The Bitcoin mining company that lies in Nasdaq, Iren Ltd., is currently one of the most popular actions of Wall Street. IREN has recovered almost 300% since March and 74% during the past month.

After falling at the beginning of the year, Bitcoin’s mining shares have almost quintuado of their April minimums. The action almost made a break for $ 30 before experiencing a setback, but the recent price objectives of the analysts suggest that a new historical maximum is inevitable.

Iren Price Target

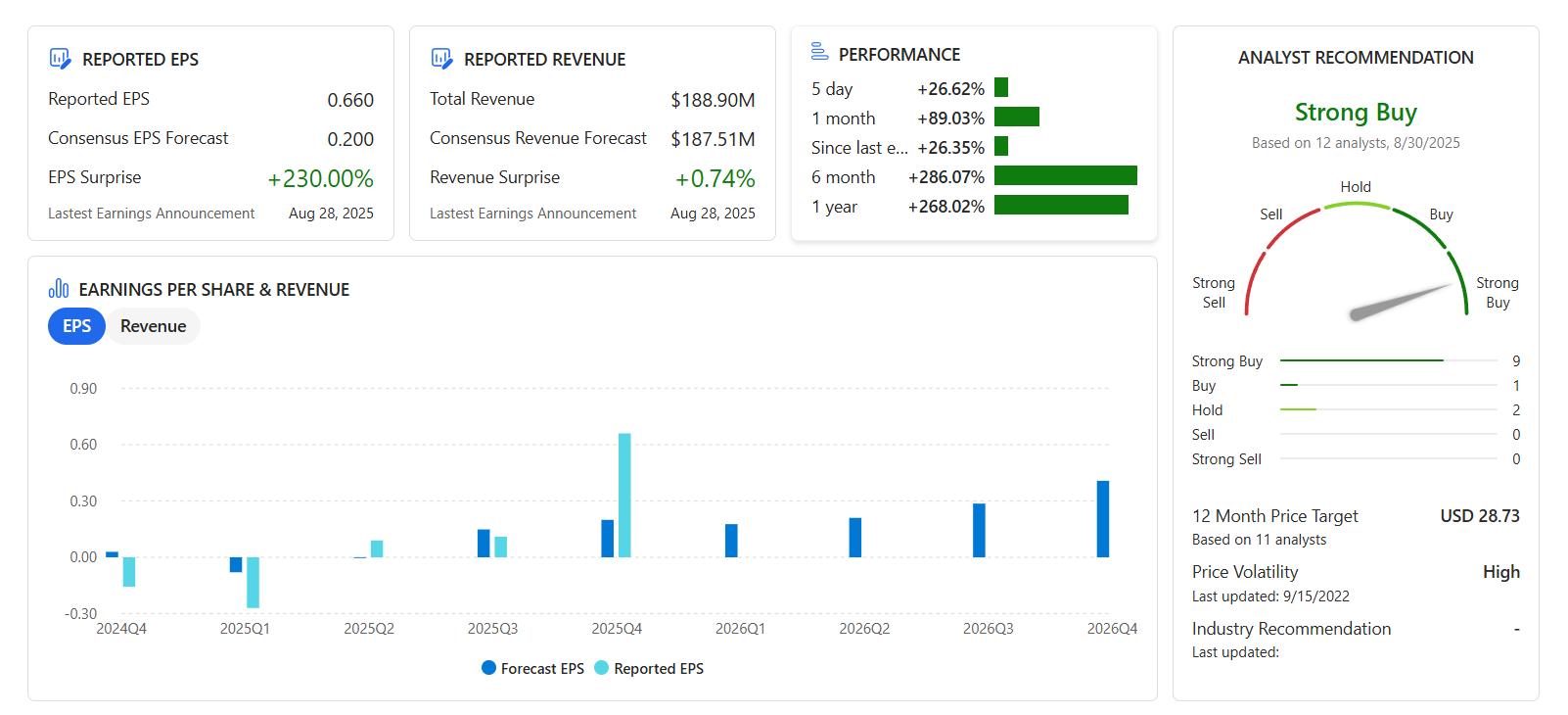

Canaccord Genuity increased its IREN target price from $ 23 to $ 37 per share after Iran’s profit report. They were not the only ones. HC Wainwright allocated an objective price of $ 36, while Roth Capital believes that I will reach $ 35 per share.

The three price increases suggest massive rise in the closing price of IREN $ 26.48 at the end of August.

What caused the rally?

Iren has been a Bitcoin miner since it was founded in 2018. But the necessary infrastructure for Bitcoin mining has given Iran an advantage in the AI infrastructure scale.

The company has seen the opportunity to build AI infrastructure with its mining knowledge of Bitcoin, and investors have noticed.

However, the transition from cryptographic mining to AI is not new, and Iren is not the only action that benefits from this trend.

The AI agreement of $ 3.2 billion of Terewulf with Alphabet shows how lucrative can be for Bitcoin miners focus on AI instead of expanding their Bitcoin operations.

The executive president and co -founder of Hive Digital Technologies, Frank Holmes, recently joined Beinyptto to discuss several high growth catalysts for cryptographic miners that turn to artificial intelligence.

Meanwhile, the FY25 profits of IREN FY25 confirmed the bullish thesis while presenting new information.

Income increased by 168% in fiscal year 2025, reaching $ 501.0 million. Bitcoin Mining brought $ 484.6 million, while AI Cloud Services only generated $ 16.4 million.

Ai Cloud Services is a small income portion now, but the recent expansion of the company’s Nvidia chip and its new state of preferred partner of Nvidia suggest that cloud revenues accelerate.

In addition, leadership even told investors in the FY25 Q4 press release that the AI Cloud segment can produce $ 200 million annualized to $ 250 million by December 2025.

Enthusiasm is based on social networks

Investors are excited about the amount of Ai Cloud services that can climb. In addition, a Bitcoin promotion price will result in greater profits for the company’s Bitcoin mining business. Many of those investors are talking on social networks.

Iren Stock has its own Reddit page that sees the daily activity of a growing user base. Even so, most of the emotion is carried out in the X account of X. Iren received an avalanche of commitment and positive comments when he reported the results of fiscal year 2015.

The founder of #miningMafia also tweeted that he could cut his position of Iran once he reaches $ 420 per share.

Another X user said that Iran is the type of stock that can increase by more than 100% and “still be undervalued.” Eric Jackson, the investor behind Open 1,000% Rally shares, believes that I will be a 100x action.

Where will Price go from here?

The enthusiasm in social networks does not guarantee that an action reaches any of the price objectives that investors see on platforms such as X.

However, Iran stock from $ 5 to almost $ 30 per share in a few months, a strong participation in retail investors, analysts price increases and an attractive long -term opportunity make Iran’s shares promise.

If you will reach $ 200 million to $ 250 million in annual revenues of your services in the AI cloud, shares will probably have more place.

Many analysts anticipate that scenario, and if Ai Cloud Services reaches that reference point, it is easy to ask how much this segment will accelerate in 2026 and beyond.

In general, artificial intelligence is still in its first entries. While Nvidia has become a giant in the AI industry and other chips manufacturers continue to reach high records, it is relatively small cryptographic miners that can present the next wave of long -term capital appreciation.

Analysts after Iran Price Target’s goal: shares will continue to increase? He appeared first in Beinyptto.

He broke why

He broke why