Chainlink (Link) has been one of the best performances in the market, gathering more than 109% during the past year. Even only in the last three months, the price of the link has earned around 68.5%.

But last week the weakness has revealed, with the token sliding more than 9%, and both the metrics in the chain and the technical lists now suggest that the one -year -old trend of a year can be losing steam, at least for now.

Profit pressures are mounted as the holders feel in profits

One of the clearest signs comes from the percentage of link supply in profits, which is still around historically high levels.

As of August 29, almost 87.4% of the circulating offer has profits, near the recent peak of 97.5% seen on August 20. That peak coincided with the price of the link price at $ 26.45, which quickly becomes tangled at more than 6% to $ 24.82 the next day.

A look further back shows the same pattern. On July 27, the gain supply was 82.8%, just before Link was corrected from $ 19.23 to $ 15.65, which made a 19%drop. Current reading about 87% is again uncomfortably high, hinting at high gains taking risks.

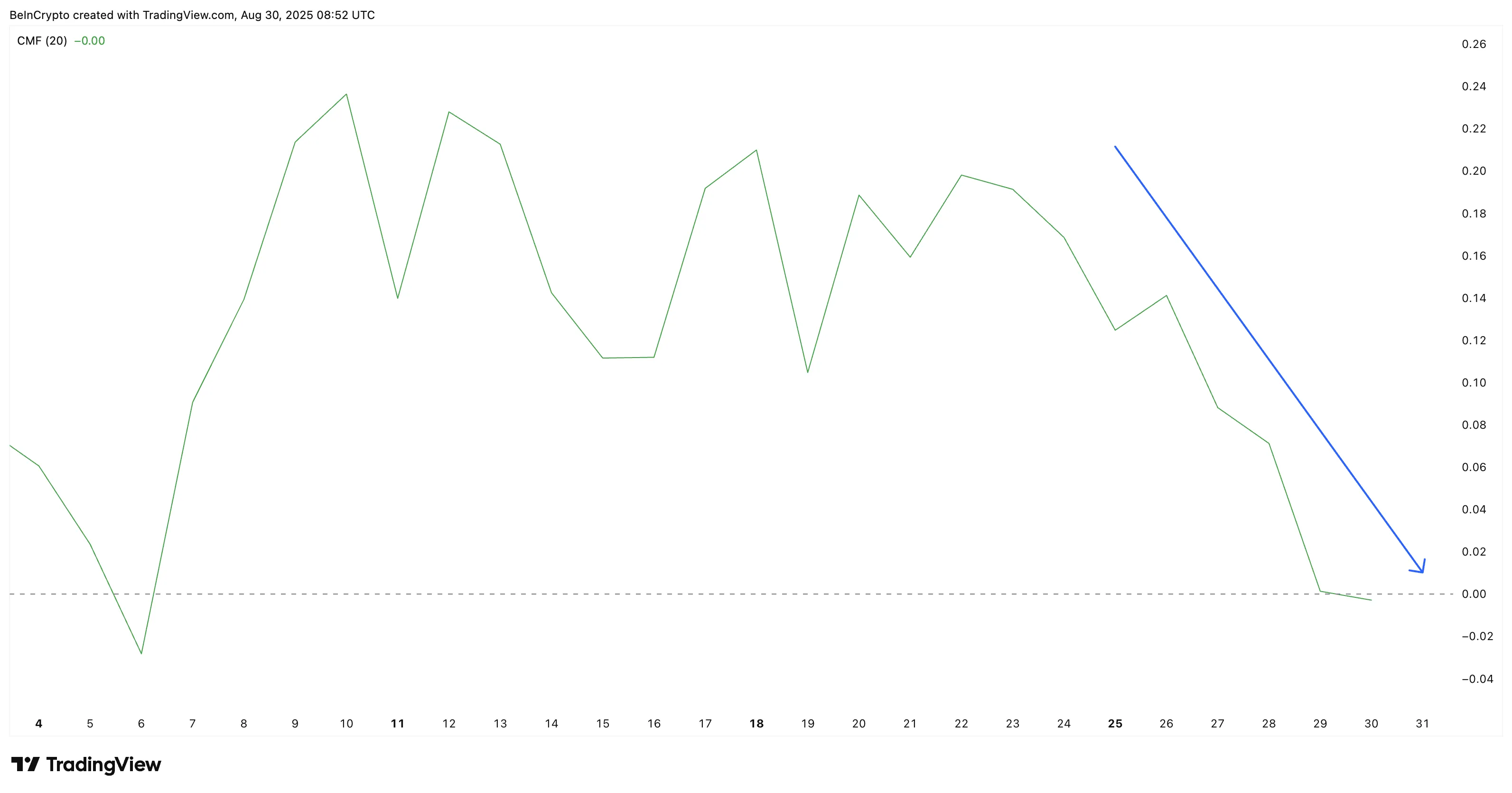

In addition, the Chaikin (CMF) money flow, which tracks capital tickets and exits, has labeled since August 22 and has finally been reduced to zero on August 29 for the first time since August 6. This change to negative territory signs that fade the purchase pressure and capital tickets, which strengthens the case of a possible setback.

For Token ta and market updates: Do you want more tokens ideas like this? Register in the editor Harsh Notariya’s Daily Crypto Newsletter here.

Chainlink Price Points (Link) to bass exhaustion

The daily table reinforces this caution. The price of the link is currently quoted at $ 23.31, sitting inside a rising wedge pattern, a structure often associated with the loss of ascending impulse near the end of a bullish phase. This “megaphone” pattern is infamous to start bassist reversions, a risk that is now coming over the link.

The key support to see is $ 22.84. A decisive breakdown below this level expose the following objective to the decline at $ 21.36, and fall under that could risk a deeper setback. That could be anywhere in the range from 6% to 19% percent, as experienced during local earnings.

On the other hand, if the price of the link manages to claim $ 25.96, you can still try another higher movement.

But even this recovery would not completely cancel the wider signs of exhaustion unless the Token can break convincingly above $ 27.88.

Discharge of responsibility

In line with the guidelines of the trust project, this price analysis article is only for informative purposes and should not be considered financial or investment advice. Beinyptto is committed to precise and impartial reports, but market conditions are subject to changes without prior notice. Always carry out your own research and consult a professional before making financial decisions. Note that our terms and conditions, privacy policy and resignations have been updated.