Bitcoin (BTC), the largest cryptocurrency, touches a fund in $ 107,000 since investors are losing interest in BTC ETFs. Meanwhile, Bitcoin OI in exchanges points to $ 40 million in equivalent.

Bitcoin (BTC) reaches the lower part of $ 107,000

The price of Bitcoin (BTC) recovered today after reaching a local minimum at $ 107,000 in some exchanges. Yesterday, on September 1, 2025, Bitcoin (BTC) fell below $ 107,500 in Coingcko.

Imagine Coingcko

After touching the lowest level in two months, the price of Bitcoin (BTC) is recovering. At the time of printing, the orange currency is changing from hands to $ 110,900, trying to stay above the critical level of $ 110,000.

Bitcoin’s negotiation volume (BTC) fell to $ 46 billion in equivalent. In the last 24 hours, $ 74 million were settled in Bitcoin (BTC) positions, with $ 37 million for a long time.

Bitcoin’s domain (BTC.D) has decreased by 3% during the night:

- Bitcoin domain: 57.8%

- Ethereum domain: 13.8%

- Other cryptocurrencies: 28.4%

At this time, BTC.D is losing traction as liquidity flows to Altcoins.

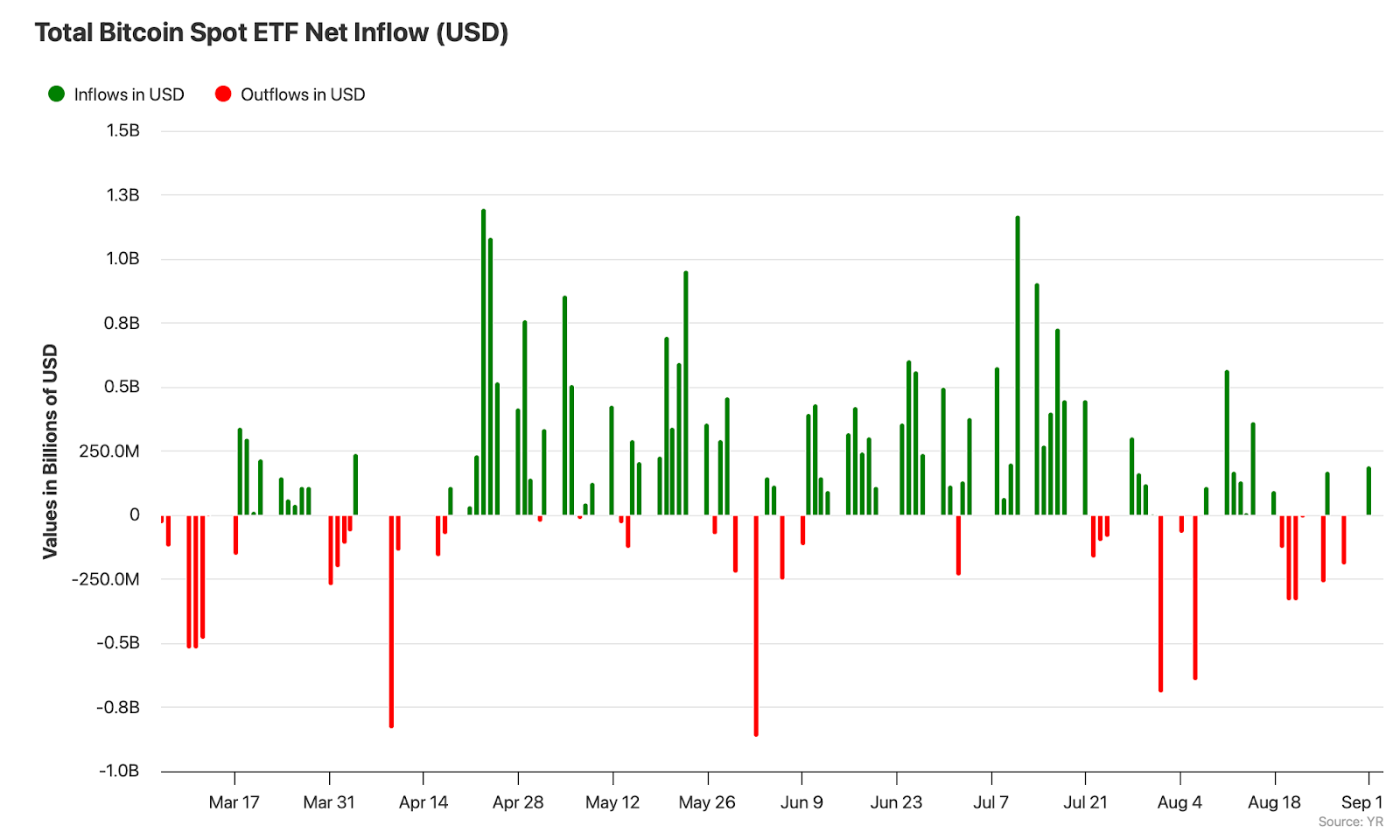

Bitcoin ETF losing steam: entries that are reduced for two months

Bitcoin Spot ETF in the US. UU. Reflect the pessimism of long -term investors. From mid -July, the volume of tickets in Bitcoin -based exchange products has collapsed.

