Solana has had a turbulent August. The Token repeatedly tried to keep above $ 210, but could not maintain the impulse, returning to the range. At the time of publication, the price of Solana is quoted by about $ 205, 4.5% less in the last 24 hours and approximately 1% lower in the last week. Monthly profits remain above 13%, and the annual trend remains positive in almost 50%.

However, September could challenge this upward trend since technical signals and in the chain point to potential weakness.

Gain supply about six months tall

One of the most important metrics is the percentage of gain supply, which measures how many coins are currently worth more than its cost of costs.

This metric reached a maximum of six months of 96.56% on August 28 before relieving slightly to about 90% now.

The story shows that such maximums often precede corrections in the price of Solana. On July 13, the metric touched 96%, while the price of Solana traded around $ 205, followed by a 23% drop to $ 158.

Again, on August 13, the metric reached its maximum point at 94.31%, which caused a 12% correction of $ 201 to $ 176. Later, on August 23, another peak in 95.13% led to a slide of 8% of $ 204 to $ 187.

With the metric back close to the maximum record, the risk of a deeper correction in the price of sun in September is increasing.

For Token ta and market updates: Do you want more tokens ideas like this? Register in the daily newsletter of Editor Harsh Notariya here.

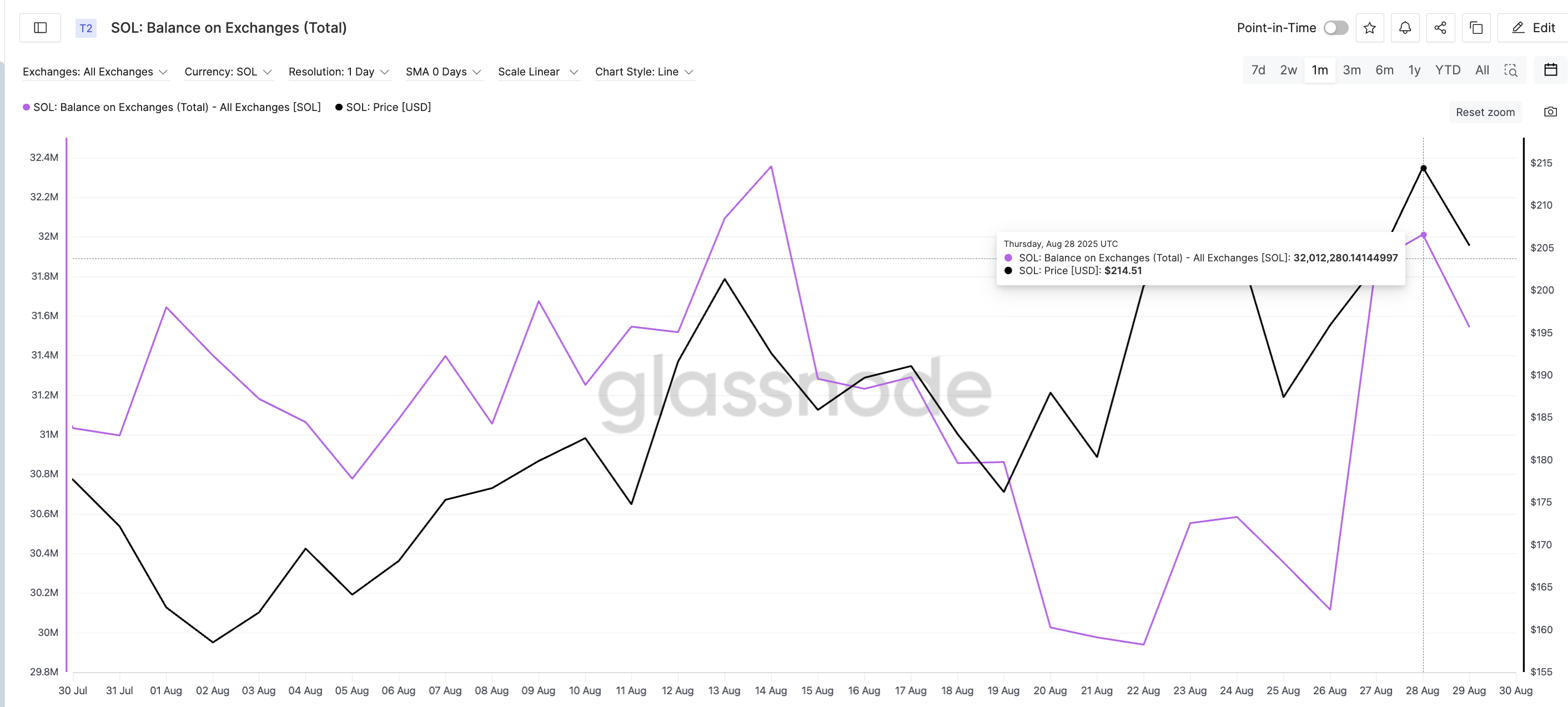

Exchange balances reinforce the risk of sale

This risk of sale is reinforced by exchange balances. The amount of sun maintained in centralized exchanges increased to more than 32 million tokens on August 28, compared to less than 30 million at the beginning of the month. Ascending balances generally suggest that headlines are preparing to sell.

