Since the signing of Law 401 (K) in the US, cryptographic exchanges worldwide have been watching retirement savings as an important entrance ramp for digital assets. According to a Bloomberg report, the Pension Group of $ 2.8 Trillones from Australia, known locally as retirement, has become one of the largest objectives, with coinbase and OKX products aimed at directing retirement funds to Crypto.

The retirement, the mandatory retirement savings scheme of Australia, totaled $ 2.7 billion as of September 2024, compared to $ 1.2 billion per decade before, with an average annual growth rate of 8.2%. This eclipses the market capitalization of $ 2.5 billion of all the companies that appear in the Australian Stock Exchange.

Deloitte projects that the sector will expand even more, reaching $ 11.2 billion by 2043 in nominal terms (approximately $ 7 billion in the current value).

The massive size of this group indicates why global exchanges see retirement as a critical entry point. Coincidentally, the impulse to pensions also arrives at a time when the super system is looking for performance and dealing with its scale.

Cath Bowtell, president of IFM Investors, which manages $ 230 billion in assets worldwide, described the magnitude in a report, indicating that $ 3.2 billion flow to the system weekly, which requires constant investment opportunities.

Super funds already cover infrastructure ranging from US toll roads to Canadian ports, but liquidity challenges and global risks mean that funds mean more and more abroad for diversification.

However, Deutsche Bank’s strategist, Lachlan Dynan, warned that this global reach could expose the system to shocks, especially if large -scale currency coverage leads to cash calls during crises.

However, the pandemic demonstrated the flexibility of Super, with the Australians withdrawing $ 38 billion early without destabilizing the markets. In this context, Crypto seems more attractive as an alternative asset class, particularly for self -managed retirement funds (SMSF), which provide people direct control over their investments.

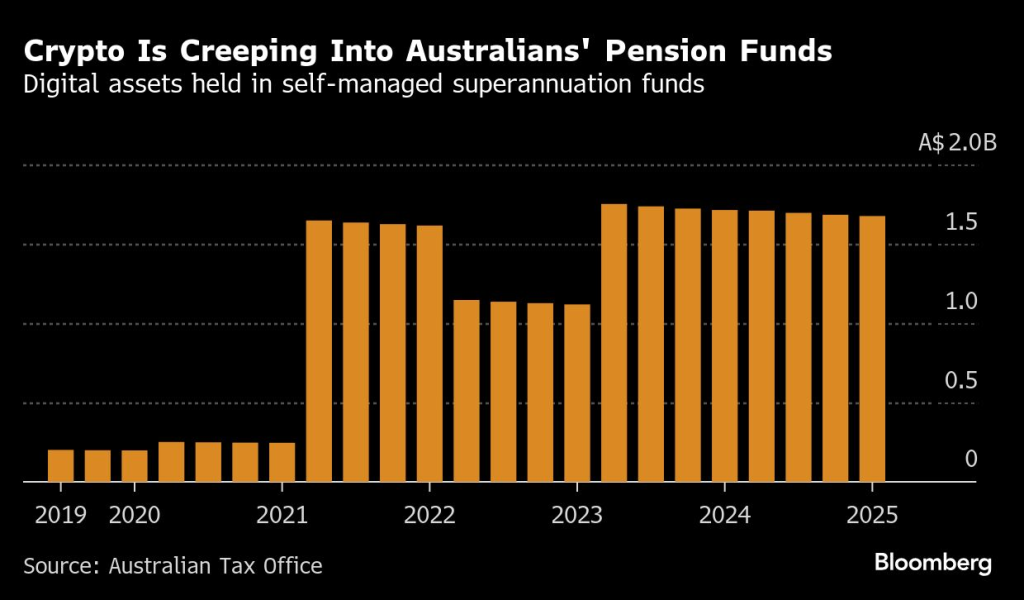

In particular, the SMSF now represent a quarter of the pension system, and exposure to cryptographic within them has already jumped seven times from 2021 to $ 1.7 billion.

Coinbase and OKX launch different services around the pension pot of billions of dollars

Coinbase and OKX are focusing their cryptographic strategies linked to pensions in SMSF, which are considered more receptive to alternative assets than traditional funds.

