60 resistance, testing a key rupture level after recent progress through multiple resistance areas.

The ascending line of trend provides a critical support of around $ 210-212, maintaining the structure of the upward channel.

The analysis of the stage theory indicates that Sol remains in “bullish trend” in stage 2 after an extended period of “base 1 of stage 1”.

The ghost indicator shows bullish readings despite the recent consolidation, which suggests that the underlying impulse remains positive for continuous advances.

Weekly graphics confirm the sun’s position well above the 200 -day mobile average to $ 158.43, validating the integrity of long -term upward trend.

In particular, some analysts have discovered a pattern of “higher slow routine” that shows constant respect for the support of the ascending trend line, indicating the institutional accumulation that provides floors during weakness.

This constant advance with minimal volatility often precedes explosive movements as resistance levels are exceeded.

According to technical evidence in multiple deadlines, Sol seems positioned for the continuous bullish impulse towards the objective of $ 245.

The immediate approach focuses on the decisive breakdown above the resistance of $ 218.60, which would probably trigger the purchase based at the time for the movement objectives measured with support maintained around the rising line of upward trend of $ 210- $ 212.

Post Sol strategies are now operated in Nasdaq as Stke with Solasury Holdings of $ 94 million – Sol Breakout Next? It appeared first in Cryptonews.