Cryptographic ETF based in the US. UU. They have witnessed a Change of dynamics in August, that has seen tickets that lean towards Etfs Ethereum. However, last The trend of the week of strong entries He ended with substantial outings on Friday, with Etfs Ethereum leading the withdrawal with $ 164.64 million and Bitcoin ETF continuing with $ 126.64 million. This sudden reversion coincides with an interesting moment of third inflation data that seems to have shaken institutional investors.

Related reading

A sudden reversal at the end of the week

According to the data of the Farside investors, ETFS Ethereum Spot based in the USA. UU. The week ended with $ 164.64 million in departures. The departure came from Feth Feth of Fidelity with $ 51 million, Bitwise Ethw with $ 23.7 million, Ethe of Grayscale with $ 28.6 million and Gryscale ETH and Gryscale ETH with $ 61.3 million. Blackrock, on the other hand, was not witnessed or entries or exits in its spot Eth Ethfs, along with 21Shares, Vaneck, Investco and Franklin Templeton Ethereum ETF.

Friday’s departures were discordant Stable gain output That had defined the ETHERUM ETF Spot since August 21. The six -day entrance streak of Ethereum, which had added around $ 1,876 billion, was put up with the departures on Friday. As a result, total assets under administration for Spot Ethereum ETFS fell to $ 28.58 billion.

ETF Ethereum Flow: Farside investors

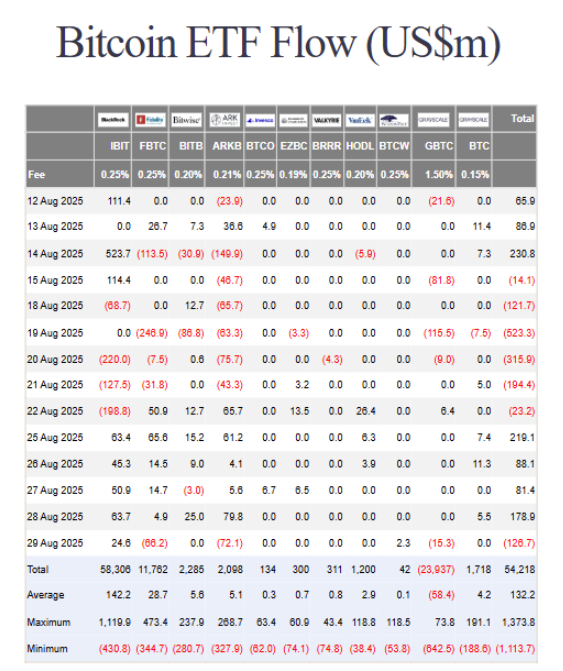

Meanwhile, Spot Bitcoin ETFS also registered its first daily decrease since August 22 with $ 126.64 million in departures on Friday. As a result, its total assets under administration fell to $ 139.95 billion.

However, not all emitters felt the pressure with Bitcoin. Fidelity FBTC led the exodus with $ 66.2 million, followed by the $ 72.07 million of ARKB and the $ 15.3 million of GBTC in departures. On the other hand, the Blackrock Ibit still achieved $ 24.63 million in Wisdomtree entries and BTCW obtained $ 2.3 million amid the broader exits.

Bitcoin ETF flow: Farside investors

The underlying cause of the outputs It can be attributed to Investors digest the latest inflation data published on Friday. In particular, the United States Personal Consumer Expenses Index (PCE) rose 2.9% year after year in July, the fastest rate since February, creating fears that the Federal Reserve can delay the target cuts.

What can be ahead this week?

As a new negotiation week begins, it is likely that the spot ETF flow both in Ethereum and Bitcoin depends on how investors continue to interpret the data. If inflation pressures persist, institutional investors can withdraw even more at the beginning of the week. However, any cooling signal could see that tickets resume in the middle of the week, particularly in Ethereum, where The foundations are currently favorable.

In the price price, Bitcoin retention above the price of $ 108,000 can offer some relief. However, it must be maintained above $ 110,000 for any rising movement to gain impulse. At the time of writing, Bitcoin is quoted at $ 109,910.

Related reading

For Ethereum, a daily closure above $ 4,500 could Confirm the return of bullish trustwhile A slide below $ 4,400 It could indicate more weakness. At the time of writing this article, Ethereum is quoted at $ 4,470, at 1.7% in the last 24 hours.

Unspash’s prominent image, TrainingView graphics