“It makes sense that we are probably seeing a little more interest in cryptography in the Super Fund Fundegestado first,” said Fabian Bussoletti, of the SMSF Association in the Bloomberg report, noting that the largest funds can eventually follow.

Coinbase is preparing to launch an SMSF service dedicated with more than 500 investors already on your waiting list. According to the managing director of Asia-Pacific John O’loghlen, 80% of these potential users intend to establish a new SMSF, and 77% plans to invest up to $ 100,000 in digital assets.

OKX, who launched a similar product in June, has already seen the demand to exceed expectations, according to the CEO of Australia, Kate Cooper. Both exchanges plan to optimize the creation of SMSF linking investors with legal counters and advisors.

Although a minimum balance is not required, administrative costs mean that SMSFs are generally viable only for larger accounts, positioning these more offers for purchase and retention investors than for active merchants.

For now, AMP is still the only important pension provider with exposure to revealed cryptography. However, with the growing impulse in the SMSF and the growing demand for diversification, Coinbase and OKX bet that the main funds of the superstream finally do the same.

If so, Australia’s mass pension system could become one of the most influential global doors for the institutional adoption of cryptography.

Australia emerges as a case of cryptography test in retirement portfolios in the midst of regulatory repression

Despite the growing impulse, Australia’s experiment could depend on whether cryptography can overcome persistent regulatory skepticism. The regulators of the country, including ASIC, Austrac, the Tax Office and the Central Bank, have constantly urged caution.

“These are highly volatile products, and overexposure can lead to substantial losses,” Asic warned in a statement sent by email, urging Australians to consider cryptography within the SMSF to seek professional financial advice.

At the same time, regulators have intensified the application. Last month, Austrac ordered the local arm of Binance, Investbybit Pty Ltd, which would designate an external auditor about money laundering and terrorism financing concerns. The exchange has 28 days to nominate a company for the Austrac review.

This fits into a broader pattern of global scrutiny. In the United States, OKX agreed to pay $ 500 million earlier this year for transactions without a license, while Coinbase was fined in the United Kingdom for serving high -risk clients.

Austrac has intensified its supervision through a national campaign aimed at non -compliant exchanges and money laundering risks. In December, he established a working group to investigate the suspicious activity associated with cryptographic automatic ATMs, scams and fraud. He also contacted 427 registered digital currency exchange suppliers that seemed inactive, warning them that they could face performance.

An upcoming public search record will allow consumers to verify if exchanges have an adequate license. Regulators fear that latent records allow criminals to take advantage of legitimacy while operating fraudulent schemes.

ASIC has also intensified its digital application, closing an average of 130 fraud websites per week. To date, it has disabled more than 10,000 malicious sites, including 7,200 false investment platforms and 1,500 phishing scams.

The regulator also obtained the approval of the Court to finish 95 companies linked to the international “pork carnage” fraud, which left almost 1,500 victims with losses for a total of $ 35.8 million.

Even compatible operators have been pressed. Exchange Cointree, based in Melbourne, received a fine of $ 75,120 for not presenting suspicious matter reports on time, and Austrac emphasized that such delays hinder the capacity to apply the law to trace illicit funds.

While regulatory precaution remains firm, the investor presses in crypto-SMSFS continues. However, the Australian Tax Office has issued a reminder that shows the policy dilemma: “The objective of retirement is to preserve savings to deliver income for worthy retirement.”

The post coinbase, OKX unlocks the pension boat of $ 2.8 billion of Australia for cryptographic: Bloomberg first appeared in Cryptonews.

AMP, one of Australia’s main retirement funds, has allocated $ 27 million of its portfolio to Bitcoin.

AMP, one of Australia’s main retirement funds, has allocated $ 27 million of its portfolio to Bitcoin.

Australia is intensifying efforts to harden the supervision of cryptocurrency exchanges, warning that inactive platforms run the risk of tear.

Australia is intensifying efforts to harden the supervision of cryptocurrency exchanges, warning that inactive platforms run the risk of tear.