The session of September 1, 2025 was positive, but only brought $ 192 million in tickets to all combined Bitcoin ETFs. Ibit and FBTC were traditionally among the most active funds.

Imagine Bitbo

With $ 83 billion assigned in the total market capitalization, the Blackrock Ibit is the largest seventh ETF in the US.

In total, the AUM of the segment fell to $ 142 billion compared to the peak of $ 155 billion in mid -August. During this period, the market capitalization of Ethereum ETFs increased from $ 22 billion to $ 24 billion.

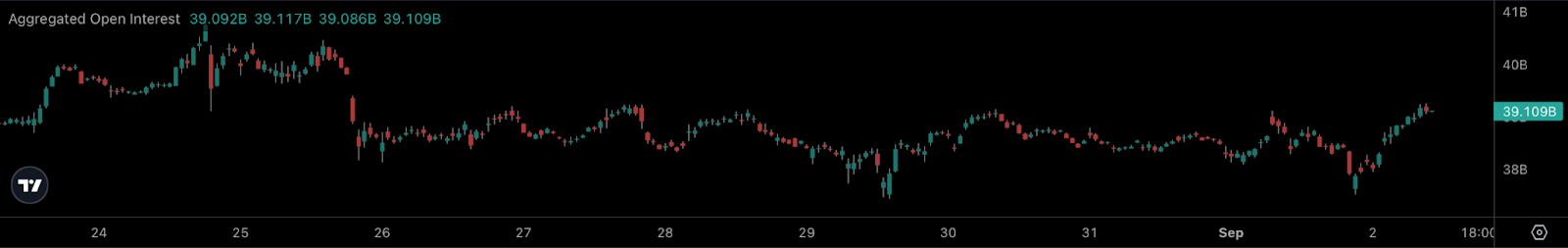

Bitcoin (BTC) open interest about $ 40 billion, gives hope for bulls

Bitcoin’s open interest, that is, the total value of open futures (contracts) in derivative exchanges, is also recovering.

Imagine Coinar

In the last hours, it almost increased to $ 40 billion in equivalent, which is close to the weekly maximums. This is an indicator of increasing volatility that is combined with investors that show interest in the asset.

With its ups and downs, Bitcoin’s open interest (BTC) has remained relatively high in recent months. To provide context, a year ago I was at $ 15-16 billion.

Accompanied by a remarkable institutional flow, this is another sign that the Bitcoin (BTC) rally peak could not yet be in. Normally, the Q4 of the year after the sheet marks the maximum stage of the cycle.

WLFI makes a controversial debut in exchanges

WLFI, a cryptocurrency token from World Liberty Financial, debuted in centralized exchanges yesterday, September 1, 2025. Immediately after the list, its price exceeded $ 0.3, the capitalization of the Phishing market to incredible $ 8,26 billion. WLFI appeared in all centralized level 1 exchanges and some minor platforms.

Today, the price of WLFI stabilized around $ 0.22. WLFI is the 27th largest cryptocurrency for market capitalization from now on. Its completely diluted valuation exceeds $ 22 billion.

At the same time, the launch faced many criticism from the cryptocurrency community. A total of 80% of the token supply remains blocked without a precise award schedule. As such, Wlfi’s supply is too concentrated and is prone to manipulations.

The launch of WLFI has already allowed its team and beneficiaries to win $ 5-6 billion.

No, the Venus protocol was not pirated for $ 30 million

Today, in the early hours of the morning, a rumor on Venus Protocol began to spread, a popular Defi platform, which runs out of $ 30 million. However, shortly, the security researcher Pckshield discredited this theory.

On the other hand, a user of the Venus protocol lost $ 27 million, being beaten by a phishing scam. The merchant passed by mistake a malicious transaction, granting the approval of Token to the attacker’s address for asset transfer.

As the cryptocurrency market is still in its upward phase, the activity of the scammers increases. As covered by U.TODAY previously, the malefactors drained Bunni Defi for $ 2.4 million today.

The exchange is based on the UNISWAP V4 code. Bunni dex team froze all the activity in the protocol while the investigation was ongoing.