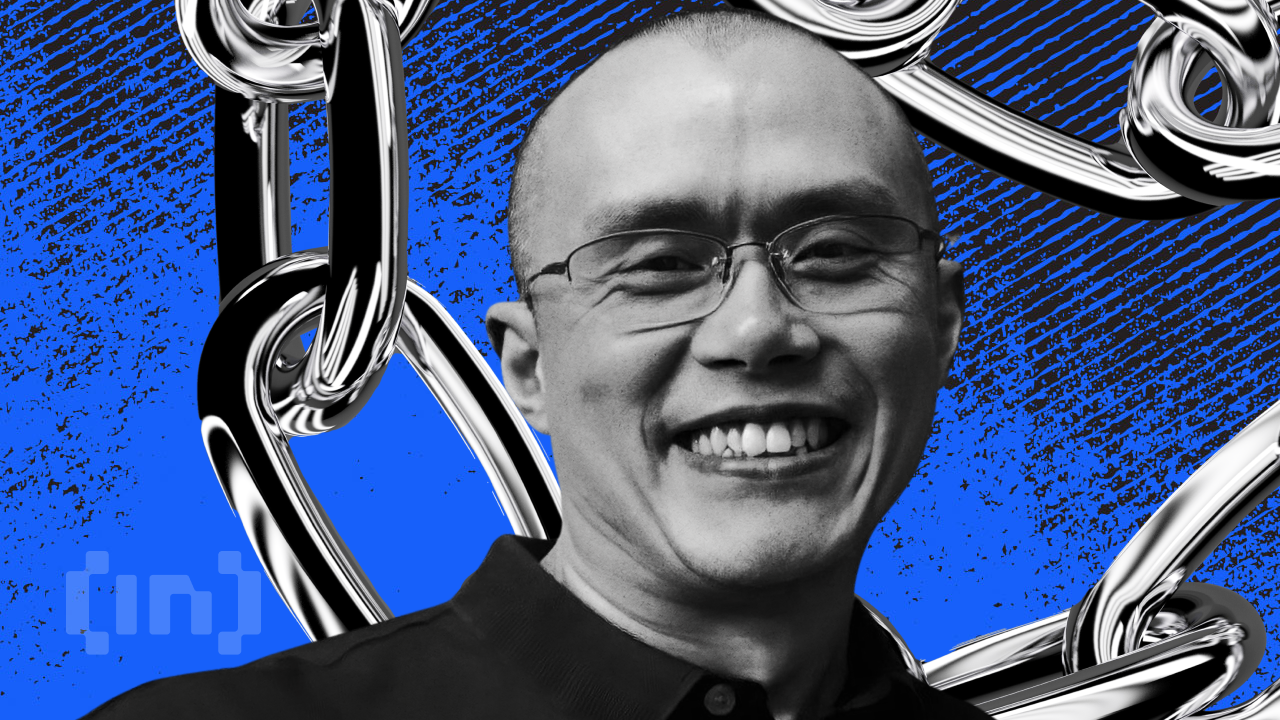

The founder of Binance, Changpeng Zhao (CZ) joined the BNB chain this week, since he marked his fifth anniversary in Tokyo.

Meanwhile, Japan Post Bank plans to activate its ¥ 190 billion ($ 1.29 billion) in deposits, issuing a digital currency for financial products based on blockchain.

CZ de Binance says that he will defeat the centralized businesses in the middle of the increase in Japan web3

In his chat next to the fire, Changpeng Zhao emphasized that the success of BNB Chain has been driven by his community instead of any individual.

“The chain has a small technological team and is much more driven by the community. I do not do so much; I publish tweets and encouragement to people to build. I am an animator,” he said.

With more than 4,000 now active decentralized applications, including Pancakeswap and Aster, the BNB chain has become one of the largest ecosystems in the industry.

CZ pointed out that the use of Stablecoin has almost doubled this year. Meanwhile, real world assets (RWAS) are beginning to take shape despite regulatory and liquidity challenges.

Although he acknowledged that he has many BNB tokens, which represents a significant portion of its value, CZ declared that it sees decentralized finances (defi) to overcome centralized exchanges.

“It is very likely that Dex’s volumes exceed CEX in the future. Defi is the future. And normal trade should be the preservation of privacy,” he said.

If it started from scratch today, CZ said it would focus on building a commercial agent with AI and a perpetual dex that presents privacy. He also pointed to Rwas and Stablecoins as areas of great opportunity.

“The values, treasure bonds and products have great potential. But regulation, kyc and liquidity are important challenges,” he acknowledged.

In this context, the Binance Executive highlighted BNB Chain’s investments in associations with issuers such as Securitize and Sprawed.

Japan, he argued, is well positioned to play a main role in this next chapter of Web3.

“I would love to see a BNB chain team dedicated here, and more projects that gather robotics, AI and web3,” CZ shared.

Japan Post Bank’s Digital Monine Push

While CZ analyzed the future of Global Defi, the financial sector of Japan is preparing for its own leap.

Japan Post Bank announced that it will issue the DCJPY digital currency in fiscal year 2026. The measure would allow depositors to instantly convert savings into digital money to negotiate blockchain -based assets.

Local media report that the bank manages ¥ 190 billion ($ 1.29 billion) in deposits in 120 million accounts. When integrating Rails blockchain into its main services, it hopes to revitalize inactive balances and attract younger customers.

DCJPY, developed by Decurret DCP, 1: 1 will be set for Yen and can be used to buy security tokens and NFT (non -fungible tokens).

The measure could significantly improve commercial efficiency by allowing instantaneous liquidation of tokenized values. Japan Post Bank also foresees subsidies and government subsidies distributed through DCJPy, integrating further digital money into daily life.

Meanwhile, the Boston Consulting Group and Ripple say that the RWA Tokenized market could expand from $ 600 billion in 2025 to $ 18.9 billion by 2033.

According to these reports, both CZ and Japan Post Bank aim to capture this opportunity.

From the decentralized community of BNB Chain to the digital currency backed by the state of Japan, Tokyo is emerging as a center where web3 ideals and institutional innovation converge.

Discharge of responsibility

In compliance with the guidelines of the Trust Project, Beinypto is committed to impartial transparent reports. This news article aims to provide precise and timely information. However, readers are advised to verify independently and consult with a professional before making any decision based on this content. Note that our terms and conditions, privacy policy and resignations have been updated.