The correlation is clear. On August 14, when the balances reached their maximum point above 32 million, the price of Solana fell 8% of $ 192 to $ 176 in a matter of days.

Now, with the balances rising again, a similar configuration is being formed, pointing to a renewed low pressure that could weigh the price of sun in September.

Solana’s price pattern suggests a bearish configuration despite positive history

The technicians also align with this bassist perspective. Solana moves inside an ascending wedge in the weekly graph, a pattern that often indicates the impulse of weakening and can lead to a standard or reversal bassist.

If the Solana price loses $ 195 and $ 182, the decrease could extend to $ 160, marking another possible disposal of 15-20%. Interestingly, such setbacks were previously seen when the exchange balances and the offer in profits increased. A rape of less than $ 182 would even validate the breakdown of the bearish pattern.

However, bulls still have a way to recover strength. A weekly closure above $ 217, the last local maximum, will invalidate the bearish involvement of the wedge and open the road to higher objectives. Until then, bias remains inclined down.

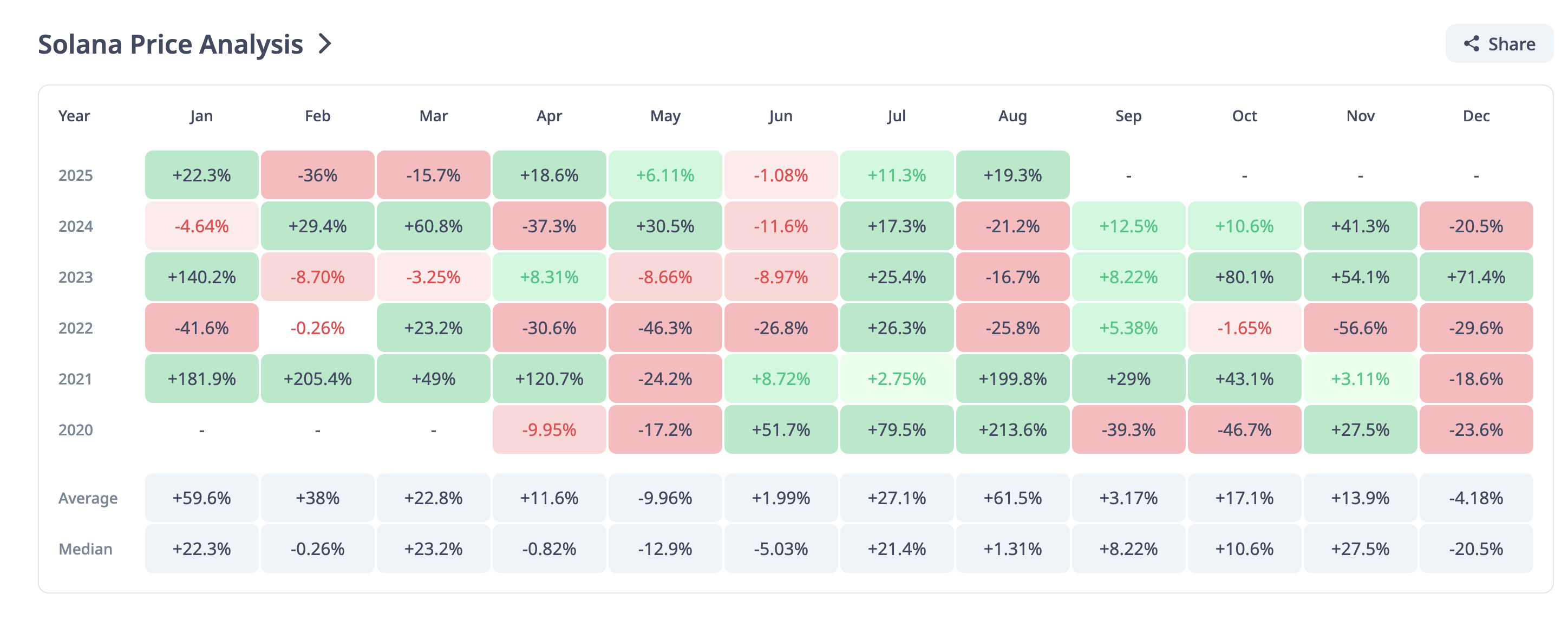

This bearish technical configuration comes in a generally positive seasonality context. Since 2021, Solana has delivered September 29%, 5.3%, 8.2%and 12.5%. But with the supply in high gains and high exchange balances, 2025 may be the year in which this streak is broken.

Unless Sol manages a decisive closure above $ 217, the price of Solana in September could fight, even with the positive impulse of historical performance and optimism related to ETF.

Discharge of responsibility

In line with the guidelines of the trust project, this price analysis article is only for informative purposes and should not be considered financial or investment advice. Beinyptto is committed to precise and impartial reports, but market conditions are subject to changes without prior notice. Always carry out your own research and consult a professional before making financial decisions. Note that our terms and conditions, privacy policy and resignations have been updated.